Feb 9, 2023

U.S. stock buyers' fatigue kicks in as bond yields jump

, Bloomberg News

BNN Bloomberg's closing bell update: Feb. 9, 2023

Wall Street couldn’t find many reasons to keep lifting stocks amid higher bond yields, hawkish Fedspeak and a surge in equity bullishness among retail investors that’s often seen as a contrarian indicator.

The S&P 500 finished lower after wiping out a rally of almost 1 per cent. Options traders continued piling into bets targeting a 6 per cent Federal Reserve peak rate, nearly a percentage point higher than consensus. The two-year note’s yield hit 4.5 per cent, and earlier pushed above the 10-year rate by the widest margin since the early 1980s — a sign of flagging confidence in the economy’s ability to withstand additional tightening.

Adding to the drumbeat of officials signaling the central bank has a ways to go to curb prices, Fed Bank of Richmond President Thomas Barkin said it’s important to continue hiking to rein in inflation. Data on jobless claims reinforced the idea of a hot labor market that points to tight policy, while mortgage rates rose for the first time in more than a month.

“The market’s questioning if it’s even possible for the Fed to walk the line to do what they’re aiming to do because it’s a very difficult job — slowing the economy down though interest-rate increases while keeping us from slipping into a severe recession,” said Chris Gaffney, president of world markets at TIAA Bank. “Investors understand and realize that it’s a very difficult path that the Fed has ahead of it.”

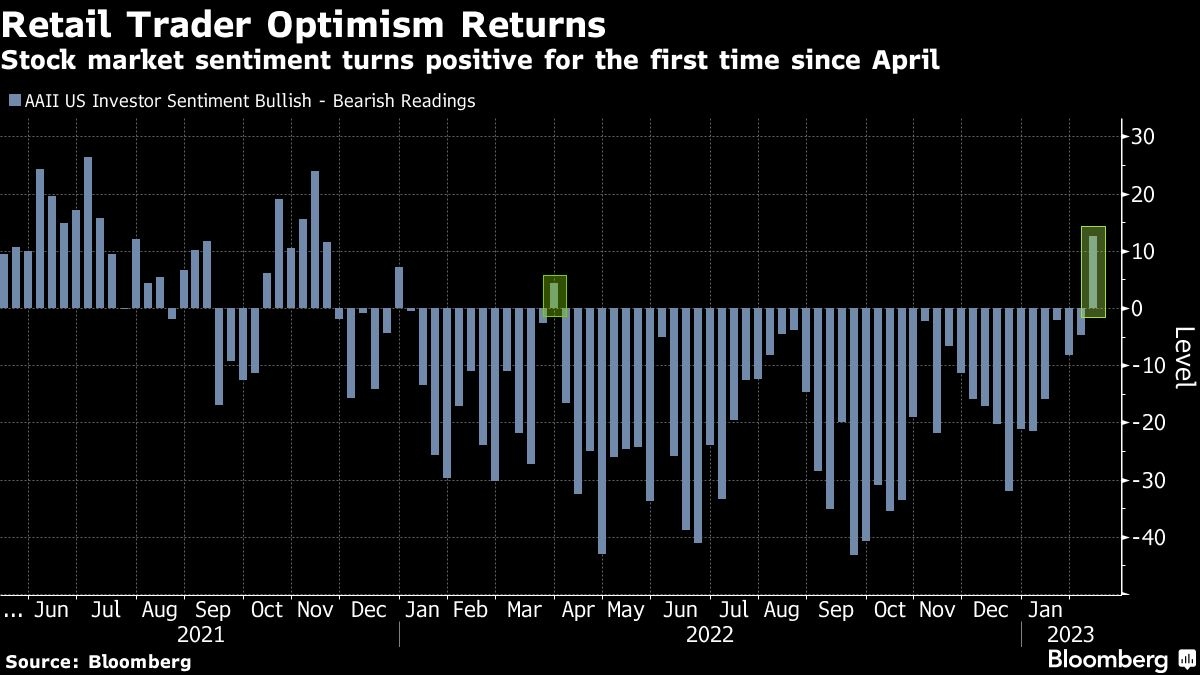

Amid so many uncertainties, some analysts see room for consolidation, especially after a surge that put stocks near overbought levels. To Katie Stockton at Fairlead Strategies, the biggest potential challenge for the market right now is overly bullish sentiment.

The latest survey from the American Association of Individual Investors showed U.S. retail investors turned bullish for the first time since April, with the bull-bear spread rising to 12.5 from -4.7 a week earlier. The percentage of investors with a bearish view over the next six months fell to 25 per cent, the lowest since November 2021.

“Well, as human nature never changes, sentiment ALWAYS follows price,” wrote Peter Boockvar, author of the Boock Report. “And the bulls are back now across the board. From a contrarian perspective, we now need to pay attention, and while not extreme and standing room only, the bull boat is getting filled up.”

For some market watchers, trades favoring disinflation are soon set to reverse as price increases prove more entrenched than anticipated.

This year, higher-duration sectors, such as tech and consumer discretionary have led stocks’ advance, while low-duration ones such as energy and utilities have underperformed. This is a reversal of the trend from late 2021, where investors started to shun high-duration stocks as inflation began to rise rapidly.

The performance of megacaps in those two industries was fairly mixed on Thursday. Tesla Inc. extended its breakneck rally, while Google’s parent Alphabet Inc. extended a two-day selloff as concerns surfaced about the competence of Bard, the ChatGPT rival it unveiled on Feb. 6.

Key events:

- U.S. University of Michigan consumer sentiment, Friday

- Fed’s Christopher Waller and Patrick Harker speak, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.9 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.9 per cent

- The Dow Jones Industrial Average fell 0.7 per cent

- The MSCI World index fell 0.4 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.1 per cent

- The euro rose 0.2 per cent to US$1.0734

- The British pound rose 0.4 per cent to US$1.2117

- The Japanese yen fell 0.2 per cent to 131.63 per dollar

Cryptocurrencies

- Bitcoin fell 4.2 per cent to US$21,989.8

- Ether fell 4.7 per cent to US$1,575.74

Bonds

- The yield on 10-year Treasuries advanced six basis points to 3.67 per cent

- Germany’s 10-year yield declined six basis points to 2.30 per cent

- Britain’s 10-year yield declined two basis points to 3.29 per cent

Commodities

- West Texas Intermediate crude fell 1.1 per cent to US$77.63 a barrel

- Gold futures fell 1 per cent to US$1,872 an ounce