Jul 25, 2022

U.S. stock trading hits 2022 low before Fed, earnings

, Bloomberg News

Bank stocks have already priced in a recession, buy today and benefit next year: Chuck Lieberman

Stocks wavered in a choppy session as traders braced for earnings from technology bellwethers amid the threats of a hawkish Federal Reserve, scorching inflation and a looming economic recession.

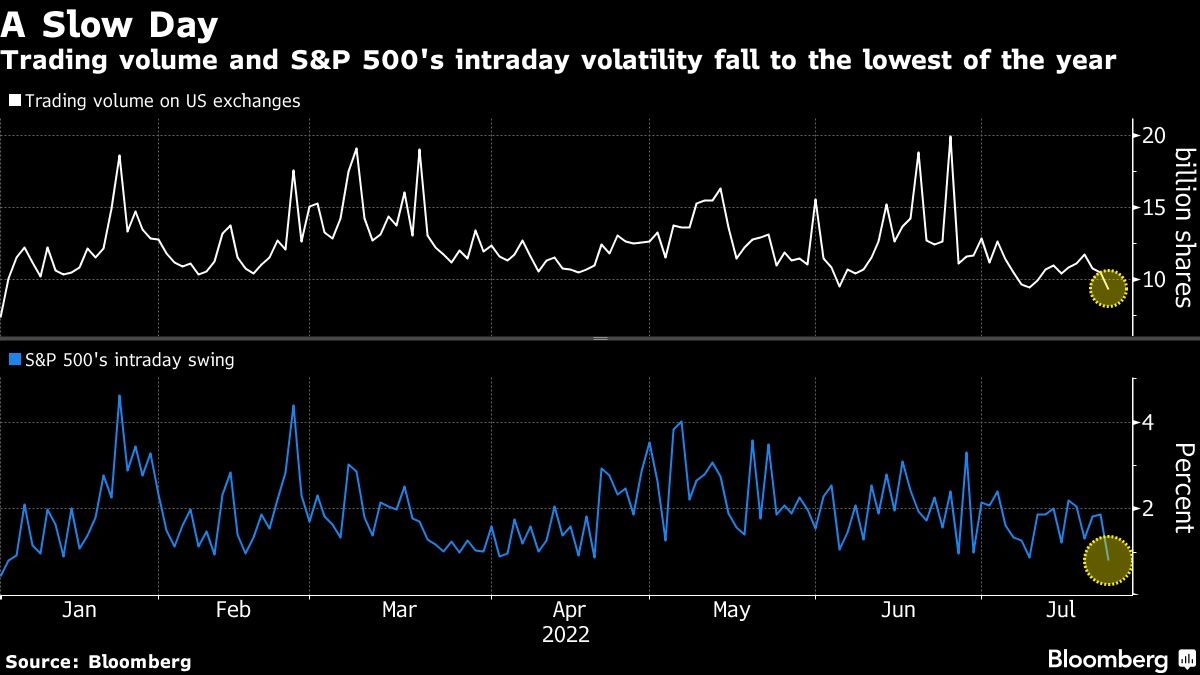

Traders turned more cautious after last week’s rally, with the S&P 500 closing slightly higher amid the lowest intraday volatility and volume of the year. The Nasdaq 100 underperformed ahead of results from the likes of Apple Inc. and Google’s parent Alphabet Inc. In late trading, Walmart Inc. tumbled after cutting its profit outlook. Ten-year US yields halted a two-day plunge.

This week will be a “make-or-break” period for investors’ confidence in the power of Corporate America, said DataTrek Research’s Nicholas Colas. The economy is already feeling the pinch from repeated rate increases -- with the Fed expected to deliver another jumbo hike Wednesday -- and traders will get more clues on how much of that slowdown is reflected in earnings.

For now, investors are expecting mostly bad news from megacaps. Amazon.com Inc.’s revenue is seen growing at its slowest rate in decades. Chipmakers are lurching from boom times to a potential glut. Gig-economy companies such as Uber Technologies Inc. and DoorDash Inc. could be victims of consumer budget cutting. And the pullback in online advertising is set to weigh on results from Facebook owner Meta Platforms Inc.

“For the recent rally to continue, markets need to feel that monetary policy and corporate earnings power are incrementally more predictable than six weeks ago,” Colas wrote in a note to clients. “Our bias is to lighten up here, but even long-term investors should understand that this week is critical to market psychology.”

Strategists at major Wall Street firms remained split on their views about earnings.

Goldman Sachs Group Inc.’s David Kostin sees revenues under pressure of a stronger dollar, while Bank of America Corp. strategists note that corporate sentiment during earnings calls is deep in recession territory. Meantime, Citigroup Inc. and UBS Global Wealth Management strategists say the earnings season is turning out to be better than feared as consumer spending remains resilient.

Investors are skeptical that the Fed can tame the worst inflation in four decades without driving the economy into a recession. Over 60 per cent of 1,343 respondents in the latest MLIV Pulse survey said there’s a low or zero probability that the US central bank can rein in consumer-price pressures without causing an economic contraction.

A hallmark of recession is a drop in investment, often driven by a slowdown in inventory building or outright destocking. Inventories and durable goods orders -- due Wednesday -- will help clarify whether a recession is at hand, according to Anna Wong, chief U.S. economist for Bloomberg Economics. She estimates that both have weighed on second-quarter gross domestic product. The Fed’s preferred inflation gauge -- PCE deflator -- comes out Friday.

“Naturally, during times of market stress, every week seems pivotal,” wrote Strategas’ Jason De Sena Trennert and Ryan Grabinski. The strategists added that they are still cautious as “earnings estimates have not yet begun to discount what would seem to be some obvious pressures on profit margins.”

Meantime, Ed Yardeni has some words of comfort -- the worst has passed for this bear market.

“It’s never easy to pick a bottom in the stock market, but I’m going to give it a try,” the president of Yardeni Research said on Bloomberg Television. “The real question is going to be the earnings season, and so far the earnings season is going reasonably well. It has not really thrashed the stock market, and the stock market’s held up quite well.”

In corporate news, Apple announced a rare retail promotion in China, offering four days of discounts on its top-tier iPhones and related accessories in advance of the launch of its next-generation devices. Intel Corp. has secured one of the biggest customers to date for its year-old contract chipmaking arm. Regulators are directing US operators of Boeing Co. 777 widebody jets to repair aircraft to address concerns about potential fuel-tank explosions, according to a filing Monday.

Here are some key events to watch this week:

- Alphabet, Apple, Amazon, Microsoft, Meta earnings due this week

- Bank of Japan releases minutes from its June meeting, Tuesday

- US new home sales, Conf. Board consumer confidence, Tuesday

- IMF’s world economic outlook update, Tuesday

- EU energy ministers emergency meeting, Tuesday

- Fed policy decision, briefing, Wednesday

- Australia CPI, Wednesday

- US GDP, Thursday

- Euro-area CPI, Friday

- US PCE deflator, personal income, University of Michigan consumer sentiment, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 rose 0.1 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 0.5 per cent

- The Dow Jones Industrial Average rose 0.3 per cent

- The MSCI World index was little changed

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro rose 0.1 per cent to US$1.0227

- The British pound rose 0.5 per cent to US$1.2053

- The Japanese yen fell 0.4 per cent to 136.62 per dollar

Bonds

- The yield on 10-year Treasuries advanced six basis points to 2.81 per cent

- Germany’s 10-year yield declined one basis point to 1.02 per cent

- Britain’s 10-year yield was little changed at 1.94 per cent

Commodities

- West Texas Intermediate crude rose 2.2 per cent to US$96.75 a barrel

- Gold futures fell 0.5 per cent to US$1,736 an ounce