Feb 15, 2022

U.S. producer-price inflation stays hot, reinforcing Fed’s plan to start raising rates

, Bloomberg News

Demand will be disappointingly slow which will cause inflation to slow: David Rosenberg

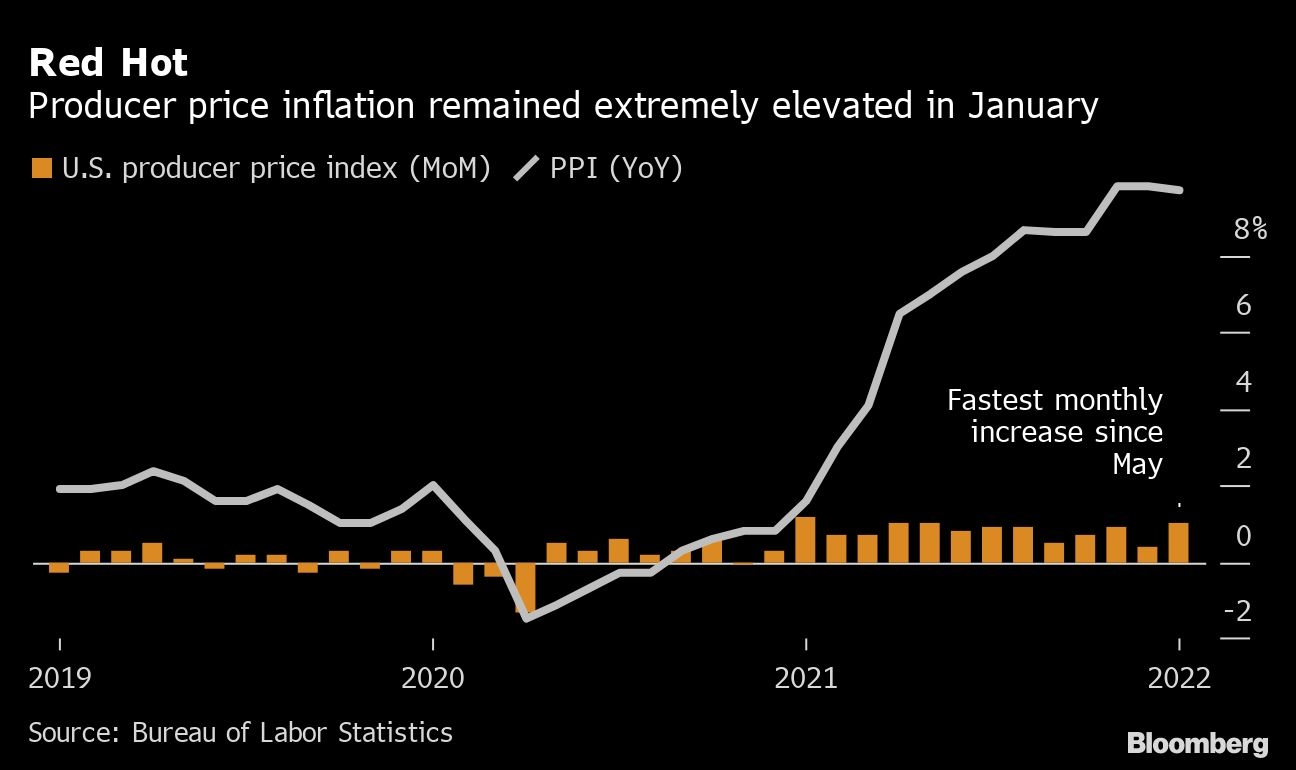

Prices paid to U.S. producers jumped in January by more than forecast, pointing to persistent inflationary pressures as companies contend with supply-chain and labor constraints.

The producer price index for final demand increased 9.7 per cent from January of last year and 1 per cent from the prior month, Labor Department data showed Tuesday. The gain from December was the largest in eight months. The median forecasts in a Bloomberg survey of economists called for a 9.1 per cent year-over-year increase and a 0.5 per cent monthly advance.

“Inflation is everywhere and it seems to be gathering both breadth and momentum,” Stephen Stanley, chief economist at Amherst Pierpont Securities LLC, said in a note.

The figures, which reflected broad increases across categories, may bolster the case for the Federal Reserve to be more aggressive on raising interest rates and shrinking its bond holdings in the coming months. Transportation bottlenecks, robust demand and labor constraints experienced through 2021 have carried over into this year and risk keeping price pressures well-elevated.

“The combination of stubborn supply disruptions and elevated energy prices will prevent producer prices from reverting to more normal patterns until later this year,” Mahir Rasheed and Kathy Bostjancic, economists at Oxford Economics, said in a note.

The S&P 500 rose on optimism Russia-Ukraine tensions may be easing, while Treasury yields climbed.

The latest monthly advance indicates inflationary pressures in the production pipeline remain intense, which will continue to filter through into final costs of consumer goods and services.

Data last week showed that consumer prices surged in January by more than forecast, sending the annual inflation rate to a fresh four-decade high.

FEDERAL RESERVE

The PPI report stands to give more credence to calls for bolder action by more hawkish policy makers such as St. Louis Fed President James Bullard. But centrists among the top Fed officials appear skeptical of a half-point hike, and have suggested that there is little need to start a hiking cycle with a half percentage point move.

A separate report Tuesday showed prices received by New York state manufacturers jumped to the highest in data back to 2001.

“As with most as with most companies, inflation is impacting more than just our raw materials,” Richard Kramer, chief executive officer at Goodyear Tire and Rubber Co., said on the company’s Feb. 11 earnings call. He added that the firm expects “cost pressures to persist over the next several quarters.”

The cost of energy rebounded in January after falling a month earlier, rising 2.5 per cent. So far this month, crude oil and other energy prices have continued to climb on risks that a Russian attack on Ukraine would prompt serious sanctions by western governments.

Excluding the volatile food and energy components, the so-called core PPI increased 0.8 per cent from a month earlier and was up by a 8.3 per cent from a year ago.

Prices of goods accelerated in January from a month earlier, rising 1.3 per cent, the most in three months. Similar to the CPI, prices for goods are still running just as hot as services.

That’s counter to the thesis that many economists, including some at the Fed, are counting on, betting that inflation will shift away from goods to services as the pandemic ebbs, supply chains normalize and Americans resume normal life.

SERVICES COSTS

The cost of services advanced 0.7 per cent, matching the prior month. The report captures changes in prices paid to producers as well as margins received by wholesalers and retailers. A major factor in the January increase in the index for final demand services was hospital outpatient care prices, which rose 1.6 per cent.

Producer prices excluding food, energy, and trade services -- a measure often preferred by economists because it strips out the most volatile components -- rose 0.9 per cent from December, the most in a year. Compared with a year earlier, the gauge advanced 6.9 per cent.

Costs of processed goods for intermediate demand, which reflect prices earlier in the production pipeline, rose 1.7 per cent from a month earlier. Compared with a year earlier, the measure was up 24.1 per cent.