Apr 11, 2023

U.S. tech stocks slump extends ahead of inflation data

, Bloomberg News

BNN Bloomberg's closing bell update: Apr. 11, 2023

U.S. stocks were subdued, trading in a narrow range as investors braced for inflation data that could signal if the Federal Reserve will once again lift interest-rates.

The tech-heavy Nasdaq 100 slumped 0.7 per cent, sliding for the fifth session of the past six, as traders mulled the likelihood of another rate increase in May. The S&P 500 skidded in the final minutes of the session as this year’s outperformers — namely mega-cap tech stocks — weighed on the benchmark. Yields on U.S. government notes rose with the policy-sensitive two-year at 4.03 per cent.

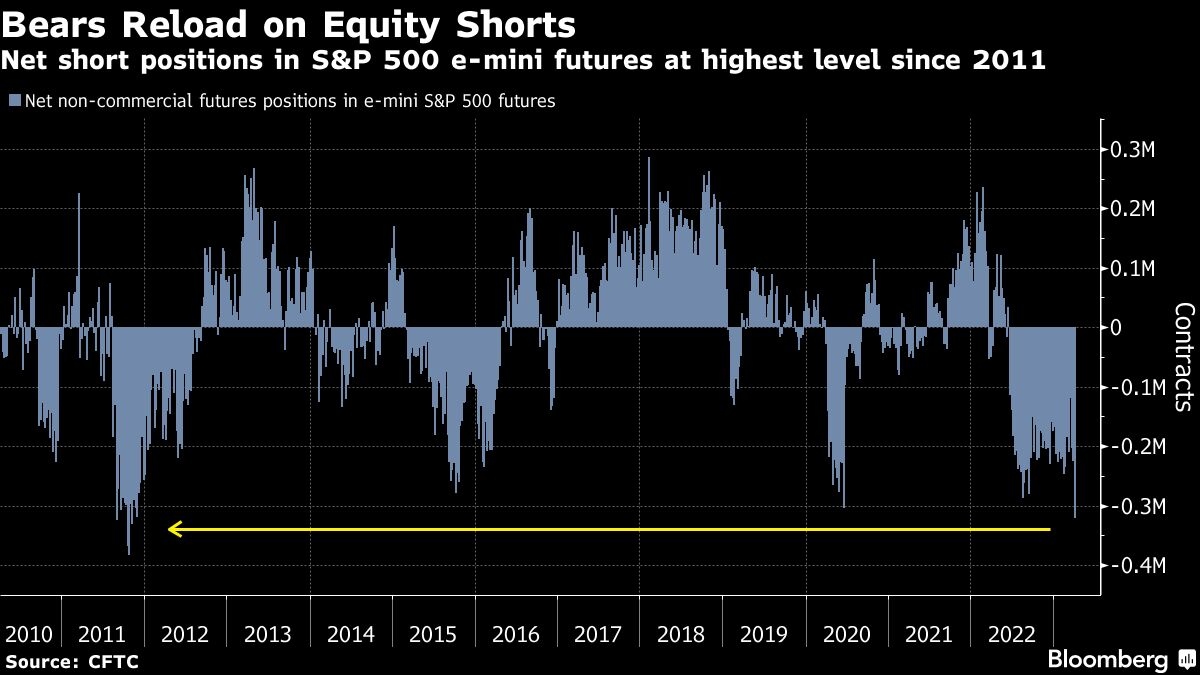

Cracks in 2023’s equity advance are appearing, as hedge funds and other speculators amass the deepest short position since November 2011 when the U.S. sovereign credit rating was cut. Bank of America Corp. data showed investors were selling U.S. stocks across the board for the past two weeks as investors position ahead of Wednesday’s closely watched inflation print.

“If inflation runs hotter than expected, it’ll undermine the idea that the Fed will be cutting rates aggressively by year-end, and that will leave markets susceptible to a pullback,” Tom Essaye, a former Merrill Lynch trader who founded The Sevens Report newsletter wrote.

Friday will also kick off what’s forecast to be the worst earnings season since the depths of the pandemic crisis as some of the biggest banks in the U.S. report.

Alicia Levine, head of investment strategy and equity advisory solutions at BNY Mellon Wealth Management, told Bloomberg Television that “earnings have to move lower.”

“Earnings estimates have barely budged in the last five weeks,” Levine said. ”That doesn’t really pass the reality test.”

Tilray Brands Inc. shares slumped after the cannabis producer’s third quarter earnings fell short of estimates. Covid-19 vaccine maker Moderna slid after a setback for its experimental flu shot.

The Fed appears on track to keep raising rates despite recent bank strains, with resilient labor markets and higher oil prices holding sway for policymakers focused on their price-stability mandate.

Markets are pricing in a strong likelihood the Fed will raise borrowing by a quarter-point May 3 to contain inflation, after U.S. payrolls rose at a firm pace last month and the unemployment rate dropped. Wednesday’s report on consumer prices, expected to show a 0.4 per cent monthly increase in the core consumer price index, could cement the Fed’s rate path.

A scenario where the central bank halts rate hikes in May, which markets had briefly entertained last month as fragility in banks raised recession fears, looks increasingly remote.

After May, though, swaps are pricing in a pivot to easier policy. Traders predict rates will peak around 5 per cent, with the Fed then cutting by roughly 50 basis points before the end of 2023.

New York Fed President John Williams said that one more increase to the target rate was a “reasonable starting place,” on Tuesday. The central bank’s newest member, Chicago Fed President Austan Goolsbee, counseled “prudence and patience” on monetary policy though he stopped short of calling for the government agency to pause.

“The Fed mantra has been once we get to the terminal rate, and that’s where the data dependency moves things around, but once we get to the terminal rate, we’re staying there for a while,” said Liz Ann Sonders, chief investment strategist at Charles Schwab.

“If the bond market is right, then the equity market probably has not fully reflected those recession-type conditions to likely hit earnings beyond what we’ve already seen,” Sonders said in a phone call. “This idea that the Fed can not just pause but pivot, and that’s great for the stock market, to me that doesn’t make sense.”

For now, some asset managers say markets could be range-bound as the chances of an upcoming economic slump are weighed.

“We’re focusing on three areas to determine if the baton passes from rate hikes to recession,” said Saira Malik, chief investment officer at Nuveen pointing to the upcoming inflation report, a potential pause in rate increases after May, as well as recent recession indicators, including manufacturing and jobs data. “Even though the Fed may pause, we’re not in the camp that we will see rate cuts in 2023.”

Meanwhile, the International Monetary Fund trimmed its global growth forecasts citing the recent banking sector turmoil and Russia’s invasion of Ukraine. Bitcoin advanced for the fourth day, blowing past the key US$30,000 level for the first time in ten months.

Oil gained, with West Texas Intermediate trading above US$80 a barrel. Gold rose to trade around US$2,000 an ounce while the dollar fell.

Key events this week:

- Minneapolis Fed’s Neel Kashkari and Philadelphia Fed’s Patrick Harker speak at separate events, Tuesday

- Canada rate decision, Wednesday

- US FOMC minutes, CPI, Wednesday

- Richmond Fed’s Thomas Barkin speaks, Wednesday

- China trade, Thursday

- US PPI, initial jobless claim, Thursday

- US retail sales, business inventories, industrial production, University of Michigan consumer sentiment, Friday

- Major US banks JPMorgan Chase, Wells Fargo and Citigroup report earnings, Friday

Some of the main market moves:

Stocks

- The S&P 500 was little changed as of 4:00 p.m. New York time

- The Nasdaq 100 fell 0.7 per cent

- The Dow Jones Industrial Average rose 0.3 per cent

- The MSCI World index rose 0.4 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.2 per cent

- The euro rose 0.5 per cent to US$1.0914

- The British pound rose 0.4 per cent to US$1.2427

- The Japanese yen was little changed at 133.70 per dollar

Cryptocurrencies

- Bitcoin rose 3.3 per cent to US$30,102.75

- Ether rose 0.4 per cent to US$1,893.2

Bonds

- The yield on 10-year Treasuries advanced one basis point to 3.43 per cent

- Germany’s 10-year yield advanced 13 basis points to 2.31 per cent

- Britain’s 10-year yield advanced 11 basis points to 3.54 per cent

Commodities

- West Texas Intermediate crude rose 2.2 per cent to US$81.46 a barrel

- Gold futures rose 0.8 per cent to US$2,019.70 an ounce