Jan 20, 2022

U.S. Stocks Lose Another Fan as HSBC Ends Long-Held Buy Call

, Bloomberg News

(Bloomberg) -- HSBC Bank Plc’s Max Kettner has been recommending buying U.S. stocks ever since Joe Biden won the U.S. presidential race. But a flurry of risks from slowing economic growth to rising bond yields has pushed the strategist to close his position and recommend European equities instead.

The U.K. bank’s chief multi-asset strategist forecasts an especially “toxic” environment for risk assets in the first half of 2022 on weaker economic recovery, U.S. fiscal drag, overly optimistic growth expectations, inflation, supply crunch and hawkish central banks.

The HSBC strategist sees “the more expensive U.S equity market likely remaining under pressure from rising real rates in the coming weeks,” he wrote in a note to clients on Thursday, cutting U.S. stocks from overweight to neutral. In a reversal of fortunes, Kettner raised euro-area equities from underweight straight to overweight.

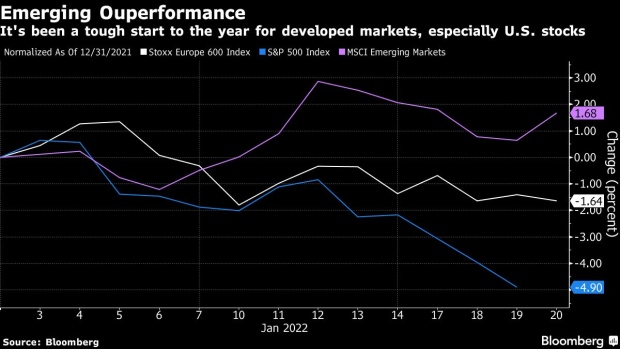

While global stock markets have had a bumpy start to the year, European indexes have so far been faring better than U.S. peers, and surveys among Morgan Stanley and Goldman Sachs Group Inc. clients earlier this month showed that most investors expect them to outperform. European equities are less exposed to rising yields, as the market has a high presence of cyclical and value shares and low share of expensive tech companies, and trades at a discount to the S&P 500.

Within European equities, HSBC doesn’t expect the recent outperformance of U.K. equities to go much further.

“The combination of disappointing global activity, inflation peaking and hawkish central banks could quite likely result in an environment of falling breakevens and higher real rates in the next six to twelve months in our view,” Kettner said.

Still, he advised investors to wait for better opportunities before they sell risk assets, as positioning is still too bearish after the recent rout. A good place to “hide” in the meantime is emerging markets, and especially China, which is in an “entirely different stage of the growth/liquidity cycle,” boosting support while developed-market central banks are starting to tighten.

©2022 Bloomberg L.P.