Jun 30, 2021

U.S. stock euphoria abates at end of big first half

, Bloomberg News

BNN Bloomberg's mid-morning market update: June 30, 2021

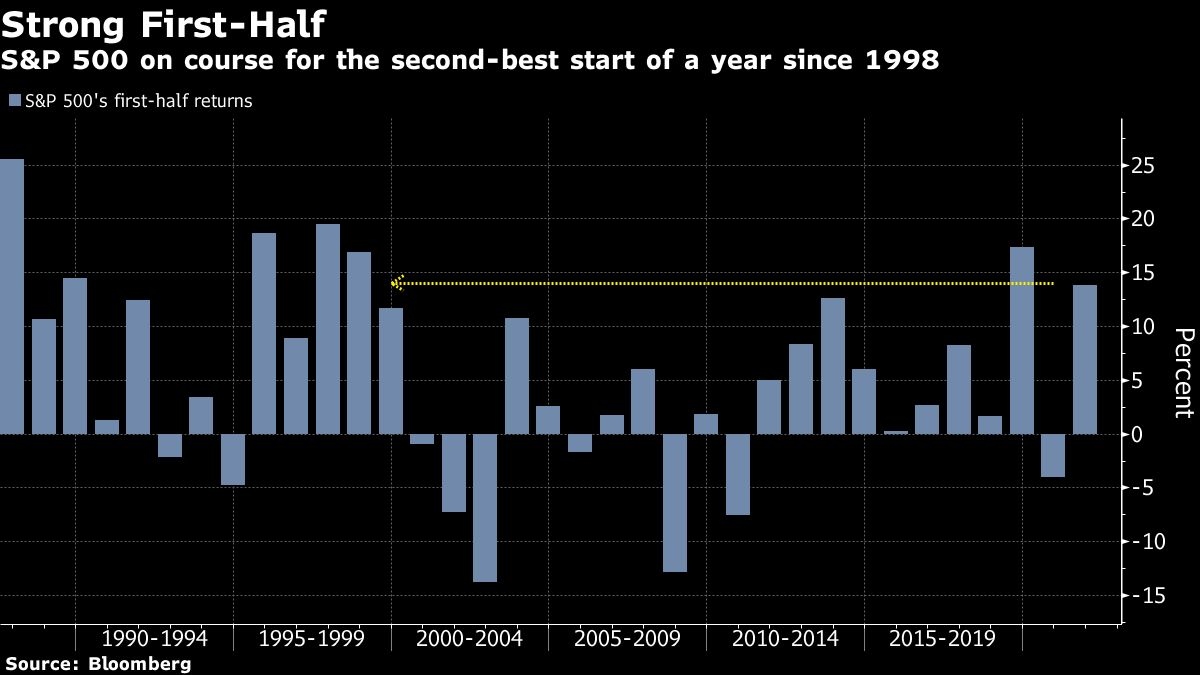

The end of one of the best first halves for stocks since 1998 was marked by small moves and slow trading.

Solid economic data tempered concern about high valuations and the spread of a more contagious coronavirus variant, with the S&P 500 closing slightly higher. The gauge notched its longest streak of monthly gains since August and has rallied 14 per cent in 2021. The Dow Jones Industrial Average outperformed major benchmarks on Wednesday, and the Nasdaq 100 fell. Treasuries, which have surprisingly beaten the world’s biggest bond markets since the Federal Reserve’s hawkish tilt in June, rose.

Investors are assessing hopes for an imminent return to normalcy amid worries that runaway inflation or further COVID-19 restrictions could derail the economic rebound. Interestingly enough, companies that stand to benefit the most from a recovery in activity -- like energy, industrial and financial shares -- rose on Wednesday, beating the tech giants that had fueled the stay-at-home trade.

“While we expect stock markets will ultimately thrive in the reflationary environment of strong, above-trend growth and ample liquidity conditions, it won’t be a smooth ride,” said Candice Bangsund, vice president and portfolio manager at Montreal-based Fiera Capital Corp. “The next phase of the bull market may exhibit more frequent bouts of volatility.”

Dallas Fed President Robert Kaplan said the tapering of asset purchases, which he hopes will start “soon,” should run smoother this time around as investors already know that a move is being discussed. His Atlanta counterpart Raphael Bostic noted the U.S. has “actually fully recovered” from the pandemic on a gross domestic product basis, but “it is going to take some time to get back” on employment.

Elsewhere, oil advanced, with investors awaiting a key meeting between OPEC+ producers that may reveal a collective output hike as a stalemate in Iranian nuclear talks drags on.

Here are some events to watch in the markets this week:

- China’s President Xi Jinping will deliver a speech as the nation marks the 100th anniversary of the founding of the Chinese Communist Party Thursday

- OPEC+ ministerial meeting Thursday

- ECB President Christine Lagarde speaks Friday

- The U.S. jobs report is due Friday

These are some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.1 per cent

- The Dow Jones Industrial Average rose 0.6 per cent

- The MSCI World index fell 0.2 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.3 per cent

- The euro fell 0.3 per cent to US$1.1859

- The British pound was little changed at US$1.3833

- The Japanese yen fell 0.5 per cent to 111.08 per dollar

Bonds

- The yield on 10-year Treasuries declined two basis points to 1.45 per cent

- Germany’s 10-year yield declined four basis points to -0.21 per cent

- Britain’s 10-year yield declined two basis points to 0.72 per cent

Commodities

- West Texas Intermediate crude rose 0.8 per cent to US$73.53 a barrel

- Gold futures rose 0.4 per cent to US$1,770.60 an ounce