Aug 19, 2022

U.S. stocks slide as short-sellers cash in on Fedspeak

, Bloomberg News

BNN Bloomberg's closing bell update: August 19, 2022

Stocks fell as short-sellers resurfaced and investors turned cautious after Federal Reserve officials beat the drum on hiking rates. Treasury yields climbed and the dollar rose.

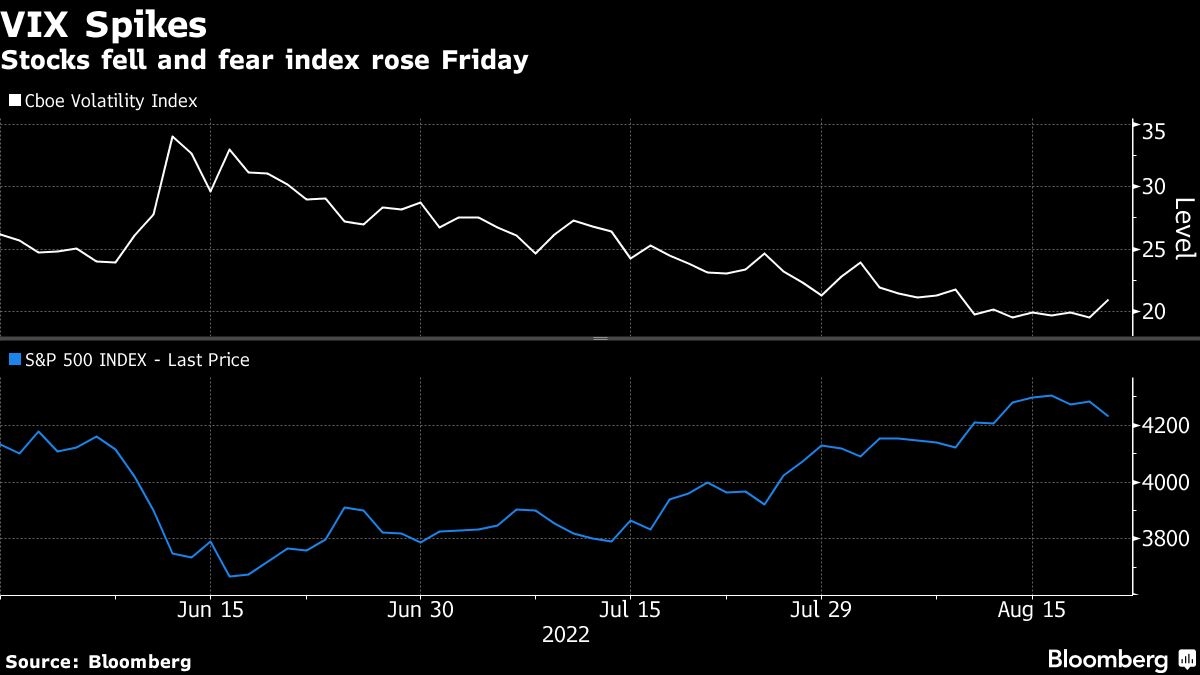

The S&P 500 Index extended losses, heading for its biggest daily decline since June. The tech-heavy Nasdaq 100 underperformed major benchmarks, with growth-related stocks among the hardest hit Friday. Meanwhile, Wall Street’s fear gauge, the Cboe Volatility Index, jumped the most in more than two weeks, back above 20.

Expiration of US$2 trillion in options, obliging investors to either roll over existing positions or start new ones, set the stage for a volatile session as failure to break a key threshold for the S&P 500 around 4,300 appeared to open the door to selling positions. And bears pounced. A basket of the most-shorted stocks dropped almost 6 per cent, extending its weekly loss to 12 per cent and giving short sellers their best week since March 2020.

In a blow to individual investors, high-flying meme stock Bed Bath & Beyond tumbled more than 30 per cent after Ryan Cohen sold his entire stake in the retailer. Cryptocurrency-linked stocks tumbled, tracking losses in Bitcoin: Coinbase Global Inc., Marathon Digital Holdings and Riot Blockchain Inc. each dropped more than 8 per cent each. Bitcoin sank back below US$21,500 apiece.

One bright spot in the equity space was Occidental Petroleum Corp., rallying the most since March on news that Warren Buffett’s Berkshire Hathaway Inc. won approval from US regulators to buy as much as 50 per cent in the oil company.

Against a backdrop of fear and volatility, the dollar marched higher, headed for its best week since April 2020. Treasuries fell, with the two-year Treasury yield, the most sensitive to policy changes, jumping 5 basis points.

Ahead of the Fed’s Jackson Hole gathering next week, officials reiterated their resolve to raise rates to curb stubbornly high inflation. In comments Thursday, two voting members of the Federal Open Market Committee -- St. Louis’s James Bullard and Kansas City’s Esther George -- stood firm on the need to hike rates, though they diverged on the size of the September move. Richmond’s Thomas Barkin echoed that resolve on Friday, noting the risk those efforts could cause a recession.

“Fighting the Fed is not a good policy at this juncture,” Jose Torres, senior economist at Interactive Brokers, said in an interview. “If you didn’t fight the Fed while they were engaging in quantitative easing and they boosted asset prices, why would you fight the Fed now when they’re engaging in the opposite. The same way we got a really violent summer bear-market rally, you can have those moves exacerbated the other way, particularly as liquidity conditions tighten.”

Stocks are poised for the first weekly decline in five weeks, snapping the longest winning streak since November. The pullback follows a rally that has sent the S&P 500 up more the 15 per cent from its mid-June nadir amid speculation that the Fed may scale back its aggressive path of rate hikes. And a force that contributed to the rally is now showing signs of fatigue, with hedge funds dialing down purchases of shares.

In a blow to individual investors, high-flying meme stock Bed Bath & Beyond tumbled more than 30 per cent after Ryan Cohen sold his entire stake in the retailer. Cryptocurrency-linked stocks tumbled, tracking losses in Bitcoin: Coinbase Global Inc., Marathon Digital Holdings and Riot Blockchain Inc. each dropped more than 8 per cent each. Bitcoin sank back below US$22,000 apiece.

Other Fed officials joined the chorus on a hawkish stance in runup to the annual symposium at Jackson Hole Aug. 25-27. San Francisco’s Mary Daly pushed back against bets for rate cuts before the end of 2023 and Minneapolis’s Neel Kashkari said that “we have an inflation problem right now,” and that the central bank has to get it down “urgently.”

“We think the Fed is likely to put an exclamation point on any premature notion that easing is in the cards, and we think they might do that with more hawkish commentary,” Leo Grohowski, CIO at BNY Wealth Management, said by phone. “There’s been a big change in sentiment and perhaps a little bit too much complacency here built in the short term.”

Some of the main moves in markets:

Stocks

- The S&P 500 fell 1.3 per cent as of 3:23 p.m. New York time

- The Nasdaq 100 fell 2 per cent

- The Dow Jones Industrial Average fell 0.9 per cent

- The MSCI World index fell 1.3 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.6 per cent

- The euro fell 0.5 per cent to US$1.0036

- The British pound fell 0.9 per cent to US$1.1817

- The Japanese yen fell 0.7 per cent to 136.86 per dollar

Bonds

- The yield on 10-year Treasuries advanced 10 basis points to 2.98 per cent

- Germany’s 10-year yield advanced 13 basis points to 1.23 per cent

- Britain’s 10-year yield advanced 10 basis points to 2.41 per cent

Commodities

- West Texas Intermediate crude fell 0.2 per cent to US$90.32 a barrel

- Gold futures fell 0.7 per cent to US$1,759.60 an ounce