Blackstone Strikes $1.6 Billion Student Housing Deal With KKR

Blackstone Inc. agreed to sell a student-housing portfolio to KKR & Co. for $1.64 billion.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Blackstone Inc. agreed to sell a student-housing portfolio to KKR & Co. for $1.64 billion.

Pending sales of existing US homes in March reached their highest levels in a year in spite of persistently high borrowing costs and a low supply.

Whirlpool Corp., the owner of the Maytag and Amana appliance brands, is cutting about 1,000 salaried positions worldwide to reduce costs as slow US home sales limit demand.

Politicians are desperate for developers in Vancouver to build more homes to alleviate pressure in one of the continent’s most expensive real estate markets. There’s just one problem — not enough buyers are showing up.

Creditors to Adler Group SA are set to take control of the company after the embattled landlord struggled to sell assets and repay debts against the backdrop of plunging prices.

Nov 22, 2021

, Bloomberg News

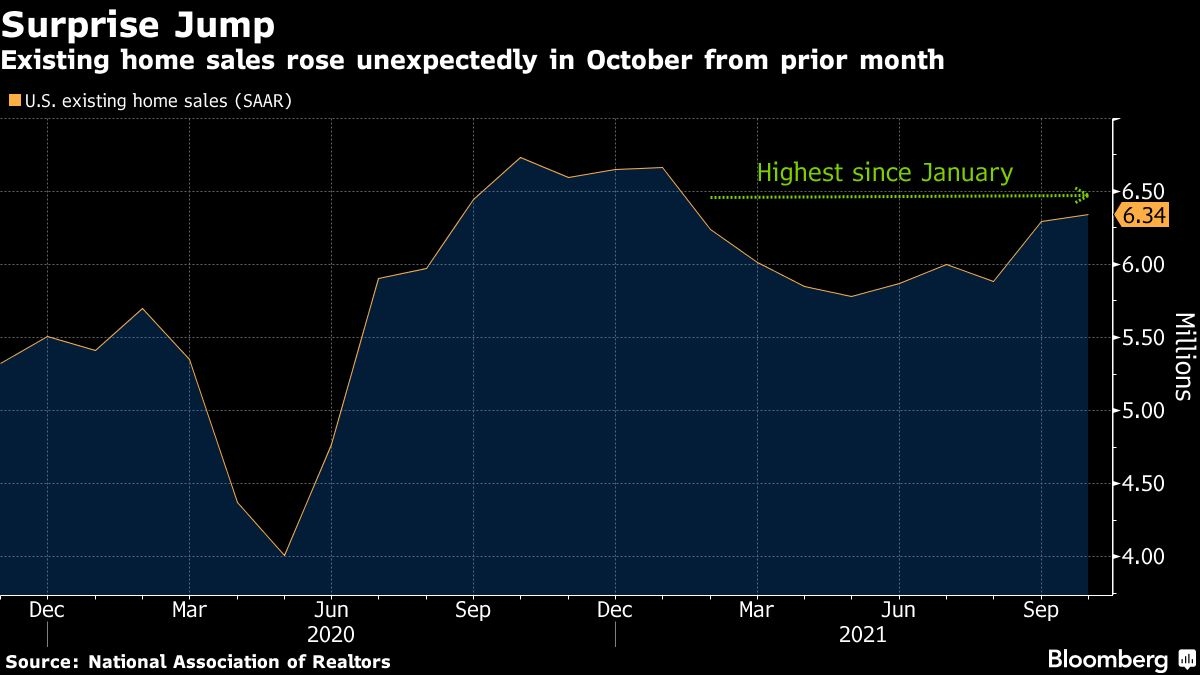

Sales of previously owned U.S. homes rose unexpectedly in October to the highest level since the start of the year, pointing to healthy demand as more buyers take advantage of stronger job growth and low mortgage rates.

Contract closings increased 0.8 per cent from the prior month to an annualized 6.34 million, figures from the National Association of Realtors showed Monday. The median forecast in a Bloomberg survey of economists called for a 6.2 million pace in October.

While the monthly pace of sales has settled back after reaching a 14-year high a year ago, they remain well above pre-pandemic levels. Sales are on track to exceed 6 million this year, which would be the strongest since 2006.

“Inflationary pressures, such as fast-rising rents and increasing consumer prices, may have some prospective buyers seeking the protection of a fixed, consistent mortgage payment,” Lawrence Yun, NAR’s chief economist, said in a statement.

The median selling price rose more than 13 per cent in October from a year ago to US$353,900. That compares with US$351,200 in the prior month.

There were 1.25 million homes for sale last month, down 12 per cent from a year ago. At the current pace it would take 2.4 months to sell all the homes on the market. Realtors see anything below five months of supply as a sign of a tight market.

Properties remained on the market for an average of 18 days last month, compared to 21 days a year ago. All-cash sales accounted for 24 per cent of all transactions in October.

Investors, who make up many of cash sales, comprised 17 per cent of October contract signings. That compares with 13 per cent in September and 14 per cent a year earlier.

The gain in October purchases reflected stronger results in the upper-end market, whereas sales for cheaper properties were restrained because of a lack of inventory.

Digging Deeper