Jan 9, 2019

U.S. pushes China to keep promises as trade deal hopes rise

, Bloomberg News

The Trump administration is pushing for a way to make sure China delivers on its commitments in any deal the two nations reach to a trade war that has roiled financial markets and dimmed the outlook for global growth.

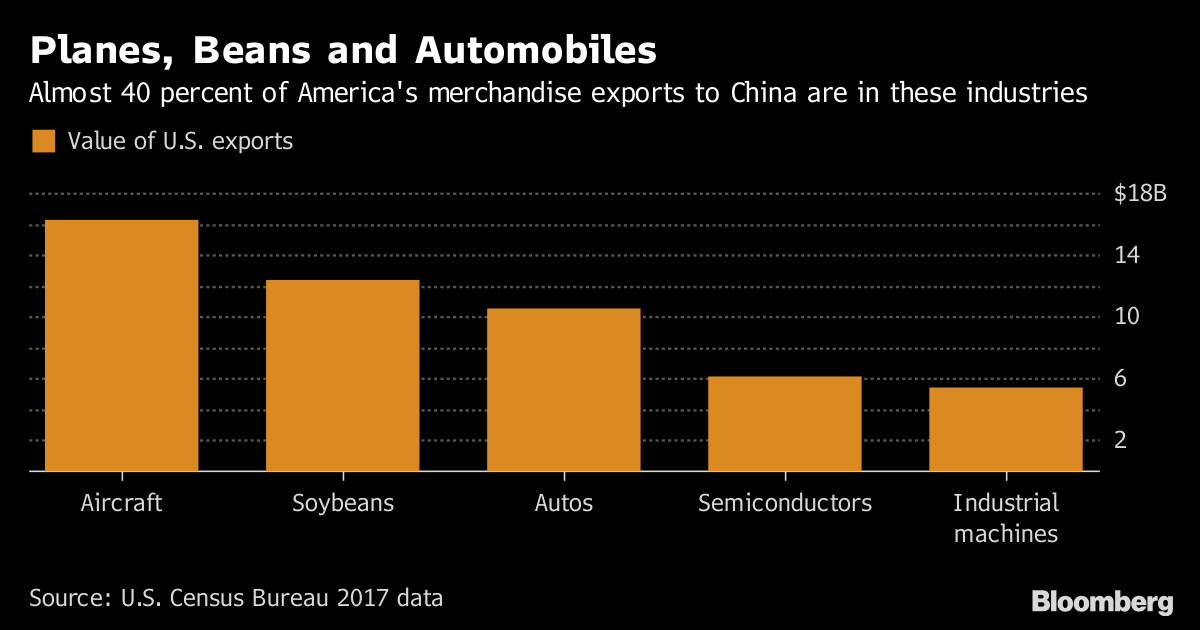

The U.S. wrapped up three days of mid-level talks with China in Beijing on Wednesday, noting a commitment by President Xi Jinping’s government to buy more U.S. agricultural goods, energy and manufactured products.

But in a statement Wednesday, the office of U.S. Trade Representative Robert Lighthizer also said it wants any deal to include “ongoing verification and effective enforcement.” The U.S. will decide on next steps after officials report back to Washington, USTR said.

Investors welcomed signs of optimism from the talks. Stocks rose globally after the two economic powers appeared to inch closer to an agreement, with the S&P 500 Index rising for a fourth day to the highest in almost a month.

Yet the U.S. push for enforceable targets in a deal underscores the challenge of reaching a lasting truce. President Donald Trump and his deputies have criticized China for failing to live up to past promises, including a pledge to promptly open up the Asian nation’s economy to more trade and investment after it joined the World Trade Organization in 2001.

Trump and Xi have given their officials until March 1 to reach an accord on “structural changes” to China’s economy on issues such as the forced transfer of American technology, intellectual-property rights, and non-tariff barriers. It’s a tight window in which to nail down deep changes to China’s economic model, some of which past U.S. administrations advocated for years and U.S. lawmakers on both sides of the aisle support.

A group representing American companies doing business in China welcomed the “substantive discussions,” but stressed the need to work out key details. “Progress should include a mechanism for the removal of tariffs and measurable, commercially meaningful outcomes,” the U.S.-China Business Council said in a statement. The U.S. and China have slapped a tariffs on a combined US$360 billion in each other’s imports since July.

The USTR statement didn’t say whether progress had been achieved on its main concerns China was believed to be preparing its own separate statement on the talks.

The World Bank this week cut its outlook for the global economy as growth in trade and investment slowed and rising interest rates sapped momentum, especially in emerging markets.

Stocks Up

People familiar with the U.S.-China discussions said positions were closer on areas including energy and agriculture but further apart on harder issues.

Chinese foreign ministry spokesman Lu Kang said a one-day extension in talks showed both sides are serious about the negotiations. Some disagreements remain on structural issues and they need to be addressed when more senior negotiators meet later on, according to Chinese officials involved in the discussions who asked not to be identified.

Later this month, Lighthizer is expected to meet with Vice Premier Liu He, Xi’s top economic aide who is leading negotiations for China, a person familiar with the situation said last week. Liu made a brief appearance at the talks in Beijing on Monday, boosting optimism that China was serious about making progress on a deal.

The talks were the first face-to-face meeting between the two sides since their leaders met on Dec. 1. Prior to the meeting, China made a number of concessions to U.S. demands including temporarily cutting punitive tariffs on U.S.-made cars, promising to open up its markets for more foreign investment, and drafting a law to prevent forced technology transfers.

China also restarted purchases of American soybeans last month, providing relief for a crop hit by Chinese retaliatory tariffs. U.S. government data shows the Asian nation scooped up more than 2.6 million metric tons of beans in December and at least another 1.3 million were sold this year, according to people familiar with the matter. China aimed to buy at least 5 million tons of American soybeans as part of the truce.

Trump is increasingly eager to strike a deal with China soon in an effort to perk up financial markets that have slumped on concerns over the trade war, according to people familiar with internal White House deliberations. The S&P 500 Index has fallen about 7 percent since Trump and Xi agreed on a 90-day truce at their meeting in Argentina last month.

“Talks with China are going very well!”Trump tweeted on Tuesday.