Apr 18, 2019

U.S. Private Sector Service Firms Increasingly Weigh on Economy

, Bloomberg News

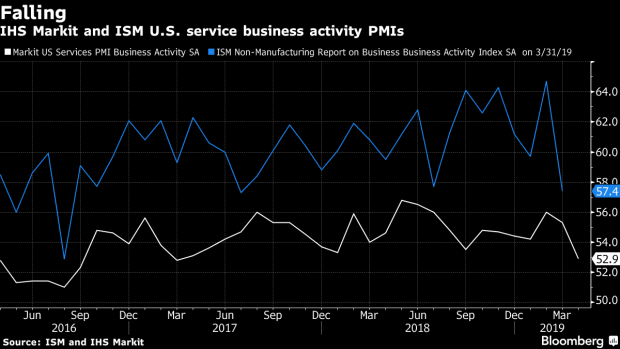

(Bloomberg) -- Two months ago, U.S. private sector service firms failed to report “any material detrimental impact on their output,” from the government shutdown. The preliminary IHS Markit U.S. Services PMI Business Activity Index for April tells another story -- service sector business activity softened to 52.9 in April from 56 in February.

The modest expansion was below the series trend and indicated the slowest increase since March 2017, according to the report. Both the pace of growth for employment and the new business activity slowed to a 25-month low.

“Meanwhile, rates of both input cost and output charge inflation eased. Increased competition for new work, as well as smaller rises in input costs, reportedly dampened the overall pace of selling price inflation.”

Key Insights

- Prices that firms are charging are down six points from late summer to a two-year low.

- Service sector exports fell for a second successive month for the first time since August 2018.

- Companies’ expectations of future growth slid to almost a three- year low. “Only mid-2016 has seen gloomier business prospects,” said Chris Williamson, economist at IHS Markit.

- Final April service sector data are expected to be published on May 3.

- The U.S. Services Purchasing Managers’ Index is based on a survey of over 400 companies.

To contact the reporter on this story: Alex Tanzi in Washington at atanzi@bloomberg.net

To contact the editors responsible for this story: Alex Tanzi at atanzi@bloomberg.net, Dominic Carey

©2019 Bloomberg L.P.