Sep 18, 2020

U.S. Stimulus Risks Simmer in Volatility Markets, Glenmede Says

, Bloomberg News

(Bloomberg) -- Investors are hedging against market turbulence in the months ahead partly over concerns about U.S. fiscal spending, not just a disputed or drawn out election, according to Glenmede Investment Management LP.

“The election could have a big impact on potential future stimulus,” Glenmede’s Stacey Gilbert said in an interview Thursday. “The real uncertainty and the volatility we’re seeing priced into this market is more than just the election. It’s the new makeup of Congress and the White House, and the transition in the economy.”

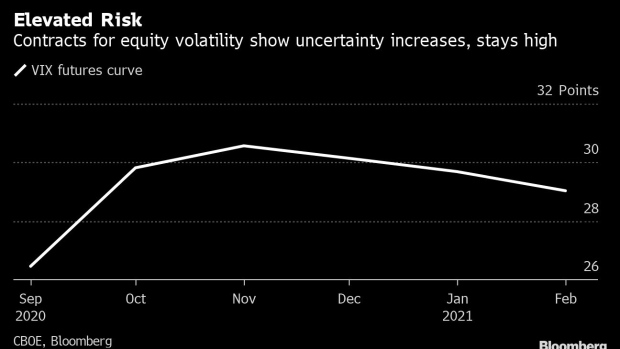

Metrics like the futures contracts on the Cboe Volatility Index, or VIX, show a big bump around the November election and beyond, which strategists often attribute to the potential for a delayed election result due to increased voting by mail amid the pandemic. At the same time, more government outlays are seen as crucial for the economic recovery, but Democrats and Republicans have yet to break a months-long deadlock over the size of the next stimulus package.

“The expectation of fiscal support is incredibly high,” Gilbert said. “We’re not out of the woods on Covid yet. As much as we’re starting to see the economy pick back up and we’re seeing positive signs, there are still limitations in this return to normal capacity” and people are expecting the administration to help, she said. But that’s by no means guaranteed, she added.

©2020 Bloomberg L.P.