Jun 13, 2022

U.S. yields, dollar surge with Fed bets as recession risk grows

, Bloomberg News

Remain diversified in quality stocks amid market sell-off: Strategist

The hottest US inflation in four decades will push the Federal Reserve to raise interest rates more aggressively this year, and a recession may not be far behind.

Those are the dramatic signals coming from markets, which on Monday saw yields surging across the board: 10-year rates hit the highest since 2011, 30-year yields climbed to the highest in more than three years and rates on both two- and three-year notes jumped as much as 20 basis points on the day. Bloomberg’s dollar gauge rose as much as 1 per cent, adding to a backdrop that sparked a spiral in risky assets.

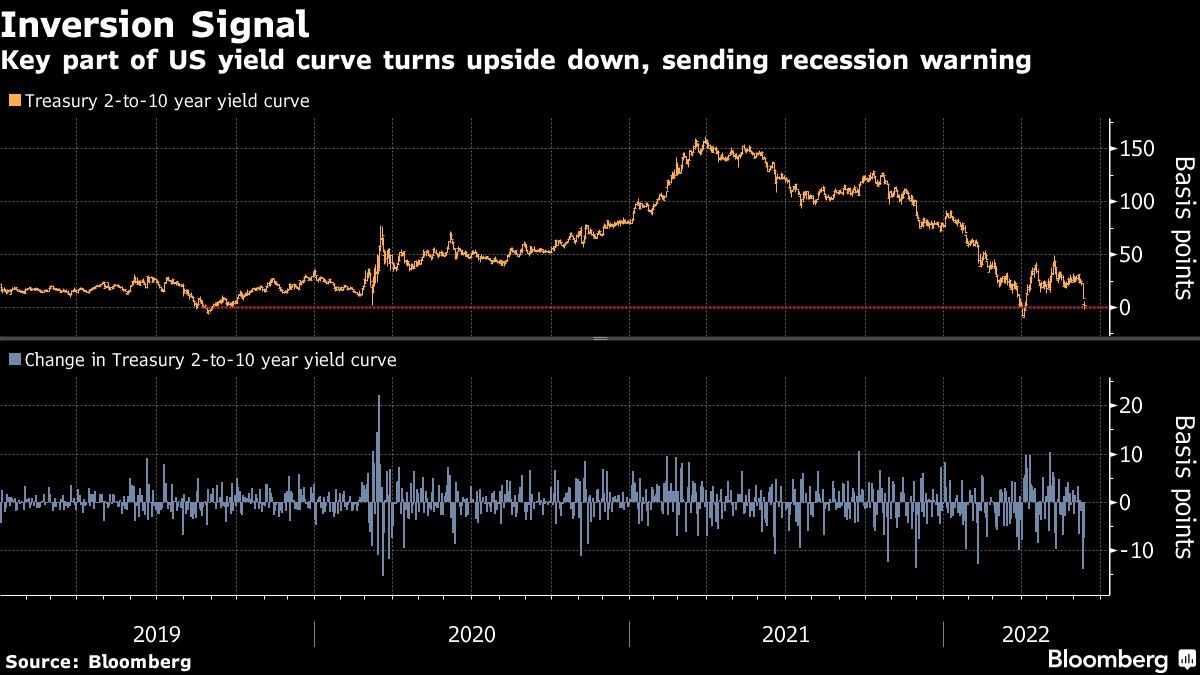

Meanwhile, a closely-watched part of the US yield curve inverted -- backed by leaping Treasury futures volumes -- amid concern that tighter monetary policy will take a bigger toll on economic growth. Data on Friday showed consumer prices accelerated to a 40-year high.

The surge in yields and fall in share prices “makes sense in wake of the astoundingly strong CPI we had on Friday,” Matthew Hornbach, global head of macro strategy at Morgan Stanley said on Bloomberg Television. “Inflation is really the Achilles’ heel of risk markets. This economy is going to require higher real rates to slow it down and put some downward pressure on inflation.”

Market pricing suggested the possibility that the US central bank might look to implement even bigger hikes than the 50-basis-point moves it’s done already this cycle.

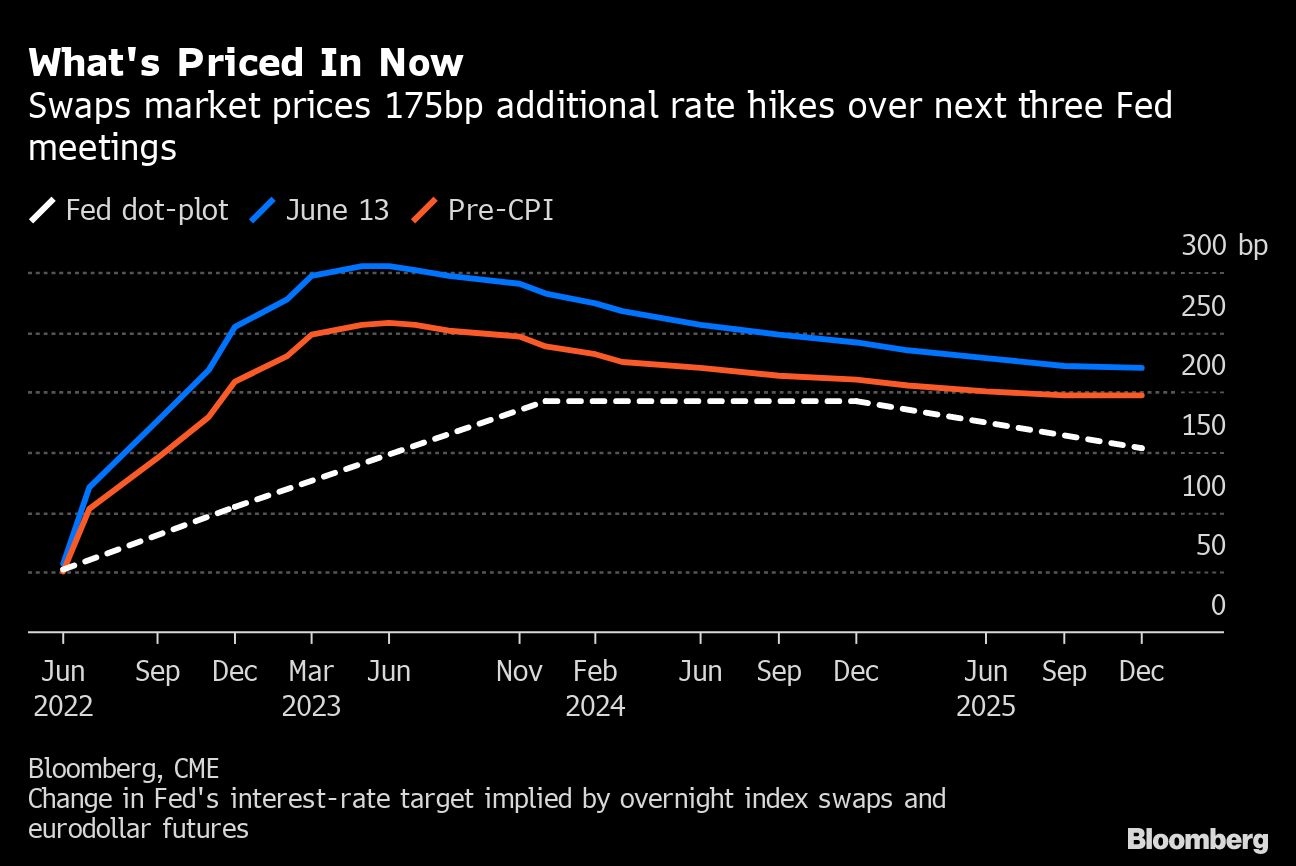

Traders see 175 basis points of tightening by the Fed’s September decision, implying two half-point increases and one 75 basis-point hike, according to interest rate swaps tied to FOMC policy outcome dates.

All eyes will be on this week’s Fed statement and Chair Jerome Powell’s post-meeting press conference, where policy makers’ characterization of inflation and long-term forecasts for the fed funds target -- the so-called dot plot -- will be critical. The Fed hasn’t hiked by three quarters of a percent since 1994, and tightening of this magnitude is fueling concerns of reduced consumer spending and business activity.

‘PEAK INFLATION’

“The high inflation print has put a dent to the peak inflation -- and peak Fed hawkishness narrative,” Mohit Kumar, an interest rate strategist at Jefferies International Ltd, wrote in a note to clients on Monday. “From a Fed perspective, the question is whether they will need to respond even more forcefully with a 75bp at the June meeting.”

Benchmark inflation-adjusted Treasury yields also surged on Monday amid prospects of an even more aggressive Fed. The yield on so-called 10-year Treasury Inflation-Protected Security rose to as high as about 0.59 per cent -- the highest since March 2020.

Pushing upward real rates, a crucial barometer of true interest costs for corporations, is a key objective of the Fed as it seeks to tighten financial conditions to bring inflation down, Morgan Stanley’s Hornbach said.

The moves reverberated across global assets. Italy’s 10-year yield climbed above 4 per cent for the first time since 2014, widening its spread over equivalent German peers -- a key gauge of risk in the region.

Italy’s 10-Year Yield Rises Above 4 per cent for First Time Since 2014

“The combination of collapsing consumer sentiment, unexpectedly intense price pressures and expectations of Fed activism are conspiring to create a particularly toxic cocktail for risky assets,” said Rabobank strategists including Richard McGuire. The yield curve inversion “resonates with the notion that the need to tackle elevated price pressures will see the Fed tip the economy into recession.”

That view is consistent with expectations that the Fed will need to loosen policy again within two years. The market is already positioning for policy makers to respond to the looming slowdown with future rate cuts, pricing two quarter-points of easing by the middle of 2024.