Sep 10, 2021

U.S. producer prices increased in August by more than forecast

, Bloomberg News

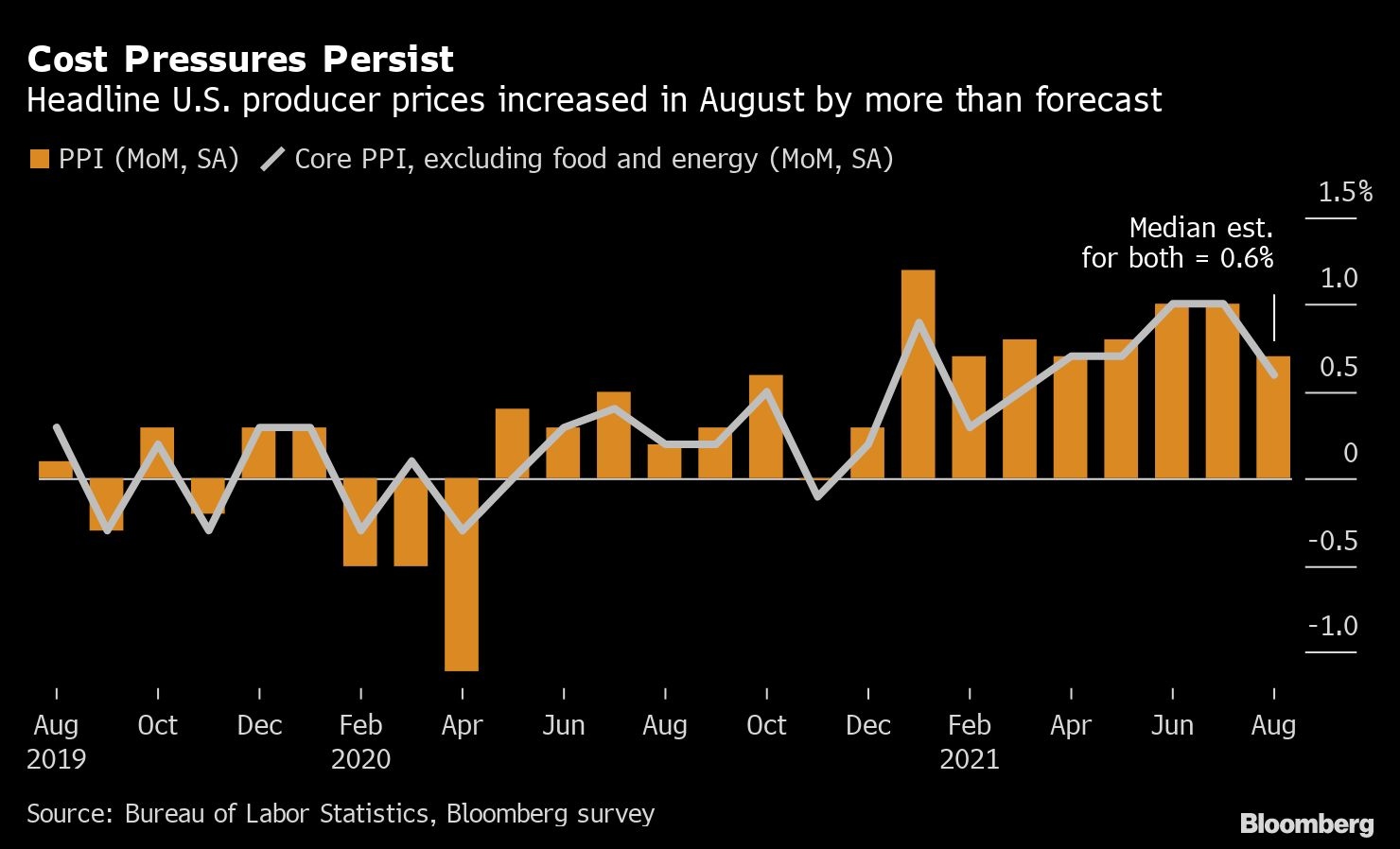

Prices paid to U.S. producers increased in August by more than forecast as persistent supply chain disruptions squeeze production costs higher.

The producer price index for final demand increased 0.7 per cent from the prior month and 8.3 per cent from a year ago, a fresh series high, Labor Department data showed Friday. Excluding the volatile food and energy components, the so-called core PPI advanced 0.6 per cent, and was up 6.7 per cent from August of last year.

The median forecasts in a Bloomberg survey of economists called for a 0.6 per cent month-over-month advance in both the overall PPI and the core figure.

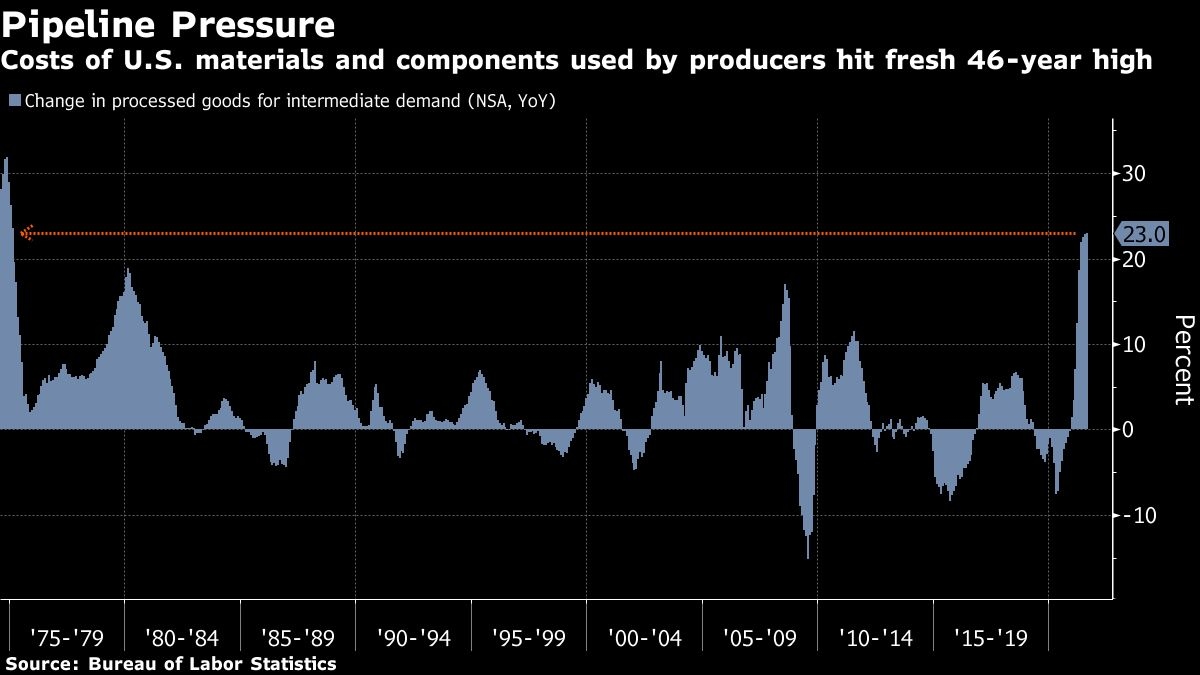

A variety of challenges across the production pipeline -- from materials shortages and shipping bottlenecks to rising labor expenses -- have driven up costs for producers. Many companies have passed along those additional costs onto consumers through higher prices in recent months, further stoking consumer inflation.

The 10-year Treasury yield ticked higher, the dollar remained lower and the S&P 500 advanced in early trading.

The PPI report showed prices for goods increased 1 per cent after a 0.6 per cent gain in the prior month, while the cost of services rose 0.7 per cent.

Meats, residential natural gas, industrial chemicals and motor vehicles were among the goods that moved higher. The rise in services reflected a 7.8 per cent gain in margins for health, beauty and optical goods retailing.

The PPI data come ahead of next week’s consumer price index report, which is forecast to show a 0.4 per cent advance in the CPI from the prior month and a 5.3 per cent increase from August of 2020.

Producer prices excluding food, energy, and trade services -- a measure often preferred by economists because it strips out the most volatile components -- rose 0.3 per cent from the prior month and increased 6.3 per cent from a year earlier.

GLOBAL INFLATION

Producers around the world are raising prices amid soaring costs for commodities and shipping. A separate report out earlier this week showed prices paid to producers in China jumped in August from a year earlier by the most in 13 years.

Costs are growing earlier in the U.S. production pipeline as well. Processed goods for intermediate demand, which include materials and components used in manufacturing and construction, rose 1 per cent in August and were up 23 per cent from 12 months ago, a fresh 46-year high.

Meantime, several districts surveyed by the Federal Reserve “indicated that businesses anticipate significant hikes in their selling prices in the months ahead,” according to the U.S. central bank’s Beige Book released Wednesday.

The elevated cost pressures and supply chain bottlenecks are augmenting the uncertainty already faced by businesses. PPG Industries Inc., which specializes in paints and coatings, withdrew its 2021 financial guidance on Tuesday as supply-chain disruptions drag on sales and higher raw-material costs hurt profit.

Notable Price Moves (MoM)

- Fresh and dry vegetables: +16 per cent

- Beef and veal: +14.7 per cent

- Residential natural gas: +5.6 per cent

- Industrial chemicals: +4.9 per cent

- Sporting goods retailing: +9 per cent

- Airline passenger services: +8.9 per cent

- Hardware, building materials and supplies retailing: -11.6 per cent

- Investment advice: -3.1 per cent

- Iron and steel scrap: -3.7 per cent