Feb 10, 2021

U.S. core consumer prices show scant inflation in snub to market

, Bloomberg News

The level of consumer spending at this stage of the pandemic is encouraging: Wells Fargo strategist

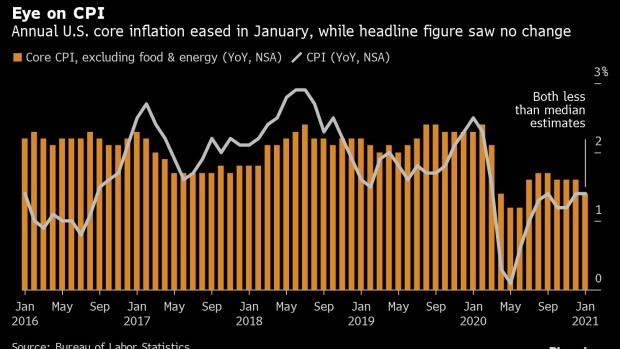

A key measure of prices paid by U.S. consumers was unchanged in January for a second straight month, underscoring the pandemic’s lingering restraint on inflation that financial markets see heating up.

The core consumer price index, which excludes volatile food and energy costs, increased 1.4 per cent from the prior year, a Labor Department report showed Wednesday. The broader CPI once again got a boost from higher gasoline prices, advancing 0.3 per cent from the prior month and 1.4 per cent from a year earlier.

The median estimate in a Bloomberg survey of economists for month-over-month core CPI was for a 0.2 per cent gain. The overall measure was projected to rise 0.3 per cent.

The CPI data are part of an intensifying debate in financial markets over the course of inflation. Despite the tame January figure, price pressures are set to firm in the months ahead. That’s partly a reflection of expectations that Congress will pass another large aid package and an anticipated pickup in demand as more are vaccinated against the coronavirus.

At the same time, a jobless rate that indicates elevated slack in the labor market is seen limiting wage growth, which makes up the biggest share of companies’ total costs.

While the government’s price data put a slight dent in the reflationary narrative currently prevailing in the bond market, yields on fixed-income securities remain near an almost one-year high.

The rate on the 10-year Treasury note slid as low as 1.13 per cent, although that’s still within sight of the 1.20 per cent high it reached earlier this week, while the dollar and stocks are both trading lower on the day.

While Wednesday’s figures were weaker than expected, “inflation is undoubtedly going to move higher in the months ahead,” James Knightley, chief international economist at ING, said in a note. “The key questions are how high and how long will it last?”

The report showed declining prices for used and new vehicles and transportation services. At the same time, Americans are paying higher prices for fuel, apparel and medical care services.

Lawmakers continue to debate the size of the next pandemic relief package. President Joe Biden has proposed a US$1.9 trillion plan, which some economists have warned could spur an outbreak of inflation. Other economists say there’s plenty of room for fiscal stimulus without fear of a more durable increase in price pressures.

Looking ahead, inflation metrics are expected to be distorted by so-called base effects in the coming months. Because of the pandemic and the recession it spurred, the CPI fell in March, April and May. When the annual figures are calculated this year, inflation will appear to be quickly accelerating when compared with the first three months of the health crisis.

Federal Reserve Chair Jerome Powell has said central bankers will support the economy “until the recovery is complete.” That, paired with the Fed’s willingness to let inflation run above its 2 per cent objective for a period, means policy makers will likely leave interest rates near zero for some time.

How fast the labor market recovers will also play a role. Persistently high unemployment would limit workers’ ability to demand higher wages, limiting the degree to which inflation heats up. Powell is scheduled to speak Wednesday afternoon on the economic outlook.

The Labor Department’s report showed the cost of merchandise excluding food and energy rose 0.1 per cent for a second month and was up 1.7 per cent from January of last year. Services prices excluding energy were unchanged for a second month and up 1.3 per cent from a year earlier.

Digging Deeper

- Shelter costs remained tame, rising 0.1 per cent for a sixth month

- Transportation services, which include airfares, dropped 0.3 per cent in January and were down 4.1 per cent from the same month in 2020

- Medical-care services prices increased 0.5 per cent, the first gain since August

- Used-vehicle prices decreased 0.9 per cent, the third straight decline, while costs of new autos fell 0.5 per cent

- A separate report Wednesday showed inflation-adjusted hourly earnings increased 4 per cent year-over-year in January

--With assistance from Sophie Caronello, Ana Monteiro and Benjamin Purvis per cent