Feb 22, 2020

U.S. Soybean Stockpiles Set to Drop to Trade War Low

, Bloomberg News

(Bloomberg) -- Donald Trump’s trade truce with China is expected to push American soybean stockpiles to the lowest since the trade war began.

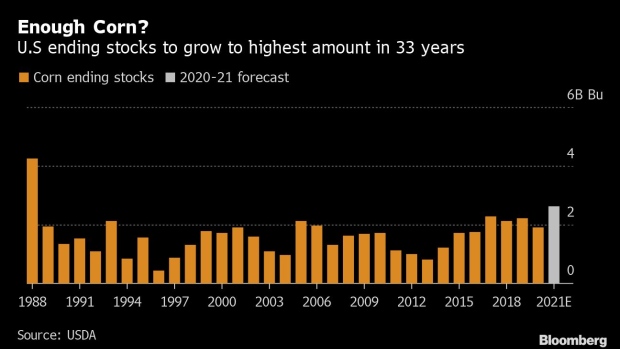

But corn stocks are going in the opposite direction, ballooning to the highest in three decades. And the president’s hints for more farmer aid could make the disconnect between the two even more pronounced.

Soybean reserves will fall 25% in the coming season to the lowest since 2016-17, the U.S. Department of Agriculture forecast at its outlook forum in Arlington, Virginia. Higher exports, especially to top importer China, will add to increased domestic demand to eat up stocks.

“Increasing global import demand, particularly for China, and a recovery in U.S. market share will support higher soybean exports following a sharp decline over the past two years,” the USDA said in a report Friday.

Stockpiles will fall to 320 million bushels at the end of the 2020-21 season, surprising analysts who had expected the figure to come in between 328 million to 825 million, according to a Bloomberg survey.

Meanwhile, the government forecast corn inventories will jump about 29% to 2.637 billion bushels as farmers plant more. That would be the highest in 33 years.

Current prices and yield prospects have increased bets that farmers will sow the yellow grain over the oilseed. The USDA on Thursday said corn plantings would likely climb to the highest in four years. While soybean acres should also rise, they are projected to stay below pre-trade war levels.

What’s more, Trump surprised the markets on Friday by raising the possibility of delivering more aid to American farmers as promised purchases from trade deals with China and other countries have yet to materialize.

Even the suggestion of more bailout money -- after the government pledged $28 billion over the past two years -- could end up distorting planting decisions.

In 2019, farmers had to sow a crop in order to qualify for aid. Anticipation for further government payments could spark some growers to seed where they might not have otherwise.

Grain prices fell after Trump’s tweet that floated the aid possibility. May corn futures fell 0.5% to settle at $3.80 3/4 a bushel in Chicago. Soybeans erased earlier gains and fell 0.2% to $8.99 a bushel. Even wheat prices dropped 1.3% to $5.52 a bushel on the news.

“That raised fears of overproduction,” Arlan Suderman, INTL FCStone’s chief commodities economist, said by phone.

Earlier in the day, prices rose after the USDA said American plantings of all varieties are expected to slump to a record low and reserves were forecast to shrink.

But the allure of aid could throw all those numbers back into question.

“The farmer will plant like crazy,” Joe Davis, a director at brokerage Futures International, said in a message. “Trump is almost wanting the farmer to be happy and plant.”

(Updates with closing prices, analyst comment)

--With assistance from Dominic Carey, Megan Durisin and Jen Skerritt.

To contact the reporters on this story: Isis Almeida in Chicago at ialmeida3@bloomberg.net;Michael Hirtzer in Chicago at mhirtzer@bloomberg.net

To contact the editors responsible for this story: Lynn Doan at ldoan6@bloomberg.net, Millie Munshi, James Attwood

©2020 Bloomberg L.P.