Dec 13, 2018

U.S. Leveraged Loan Funds Lose Cash at Fastest Pace Ever

, Bloomberg News

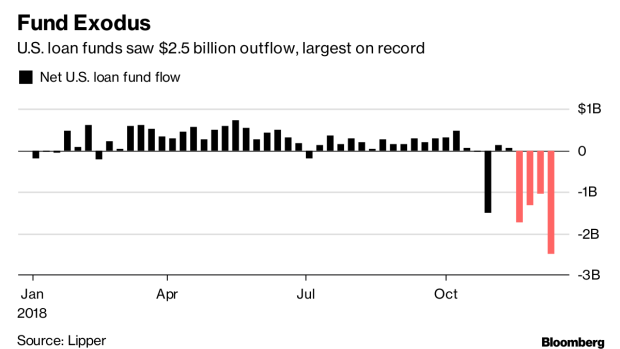

(Bloomberg) -- U.S. leveraged loan funds saw $2.53 billion of net outflows in the week ended Dec. 12, the biggest decline on record, according to Lipper. Mutual funds saw a $1.82 billion net outflow, while ETFs lost $705 million, Lipper data show.

Fund flows often trail secondary prices, which are at the lowest since October 2016, according to the S&P/LSTA Leveraged Loan Price Index. U.S. leveraged loans saw $1.04 billion in fund outflows for the week ended Dec. 5 after $1.32 billion of outflows the previous week, according to Lipper.

Since Oct. 1, loans have lost about 2 percent, including a 1 percent drop this month, while both high-yield and investment grade bonds rose slightly. Fund outflows and waning demand from collateralized loan obligations, the biggest loan buyers, are adding pressure.

Year to date, U.S. leveraged loans are returning about 2 percent and some say they could outperform with a 6 percent gain in 2019.

RELATED: Leveraged Loans Are Sinking, Even as Junk Bonds Find Support

(Adds flow breakdown in first paragraph, detail on returns in last two paragraphs.)

To contact the reporter on this story: Lara Wieczezynski in Princeton at wieczezynski@bloomberg.net

To contact the editors responsible for this story: James Crombie at jcrombie8@bloomberg.net, Kelsey Butler

©2018 Bloomberg L.P.