Oct 15, 2019

U.S. inflation expectations slip to record low in Fed survey

, Bloomberg News

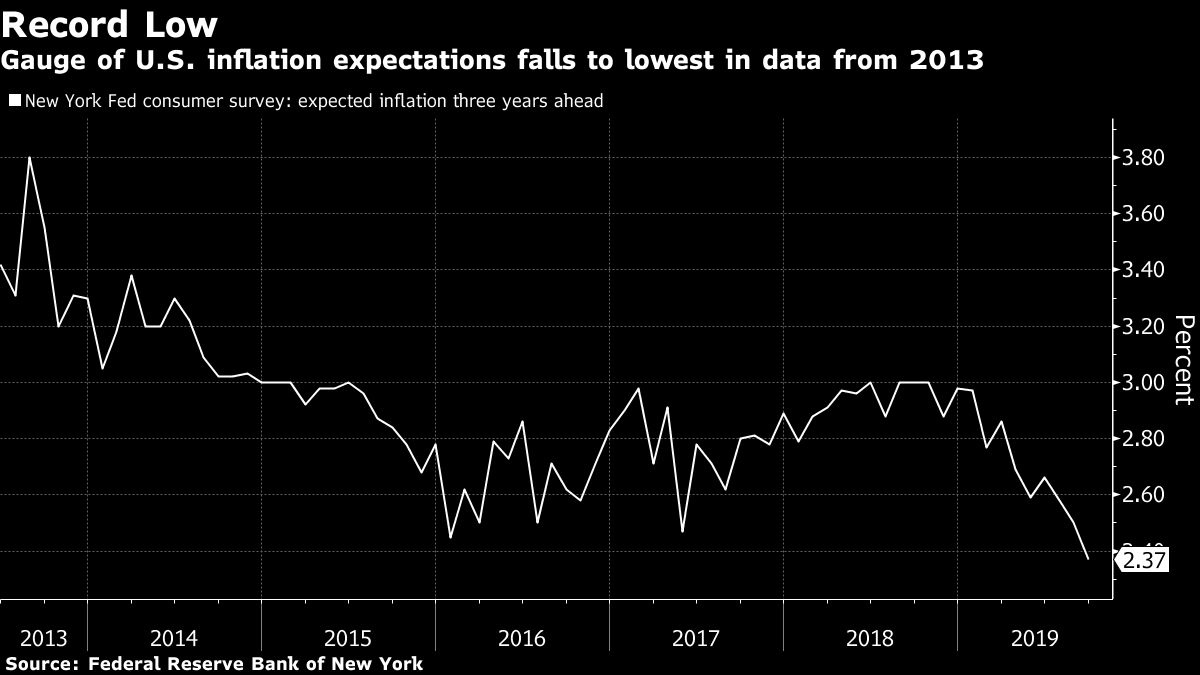

A gauge of inflation expectations from the Federal Reserve Bank of New York fell in September to the lowest level in data going back to 2013, the latest sign of weakness that could raise concerns among central bankers already fretting over muted price pressures.

The measure of inflation expectations three years from now slipped to 2.4 per cent last month from 2.5 per cent in August, according to the New York Fed’s monthly survey of consumer expectations published Tuesday.

The decline reinforces the message from preliminary results of a monthly University of Michigan survey of consumers published Oct. 11, which suggested expected inflation five-to-10 years ahead fell to 2.2 per cent this month, the lowest level in data going back to 1979.

Fed officials cut interest rates at their two most recent policy meetings in July and September — the first such reductions since the 2008 financial crisis — in part due to inflation, which has undershot their two-per-cent target throughout most of the current economic expansion. Investors are putting better-than-even odds on another rate cut when policy makers next gather Oct. 29-30.

Central bankers watch measures of inflation expectations closely because they believe they’re largely self-fulfilling.

At the September meeting, several Fed officials “stressed that survey measures of longer-term inflation expectations and market-based measures of inflation compensation were near historical lows and that these values pointed to the possibility that inflation expectations were below levels consistent with the two-per-cent objective or could soon fall below such levels,” underscoring the case for easing, according to minutes of that meeting, published Oct. 9.