May 19, 2022

Stocks end lower in late-day slide as havens bid

, Bloomberg News

My projection is we're going to see some Canadian dollar weakness: Managing director

US stocks fell in a volatile day of trading as investors weighed prospects for growth against a backdrop of rising prices and tightening monetary policy. Treasuries held gains amid a steady stream of haven bids.

The S&P 500 swung back into the red in the last hour of trading, a day after the biggest single-day drop since June 2020 that erased US$1.5 trillion from its market value. The Nasdaq 100 posted modest losses, slipping 0.4 per cent on Thursday. Cisco Systems Inc. slid more than 10 per cent after warning that Chinese lockdowns and other supply disruptions would wipe out sales growth in the current quarter.

Treasury yields were lower across the board amid a growing sense of angst over the health of the global economy and selloff in equity markets. Weaker than forecast US jobless claims and a sharp decline in a regional Philadelphia Fed survey also spurred a burst of buying. Gold gained while the dollar weakened against all of its Group-of-10 counterparts.

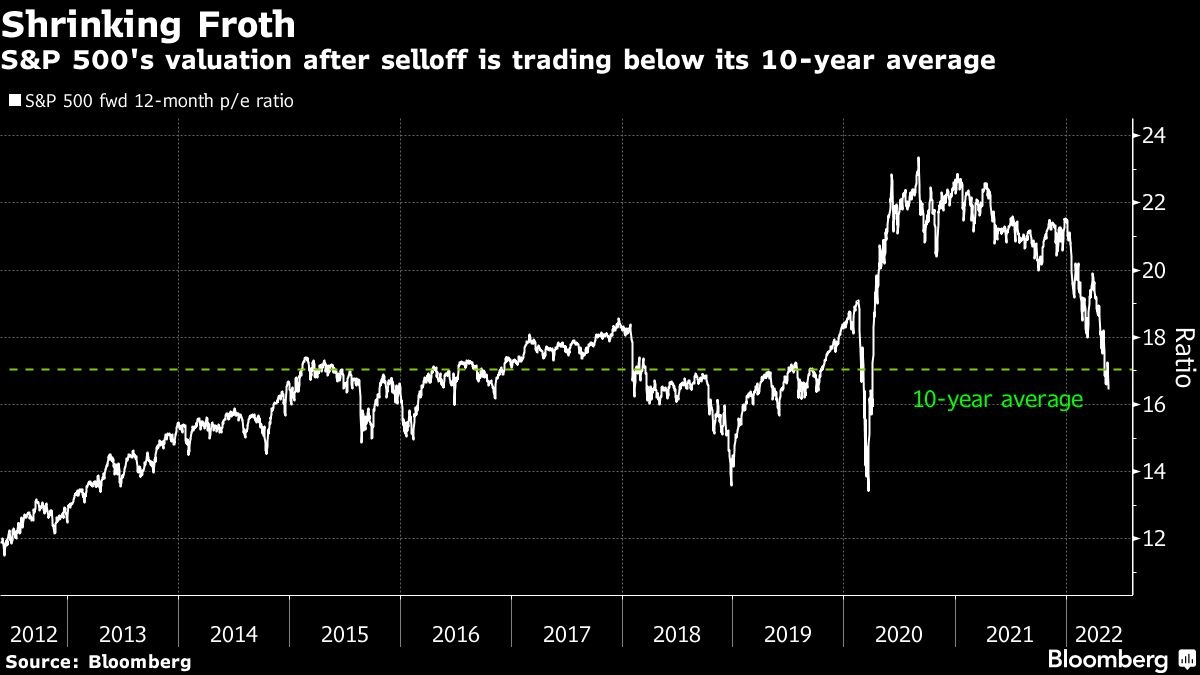

The selloff in stocks this week has left the S&P 500 on the brink of notching up its seventh weekly decline, the longest streak since the dotcom bubble burst more than two decades ago. Bets that robust earnings can help investors weather this year’s turbulence were thrown in doubt after US consumer titans signaled a growing impact of high inflation on margins and consumer spending. Meanwhile, Federal Reserve officials reaffirmed this week that tighter monetary policy lies ahead, while investors fretted over stagflation risks.

Commentary

- “In this bear market, the sour mood has been persistent and hasn’t helped at all in trying to time a market rebound,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group. “But that’s what happens in bear markets, oversold gets more oversold. That said, this level of bearishness can always lead to good bear market rallies.”

- “The focus has shifted obviously from ‘OK, we will see the Fed aggressively raise rates,’ to ‘Uh oh, what’s going to go on with growth -- are we entering a sustained period of stagflation?’” said Chris Gaffney, president of world markets at TIAA Bank. “In some instances, we’re already in a period of stagflation, but the question now is how long will that last. That’s just cast a negative tone on the markets when you’re considering central banks aggressively raising rates and at the same time we’re going into a period of maybe slower growth. That’s what’s causing the selloff.”

- “The stock market is square in the crosshairs of the Federal Reserve, which no longer has its back and is solely focused on slowing inflation back down to their long-range target of two per cent,” Chris Zaccarelli, chief investment officer at Independent Advisor Alliance, said in a note. “As the stock market goes down, the Fed can’t ease policy as long as inflation remains their main concern, and if the stock market rises significantly then then Fed will see that as an impediment to their inflation goals and will be emboldened to raise rates even higher.”

- Everybody’s afraid that policy makers are “going to get it wrong,” Lori Heinel at State Street Global Advisors said on Bloomberg TV. “We actually are a little bit more dovish in terms of what we think the Fed’s gonna do, and if they move in the summer and then actually do take a bit of a pause, then there’s a chance that we get out of this without a recession.”

On the corporate front, Twitter Inc. executives told employees on Thursday that the US$44 billion deal to sell the company to billionaire Elon Musk is moving forward as planned. Apple Inc. executives previewed its upcoming mixed-reality headset to the company’s board last week, indicating that development of the device has reached an advanced stage, according to people with knowledge of the matter. Kohl’s Corp. cut its profit and sales outlook in an already tough week for retail companies as inflationary pressures cut into profits.

Elsewhere, the Swiss franc extended its advance versus the dollar after Swiss National Bank President Thomas Jordan said policy makers are ready to act against inflation.

Some of the main moves in markets:

Stocks

- The S&P 500 fell 0.6 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.4 per cent

- The Dow Jones Industrial Average fell 0.8 per cent

- The MSCI World index fell 0.6 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.9 per cent

- The euro rose 1.2 per cent to US$1.0590

- The British pound rose 1.2% to US$1.2495

- The Japanese yen rose 0.4 per cent to 127.71 per dollar

Bonds

- The yield on 10-year Treasuries declined four basis points to 2.85 per cent

- Germany’s 10-year yield declined eight basis points to 0.95 per cent

- Britain’s 10-year yield was little changed at 1.86 per cent

Commodities

- West Texas Intermediate crude rose 1.7 per cent to US$111.44 a barrel

- Gold futures rose 1.4 per cent to US$1,847.70 an ounce