Jan 4, 2022

U.S. manufacturing gauge falls while price pressures ease

, Bloomberg News

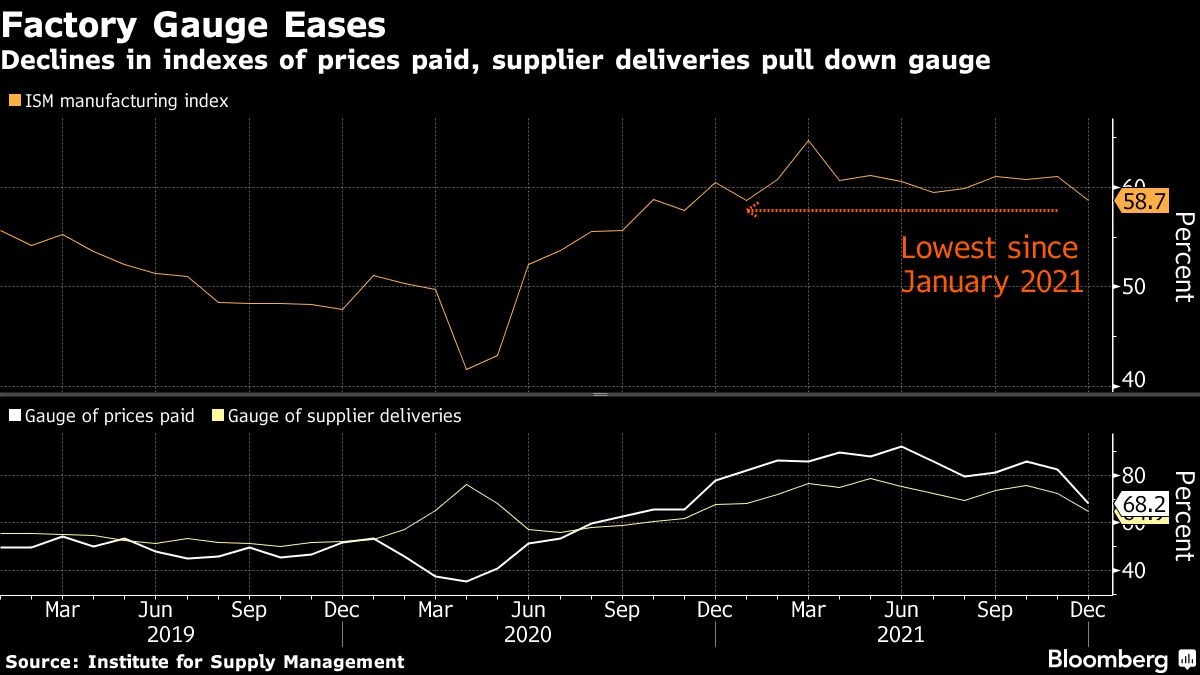

The Institute for Supply Management’s gauge of December factory activity fell to 58.7, the lowest level since January 2021, from 61.1 in the prior month, according to data released Tuesday. Readings above 50 indicate expansion and the median forecast in a Bloomberg survey of economists called for 60.

The pullback in the headline figure obscures strength in the underlying components. The group’s gauges of supplier deliveries and prices paid for materials -- while still elevated - both fell to their lowest levels in more than a year.

Improved delivery times and lower input prices typically indicate softer demand. However, the latest declines suggest capacity constraints are beginning to loosen. That’s welcome progress for manufacturers who have struggled to keep up with demand because of materials shortages, hiring challenges and transportation bottlenecks.

The ISM’s demand indicators remained firm in December, suggesting the manufacturing sector will continue to expand at a healthy pace. The ISM employment gauge rose to an eight-month high, and the new orders index eased just slightly to a healthy 60.4.

“The U.S. manufacturing sector remains in a demand-driven, supply chain-constrained environment,” Timothy Fiore, chair of ISM’s Manufacturing Business Survey Committee, said in a statement. “Coronavirus pandemic-related global issues -- worker absenteeism, short-term shutdowns due to parts shortages, employee turnover and overseas supply chain problems -- continue to impact manufacturing.”

Fifteen manufacturing industries reported growth in December, led by apparel, furniture and textiles.

The government jobs report, out Friday, is anticipated to show manufacturers added 35,000 jobs in December, following 31,000 a month earlier. Across industries, employers are expected to have added 420,000 jobs, double the prior month’s print.

Select ISM Industry Comments

- “Business continues to be good, with strong incoming orders from customers. Continue to battle labor, material and transportation pressures.” -- Furniture & Related Products

- “Continued strong demand has our production facilities producing as many vehicles as we have materials for; however, capacity is limited due to the global chip shortage.” -- Transportation Equipment

- “Price increases appear to be slowing. Lead times are shrinking slowly, and inventories are growing.” -- Fabricated Metal Products

- “Construction projects for 2022 and 2023 look very strong for us.” -- Nonmetallic Mineral Products

- “Lowered oil prices due to (the) omicron variant has caused concern around production and capital spend in 2022.” -- Petroleum & Coal Products

- “Supply chain interruptions have dramatically increased in the fourth quarter. Many of our suppliers are unable to deliver product until January or February 2022 or later.” -- Miscellaneous Manufacturing

The ISM’s factory production measure slipped to 59.2, the lowest since July but robust by historical standards.

The omicron variant -- now the dominant strain in the U.S. -- may impact the report more substantially in the coming months, as record-high case levels keep workers at home, potentially curbing production and elongating delivery times.