Jun 23, 2021

S&P 500 stuck in trading lull while bonds retreat

, Bloomberg News

BNN Bloomberg's mid-morning market update: June 23, 2021

Stocks traded in a tight range Wednesday as investors assessed prospects for an economic recovery and continued Federal Reserve support amid the threat of inflation. Treasuries fell.

The S&P 500 drifted between gains and losses throughout the day, with companies tied to a broader reopening of the economy -- such as retail and financial shares -- outperforming. A rally in Tesla Inc. drove the Nasdaq Composite to a fresh record even as the gauge rose just 0.1 per cent. Fannie Mae and Freddie Mac tumbled as the Supreme Court dealt a blow to investors in their challenge to the U.S. collection of more than US$100 billion in profits from government-sponsored enterprises.

The economy will likely meet the Fed’s threshold for tapering its asset purchases sooner than people think, noted Dallas Fed President Robert Kaplan, who’s penciled in a rate hike next year. His Atlanta counterpart Raphael Bostic said the central bank could decide to slow its asset purchases in the next few months. Meantime, Treasury Secretary Janet Yellen said her department may exhaust emergency measures to avoid breaching the debt limit as soon as August unless Congress acts to avert a potential default that would be "catastrophic."

Data Wednesday showed U.S. manufacturing activity expanded in June at the fastest pace in records dating back to 2007. Meantime, sales of new homes unexpectedly fell last month as elevated home prices continued to weigh on affordability. The reports came a day after Fed Chair Jerome Powell reiterated his views that policy makers will be patient in waiting to lift rates despite higher inflation.

"You’ve got this inflation issue that has captured the imagination of investors for the first time in a long time," said David Donabedian, chief investment officer of CIBC Private Wealth Management. "I don’t have a great case for why the market takes another leap forward here over the summer. It’s going to be more of a churn, and we usually do get a little bit more volatility because volumes are down."

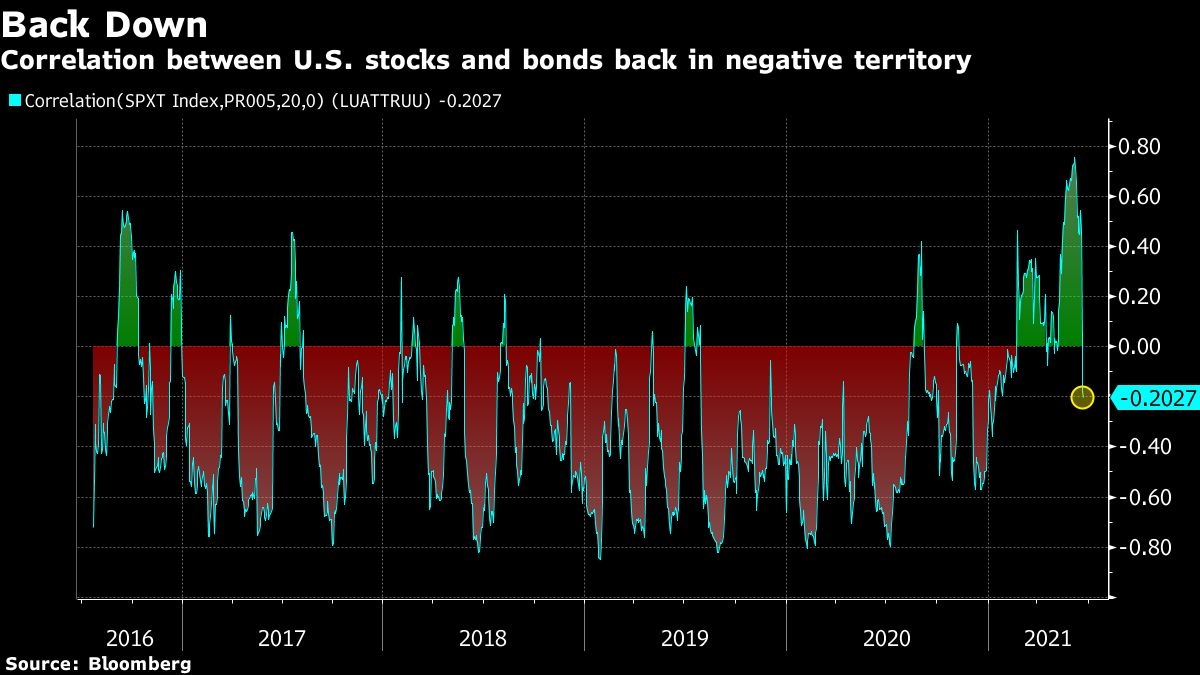

One-month correlations between the Bloomberg Barclays U.S. Treasury Index and the S&P 500 Total Return Index have fallen back below zero. Stocks and bonds moving in lockstep create headaches for fund managers who use fixed-income securities to diversify their portfolios and protect them against a selloff in equities.

Here are some events to watch this week:

- Bank of England interest rate decision Thursday

- The Fed releases Thursday the results of stress tests on the largest U.S. banks

- U.S. wholesale inventories, initial jobless claims, GDP, durable goods due Thursday

- U.S. personal income/spending, University of Michigan sentiment on Friday

These are some of the main moves in financial markets:

Stocks

- The S&P 500 fell 0.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 was little changed

- The Dow Jones Industrial Average fell 0.2 per cent

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro fell 0.1 per cent to US$1.1924

- The British pound was little changed at US$1.3959

- The Japanese yen fell 0.3 per cent to 110.99 per dollar

Bonds

- The yield on 10-year Treasuries rose three basis points to 1.49 per cent

- Germany’s 10-year yield declined one basis point to -0.18 per cent

- Britain’s 10-year yield was little changed at 0.78 per cent

Commodities

- West Texas Intermediate crude rose 0.6 per cent to US$73.26 a barrel

- Gold futures fell 0.1 per cent to US$1,775.40 an ounce

--With assistance from Andreea Papuc, Namitha Jagadeesh, Cormac Mullen and Claire Ballentine.