Jan 8, 2020

U.S. stocks extend gains after Trump's Iran comments

, Bloomberg News

BNN Bloomberg's closing bell update: Jan. 8, 2019

U.S. stocks rose and Treasuries fell after President Donald Trump toned down rhetoric against Iran, suggesting further military force isn’t needed.

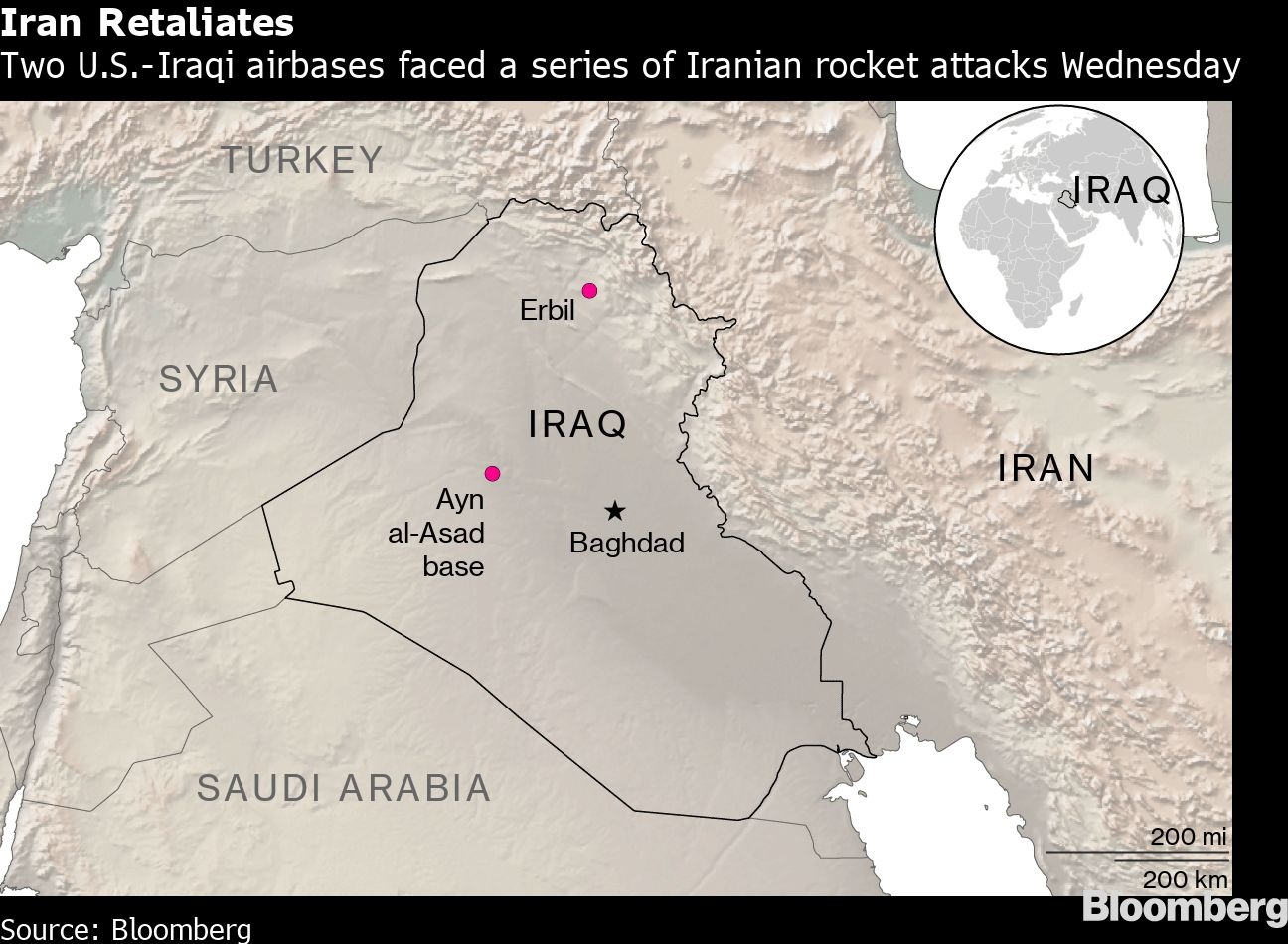

The S&P 500 headed for a fresh record after Trump said Iran appeared to be “standing down,” and announced more sanctions on the country. Ten-year Treasury yields gained after tumbling overnight following Iranian airstrikes on American bases in Iraq. The dollar advanced, while oil fell below $60 a barrel in New York.

The Nasdaq indexes also notched all-time intraday highs as tech led the advance in equities. In company news, Boeing Co. slumped after one of its planes crashed in Iran. Walgreens Boots Alliance sank 6% after the drugstore giant’s profits slid, while Lennar Corp. advanced as its earnings topped estimates.

“The main market driver right now is the generally improving macroeconomic backdrop and most other things are a distraction from that overriding theme,” Michael Reynolds, investment strategy officer at Glenmede, said by phone. “I think the loudest distraction has certainly been the geopolitical tension between the U.S. and Iran going back and forth.”

Markets settled back into the familiar risk-on mood that had pushed benchmarks to recent records, with investors betting the president’s rhetoric Wednesday will cool tensions in the Middle East. Nervousness had reigned since last week when the U.S. killed a powerful Iranian general, denting optimism sparked by signs of a resilient global economy as well as a partial Sino-American trade deal.

Investors will likely now turn their attention to the nonfarm jobs report due Friday. A gauge of private employment beat expectations Wednesday.

Here are some events to watch for this week:

President Trump said he would make a statement on Wednesday morning in wake of the Iran attack.

Federal Reserve officials Richard Clarida, John Williams, James Bullard and Charles Evans speak on Thursday.

The U.S. monthly non-farm employment report is due Friday.

These are moves in major markets:

Stocks

The S&P 500 Index advanced 0.7 per cent as of 2:25 p.m. New York time.

The Stoxx Europe 600 Index rose 0.2 per cent.

The MSCI Asia Pacific Index decreased 0.9 per cent.

Currencies

The Bloomberg Dollar Spot Index added 0.1 per cent.

The British pound fell 0.2 per cent to US$1.3098.

The euro dipped 0.3 per cent to US$1.1124.

The Japanese yen declined 0.7 per cent to 109.16 per dollar.

Bonds

The yield on 10-year Treasuries rose four basis points to 1.86 per cent.

The yield on two-year Treasuries gained four basis points to 1.58 per cent.

Britain’s 10-year yield added three basis points at 0.817 per cent.

Commodities

West Texas Intermediate crude decreased 5 per cent to US$59.41 a barrel.

Gold fell 0.9 per cent to US$1,559.80 an ounce.