May 27, 2021

U.S stocks rise as strong data rekindle value rotation

, Bloomberg News

BNN Bloomberg's mid-morning market update: May 27, 2021

Stocks that stand to benefit the most from an economic rebound rallied after solid data spurred a decline in pandemic darlings such as technology companies. Treasuries retreated.

Industrial, financial and commodity shares led gains in the S&P 500. The Russell 2000 of small caps outperformed major equity benchmarks, while the tech-heavy Nasdaq 100 dropped. A news report that President Joe Biden will unveil a budget that would see federal spending jump to US$6 trillion in the coming fiscal year also helped sentiment. The KBW Bank Index posted a back-to-back advance as the chief executive officers of the largest lenders testified before Congress.

Equities headed toward their fourth straight monthly rally as prospects for an economic rebound tempered inflation worries. Treasury Secretary Janet Yellen said she sees the burst in prices as temporary, though likely to last through the end of 2021. Data showed jobless claims dropped to a fresh pandemic low, while orders for business equipment climbed more than forecast. Pending home sales fell, but analysts highlighted underlying buyer interest that could translate into a pickup in contract signings.

“We’re seeing that kind of economic data underscore what we keep calling the recovery trade -- a move back into cyclical and defensive stocks, companies that are poised to do better with a reopening of the economy,” said Greg Bassuk, chief executive officer at AXS Investments. “Value has a much stronger path for gains going forward.”

Some corporate highlights:

- Reddit favorite AMC Entertainment Holdings Inc. hit US$10 billion in market value for the first time.

- Best Buy Co. boosted its full-year sales forecast after revenue soared in the quarter.

- Nvidia Corp. gave a bullish estimate on demand for chips used in gaming PCs, data centers and cryptocurrency mining.

- Boeing Co. climbed as Airbus SE’s ambitious output goal spurred optimism for a recovery in global aviation.

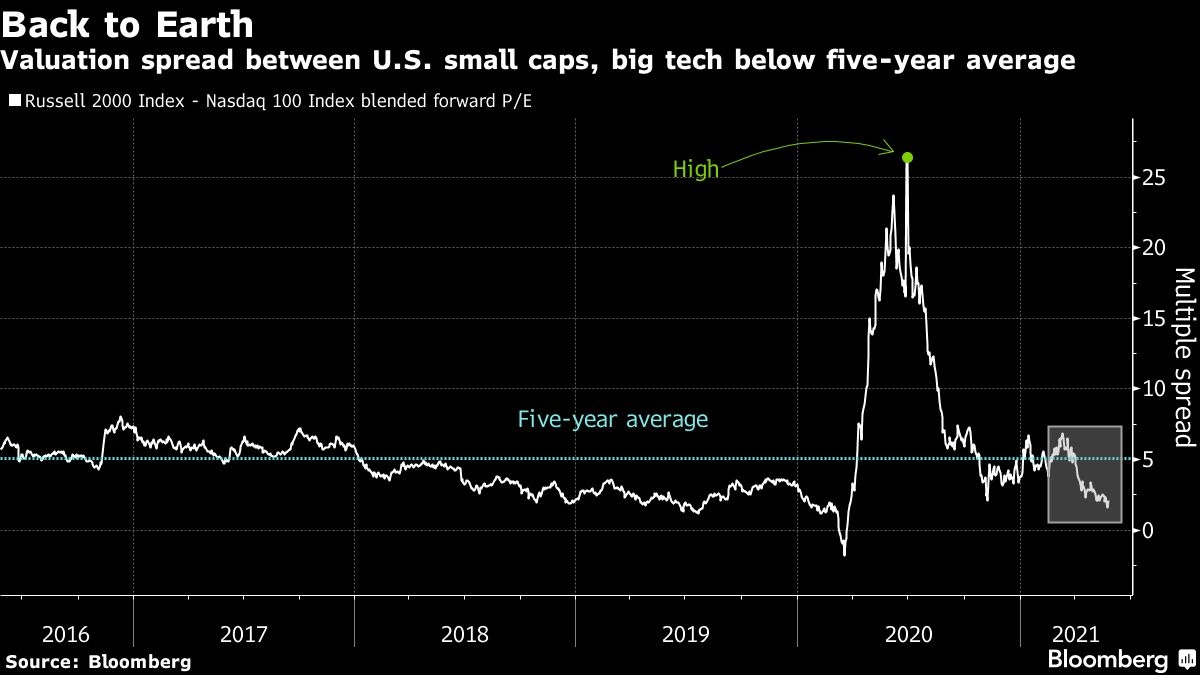

The Russell 2000 has lost ground to the Nasdaq 100 this quarter, but it has valuation on its side. The forward price-earnings spread between the small-cap and tech-heavy gauges has narrowed to below the five-year average. And while the Russell 2000 value/growth ratio has ebbed in the latter half of May, the relative strength of value suggests that small-cap stocks can continue to be big beneficiaries of the reopening recovery.

These are some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.3 per cent

- The Dow Jones Industrial Average rose 0.4 per cent

- The Russell 2000 Index rose 1.1 per cent

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at US$1.2198

- The British pound rose 0.6 per cent to US$1.4203

- The Japanese yen fell 0.6 per cent to 109.79 per dollar

Bonds

- The yield on 10-year Treasuries rose three basis points to 1.60 per cent

- Germany’s 10-year yield advanced three basis points to -0.17 per cent

- Britain’s 10-year yield advanced six basis points to 0.81 per cent

Commodities

- West Texas Intermediate crude rose 0.9 per cent to US$67 a barrel

- Gold futures fell 0.2 per cent to US$1,901 an ounce