Dec 13, 2019

U.S. stocks close higher as partial trade deal clinched

, Bloomberg News

BNN Bloomberg's closing bell update: Dec. 13, 2019

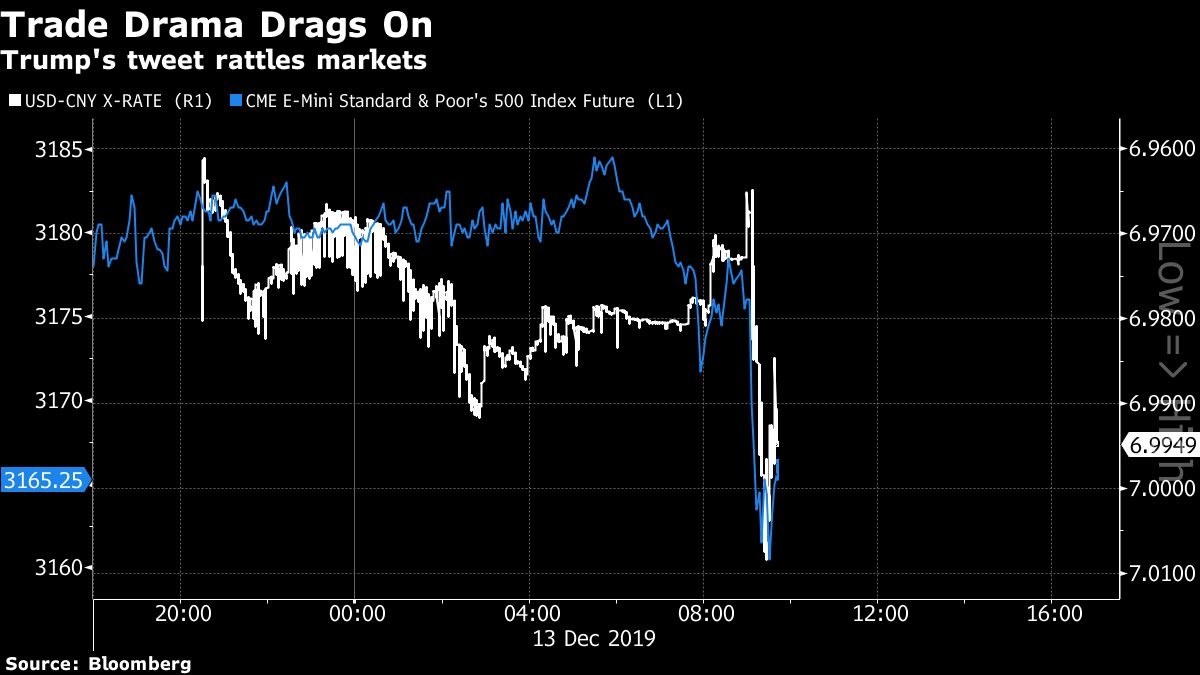

U.S. stocks ended a tumultuous session higher with major benchmarks notching records as investors attempted to assess the contours of a partial deal reached between the U.S. and China.

Stocks swung between gains and losses throughout the day, while Treasuries surged as neither side delivered enough details to calm investors who sent shares to records Thursday on reports fresh tariffs due Sunday have been averted.

President Donald Trump confirmed as much Friday, but it remained unclear whether China agreed to enough agricultural purchases or if the U.S. had planned to roll back some existing tariffs.

The S&P 500 eked out a gain, rising for the ninth week out of the last 10, after Trump signaled he’d cut in half the tariffs that took hold in September. The U.S. will maintain levies that began in the spring. The 10-year Treasury yield fell below 1.82 per cent.

“Both sides now seem to be negotiating in public,” Matt Maley, an equity strategist at Miller Tabak & Co., said. “The uncertainty makes it impossible to make concrete investment decisions. These negotiations have turned into a circus.”

The dollar was steady against major peers after U.S. retail sales data fell short of estimates. West Texas crude and gold advanced.

The fresh trade headlines overshadowed the U.K. election that puts the country on track to leave the European Union next month. The FTSE 100 index rose more than 1 per cent and the pound surged.

These are the main moves in markets:

Stocks

The S&P 500 Index rose 0.01 per cent at 4 p.m. New York time.

The Nasdaq 100 added 0.2 per cent.

The Stoxx Europe 600 Index advanced 1.1 per cent.

The U.K.‘s FTSE 100 Index rose 1.1 per cent.

The MSCI Asia Pacific Index gained 1.6 per cent.

Currencies

The Bloomberg Dollar Spot Index was flat.

The British pound increased 1.3 per cent to US$1.3338.

The euro dropped 0.1 per cent at US$1.1114.

The Japanese yen was steady at 109.31 per dollar.

Bonds

The yield on 10-year Treasuries fell seven basis points to 1.82 per cent.

The two-year yield fell six basis points to 1.60 per cent.

Germany’s 10-year yield lost one basis point to -0.279 per cent.

Britain’s 10-year yield gained three basis points to 0.845 per cent.

Commodities

West Texas Intermediate crude advanced 1.3 per cent to US$59.97 a barrel.

Gold futures rose 0.6 per cent to US$1,480.70 an ounce.