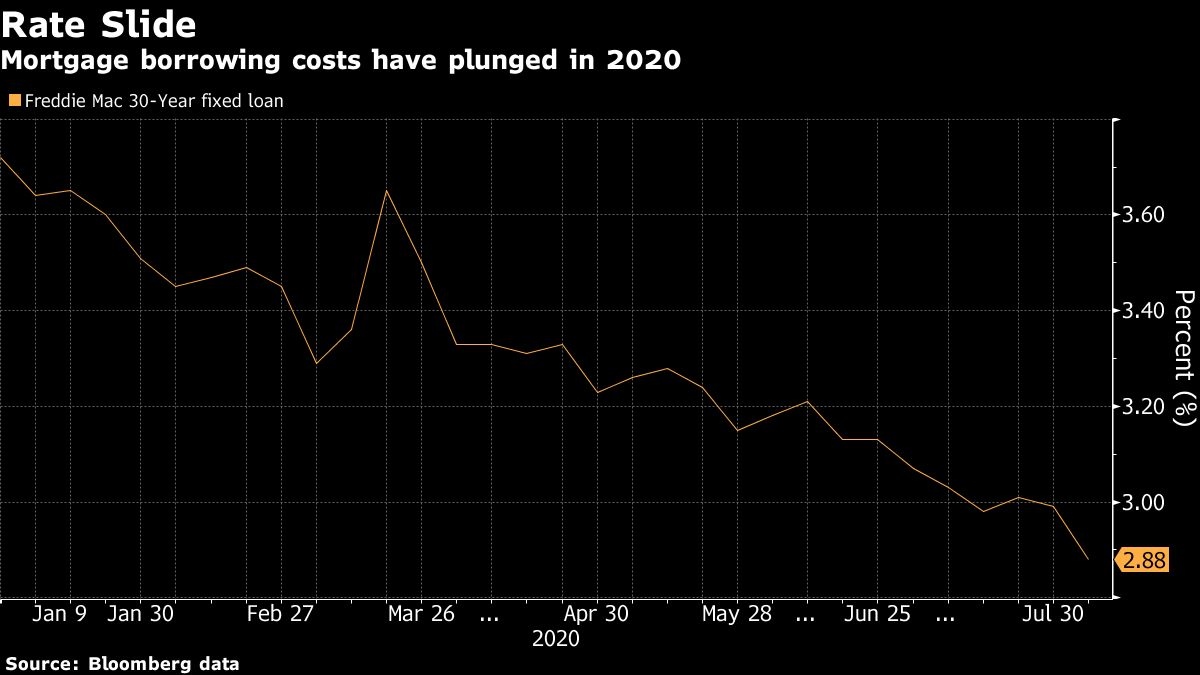

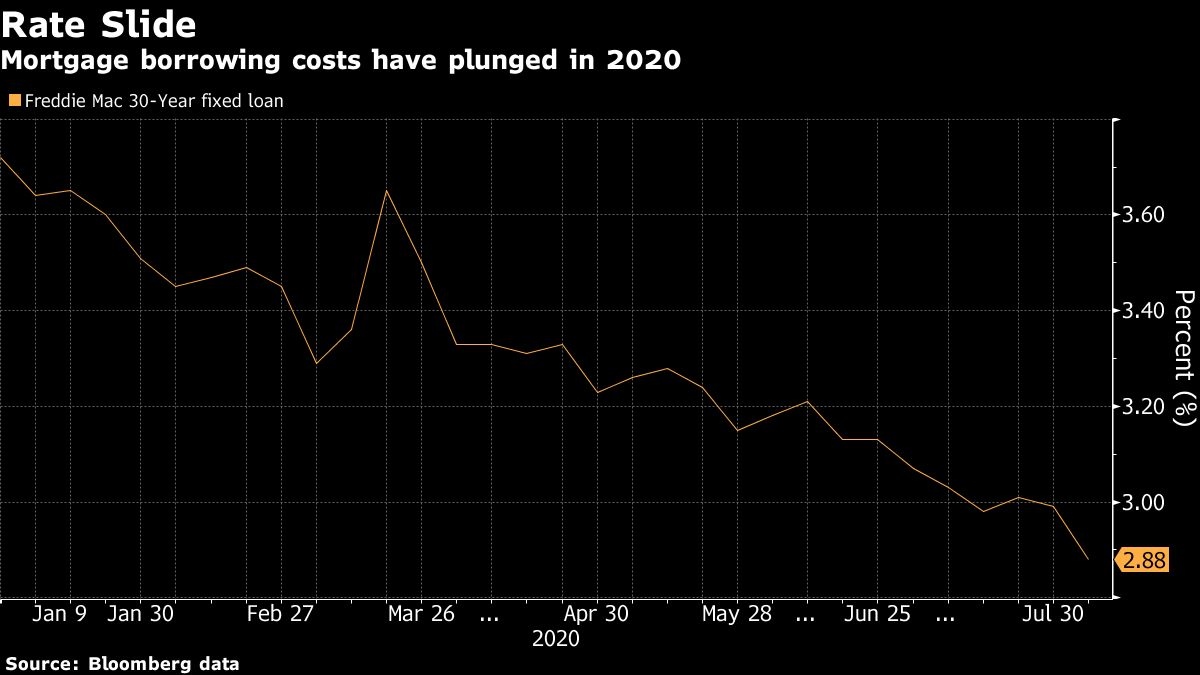

Mortgages rates have found another record low, potentially boosting a housing market that has been a bright spot for a shaky U.S. economy.

The average for a 30-year fixed loan fell to 2.88 per cent, the lowest in nearly 50 years of record keeping by Freddie Mac. It was the eighth time since the coronavirus started roiling financial markets that rates have dropped to a new low.

The previous record was 2.98 per cent last month, when borrowing costs fell below three per cent for the first time. The lower rates are “giving potential buyers more purchasing power and strengthening demand,” Sam Khater, chief economist at Freddie Mac, said in a statement on Thursday.

“We expect rates to stay low and continue to propel the purchase-market forward,” Khater said.

The slide in borrowing costs comes as the Federal Reserve holds its benchmark rate near zero and buys mortgage bonds as part of its plan to stimulate the economy.

The record-low rates have pushed more buyers to look for homes, propping up prices and driving a housing recovery that’s been a bright spot in an economy battered by the pandemic.