Aug 2, 2021

U.S. manufacturing growth softens as supply constraints linger

, Bloomberg News

Supply chain shortages make 'Pan-American manufacturing' more attractive: Professor

U.S. manufacturing expanded at a softer -- yet still solid -- pace in July as producers grappled with persistent bottlenecks and input shortages.

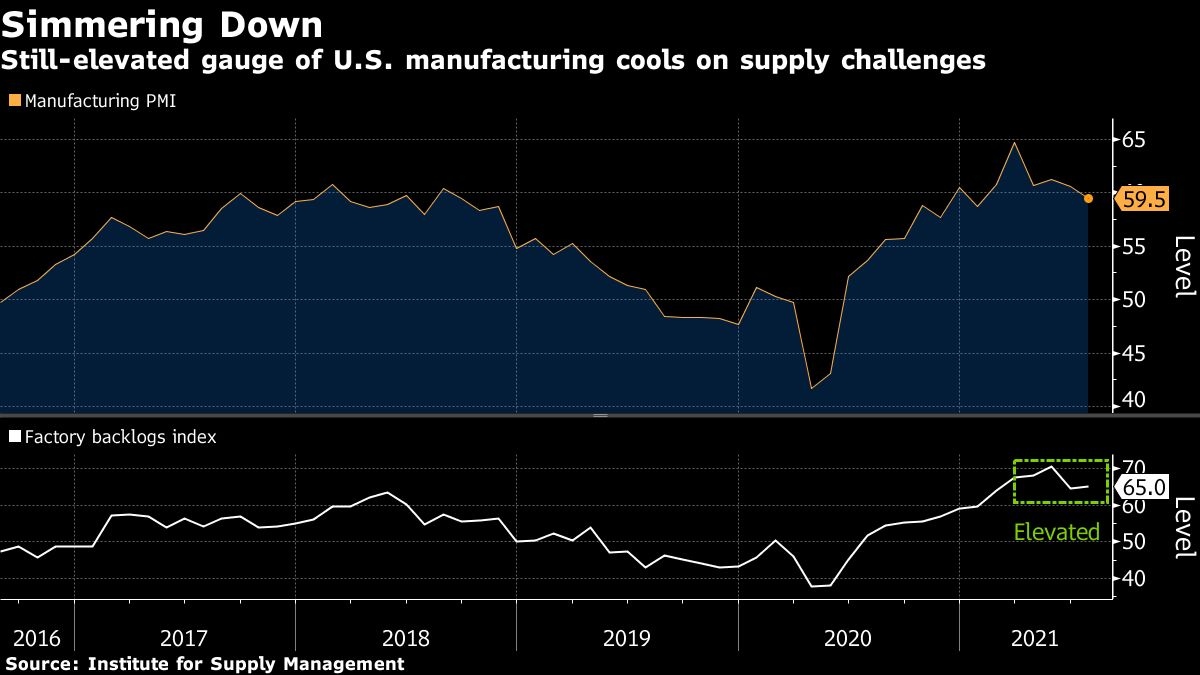

The Institute for Supply Management’s gauge of factory activity eased for a second month, to 59.5 from June’s 60.6, according to data released Monday. Readings above 50 indicate expansion. The median projection in a Bloomberg survey of economists called for a July reading of 61.

Order backlogs edged up to an elevated level as a measure of production cooled, suggesting supply and shipping challenges are restraining manufacturing growth.

“Companies and suppliers continue to struggle to meet increasing demand levels,” Timothy Fiore, chair of the ISM’s manufacturing business survey committee, said in a statement. “As we enter the third quarter, all segments of the manufacturing economy are impacted by near record-long raw-material lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products.”

Because of those production constraints, factories have had to draw down stockpiles to keep up with robust demand growth. In the second quarter, business equipment investment posted another solid gain and consumer spending accelerated to one of the fastest paces in decades, government figures showed last week.

The ISM’s index of customer inventories slumped to a record low last month. Replacing those depleted inventories should fuel output gains in future months, but when those production constraints will ease is unclear.

The group’s gauge of prices paid for raw materials cooled in July to a still-lofty 85.7 after rising in the prior month to the highest level since 1979.

Select ISM Industry Comments

- “Business levels continue to exhibit strong demand, with no signs of backing down. Purchases continue to have long lead times due to shortages of raw materials and labor force, as well as logistics challenges. Increased costs are being passed to customers.” - Computer & Electronic Products

- “Supply chains are slowly, very slowly filling up. Like a water hose, starting upstream and slowly flowing downstream. Rumor is a full return to ‘normal’ may be nearer to year’s end, but the situation is progressing.” - Chemical Products

- “Strong sales continue, and inventories are low as the chip shortage is keeping production numbers down — we have idled several of our assembly plants to reduce the strain on the chip supply base.” - Transportation Equipment

- “Continue to have hiring difficulties and are unable to fill production and salaried jobs (due to) a lack of candidates. Raw materials are still in short supply.” - Fabricated Metal Products

- “Sales are above last year by a good percentage, but meeting demand is just not possible due to force majeure situations, logistics, and labor shortages. We don’t anticipate this ending until well into 2022.” - Nonmetallic Mineral Products

- “Business levels continue to be very strong, but we also continue to struggle finding employees. We can only fill 75 percent of our order requirements due to the labor shortage.” - Primary Metals

A gauge of factory employment rebounded in July, showing companies had slightly more success hiring workers in the month. The government’s monthly jobs report on Friday is projected to show manufacturing payrolls increased by 30,000 in July. Overall employment is forecast to rise by about 875,000.

Seventeen of 18 manufacturing industries reported growth last month, led by furniture, printing and apparel.

The report also showed the average lead time for materials used in the production process eased slightly to 86 days in July from a record 88 days a month earlier.