Dec 19, 2018

U.S. Federal Reserve expected to make dovish hike with 2019 pause

, Bloomberg News

U.S. central bankers meeting in Washington are expected to raise interest rates a fourth time this year, brushing aside pressure from U.S. President Donald Trump, while signaling a slower approach to their gradual rate hike campaign in 2019.

The Federal Open Market Committee is widely expected to raise the benchmark target for rates by a quarter point to 2.25 per cent to 2.5 per cent, the highest in a decade, at the conclusion of its two-day meeting on Wednesday. Its policy statement at 2 p.m. ET might alter or drop a commitment to further gradual hikes, while officials may tamp down their economic forecasts in light of tighter financial conditions.

Investors are betting heavily on a move, according to pricing in interest rate futures. The FOMC has not delivered a rate surprise at one of its meetings in a decade, but an unexpected pause can’t be completely ruled out on Wednesday.

Chairman Jerome Powell is scheduled to hold a press conference at 2:30 p.m. ET where he can expect to face questions about why the Fed disagreed with — or surprisingly caved in to — Trump, who attacked the central bank on Monday and Tuesday via Twitter for even considering a rate hike despite low inflation.

“They are sounding pretty patient and willing to slow the pace of hikes in 2019 so as not to make a policy mistake,” said Julia Coronado, founder and president of MacroPolicy Perspectives LLC.

A hike will place rates at the lower edge of the 2.5 per cent to 3.5 per cent range officials have estimated as neutral — the level that neither accelerates nor slows down the economy. With the exact level uncertain, Powell has urged a cautious approach to making policy that he’s likened to walking in a darkened room full of furniture.

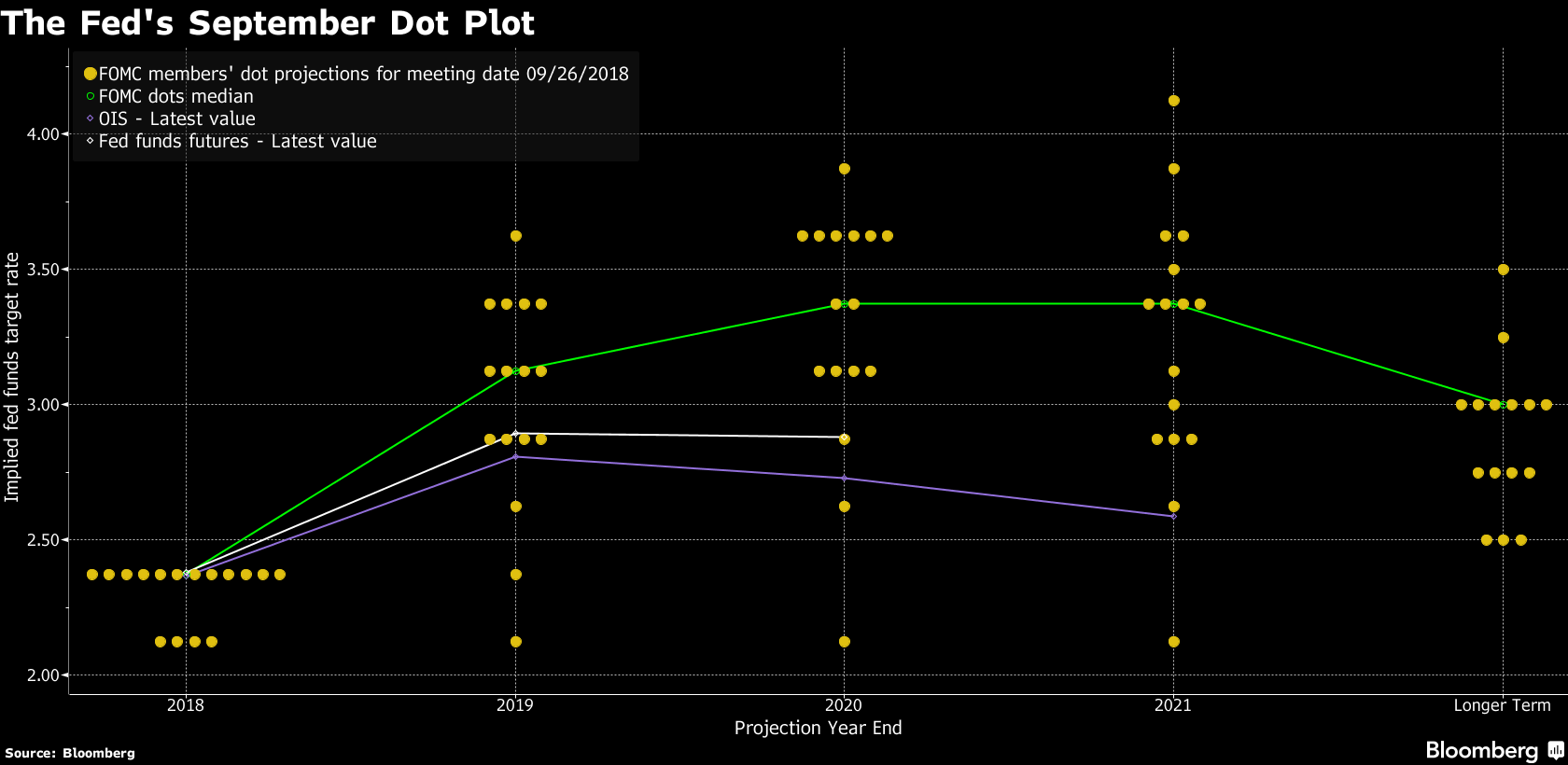

Penciling in two 2019 hikes rather than the three projected in September would allow Powell to pause the procession of quarterly rate hikes the Fed’s delivered since December 2017.

“The recent uncertainty might be enough to induce at least a couple of members to project a flatter policy path,” said Roberto Perli, a partner at Cornerstone Macro LLC in Washington and a former Fed economist. “The market would probably be convinced of a March pause if the median 2019 dot indicated only two hikes.”

Some officials might trim estimates for growth or inflation, responding to signs of global weakness, falling stock prices, slowing housing, weaker capital spending and the outlook for less fiscal stimulus.

The statement could get an overhaul, too. The FOMC in November discussed revising language promising “further gradual increases” to instead focus on incoming data. The committee could highlight slowing global growth or financial conditions, even as it points out the U.S. economy has been solid.

“The statement is likely to include more dovish language compared to the prior statement,” said James Ong, senior macro strategist at Invesco Ltd. “U.S. financial conditions have tightened measurably.”

The Fed will likely repeat risks to the outlook are “roughly balanced,” though one option is to simply say “balanced” if the committee wanted to reflect recent downside risks.

In his press conference, Powell is likely to be asked to reconcile his differing takes on the neutral rate that confused some investors. On Oct. 3, Powell said the Fed was a “long way” from neutral, contributing to a market selloff, then on Nov. 28 he said rates were “just below” the neutral range.

The Fed is also likely to make another minor technical adjustment in the interest it pays on excess reserves — a tool for keeping the effective funds rate within the Fed’s target range — following a similar tweak it made in June.