US Mortgage Rates Surge to Highest Since November, Hitting 7.1%

Mortgage rates in the US climbed past 7% for the first time this year.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Mortgage rates in the US climbed past 7% for the first time this year.

Mortgage shopping isn’t getting much easier these days.

Sales of previously-owned homes in the US fell in March from a one-year high, underscoring the lingering impact of high mortgage rates and elevated prices.

Blackstone Inc. collected more fees from big retail funds and credit strategies during the first quarter, compensating for the slower pace of deal exits.

Ken Griffin’s Citadel and Citadel Securities will move their London base to a new office tower on the edge of the City of London, a major expansion of their space in the latest sign of the firm’s growing heft.

Dec 17, 2021

, Bloomberg News

(Bloomberg) -- The U.S. economy is on track for a strong finish to 2021 and a solid start to 2022 as consumers and businesses keep spending despite high inflation, staffing challenges, persistent Covid-19 infections and lingering supply constraints.

According to Bloomberg’s latest monthly survey of economists, the economy will expand an annualized 6% in the fourth quarter before down-shifting to a still-solid 3.7% average pace in the first half of 2022. During the last expansion quarterly growth averaged around 2.3%.

Most-recent data showed further strength in manufacturing output, a rebound in home construction, robust household spending and improving labor market conditions. Against this backdrop of steady demand and investment, inflationary pressures are set to persist through much of next year.

Forecasts for the personal consumption expenditures price gauge, which the Federal Reserve uses for its inflation target, were boosted for each quarter through the end of next year. Fed officials signaled at this week’s meeting that they’re ready to raise interest rates at a faster pace in 2022, intensifying their battle against rapid price increases.

The following charts illustrate the current state of the U.S. economy through the most recent indicators as the fourth quarter comes to a close.

Consumer Spending

While retail sales data on Wednesday showed merchandise spending rose by a smaller-than-forecast 0.3% last month, total receipts stand at a record $639.8 billion. The softer November print also followed a surge in October outlays that indicated consumers got an early jump on holiday spending.

Economists in the Bloomberg monthly survey expect total consumer spending -- which includes outlays for both merchandise and services -- to rise 5.5% in the fourth quarter, much stronger than the prior period’s 1.7% advance.

Labor Market

A series of labor data this week indicated that more Americans are returning to work. A Philadelphia Fed survey showed a measure of factory employment growth in the region climbed to the highest in data back to 1968, while New York Fed data showed expanding manufacturing payrolls.

Meantime, weekly jobless claims are hovering near levels not seen in decades. The four-week moving average of initial applications, which smooths out large swings in the data, dropped to the lowest since 1969.

Manufacturing

Output at factories posted a solid advance in November, rising 0.7% and following an upwardly revised 1.4% jump in October. Capacity utilization at factories increased to the highest since December 2018, suggesting that constraints are easing and helping manufacturers ramp up production.

Economists now see industrial production rising 4.6% in the fourth quarter from a year ago, up from a previous projection of 4.3%, according to Bloomberg’s monthly survey.

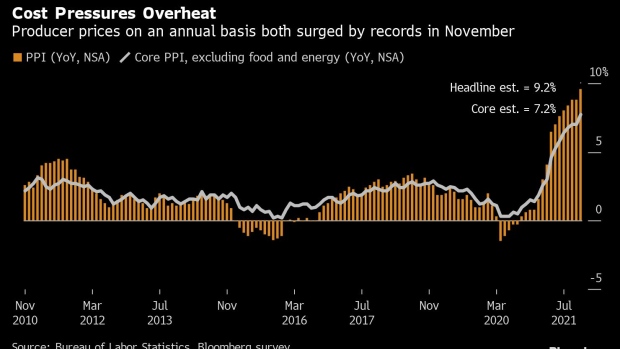

Inflation

The producer price index posted a record annual increase of almost 10% in November. Producers have been successfully passing along higher costs to customers, and the latest report suggests additional consumer price increases in the coming months.

Bloomberg’s monthly survey shows the PCE price index will increase 5.4% in the fourth quarter compared with the same three months last year. The annual inflation metric will average 4.9% in the first quarter of 2022 and 3.9% in the following period.

The Fed this week decided to quicken the pace of reducing its asset purchases, setting the central bank up to raise interest rates sooner next year if warranted.

Housing

Measures of both home sales and construction point to ongoing strength in housing. Home construction starts strengthened in November to the fastest annual pace in eight months, while applications to build, a proxy for future construction, climbed to the highest level since August.

©2021 Bloomberg L.P.