Dec 20, 2018

U.S. Leveraged Loan Fund Outflows Accelerate to Record High

, Bloomberg News

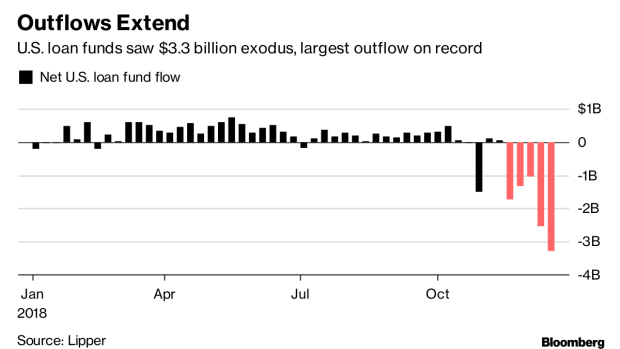

(Bloomberg) -- U.S. leveraged loan funds saw $3.3 billion of net outflows in the week ended Dec. 19, the biggest outflow on record, according to Lipper.

Investors pulled $3 billion from mutual funds that buy the debt, according to Lipper, while exchange-traded funds lost $299 million, Lipper data show . It was the fifth straight week of outflows. Fund flows often trail secondary prices, which have sunk to the lowest since September 2016, according to the S&P/LSTA Leveraged Loan Price Index.

This is the longest string of consecutive outflows exceeding $1 billion on record, according to Lipper data. Last week saw an outflow of $2.53 billion, the second biggest to date.

Since Nov. 21, there has been $9.9 billion withdrawn from loan funds. They are still positive for 2018, with $4.3 billion of inflows year-to-date, Lipper data show.

(Adds chart at end.)

To contact the reporter on this story: Lara Wieczezynski in Princeton at wieczezynski@bloomberg.net

To contact the editors responsible for this story: James Crombie at jcrombie8@bloomberg.net, Kelsey Butler, Michael B. Marois

©2018 Bloomberg L.P.