Feb 9, 2022

Uber sales beat estimates on resilient ridership, delivery gains

, Bloomberg News

John Zechner discusses Uber

Uber Technologies Inc. rallied in late trading after fourth-quarter revenue topped estimates and the ride-hailing giant reported the most active users in its history, easing fears about a disruption from COVID-19’s omicron variant.

Revenue rose 83 per cent to US$5.8 billion in the period, the company said Wednesday in a statement. That beat the US$5.4 billion analysts had projected, according to data compiled by Bloomberg.

“While the omicron variant began to impact our business in late December, mobility is already starting to bounce back,” Chief Executive Officer Dara Khosrowshahi said in the statement, noting that gross bookings are up 25 per cent in the most recent week from a month earlier. The shares jumped as much as 9.5 per cent in extended trading.

Like its rival Lyft Inc., Uber’s progress toward reaching pre-pandemic ridership was thwarted by omicron, which kept people away from offices, schools and social events. The companies’ fortunes have ebbed and flowed along with COVID-19 infection rates and restrictions, which affect demand for rides as well as meal delivery. Lyft reported fewer riders than analysts expected in the fourth quarter, but also recorded its highest-ever revenue per rider.

In the three months ending Dec. 31, Uber reported US$25.9 billion in gross bookings, which encompass ride hailing, food delivery and freight, a 51 per cent increase from the same period last year. Monthly active platform users reached an all-time high of 118 million.

“Our results demonstrate just how far we’ve come since the beginning of the pandemic,” Khosrowshahi said.

While Uber’s gross mobility bookings grew 67 per cent from a year earlier to US$11.3 billion, in line with analysts’ expectations, they are still about 16 per cent lower than pre-COVID levels.

Uber offered a tempered forecast to account for an impact from omicron, projecting gross bookings of US$25 billion to US$26 billion in the first quarter. Analysts expected US$27 million.

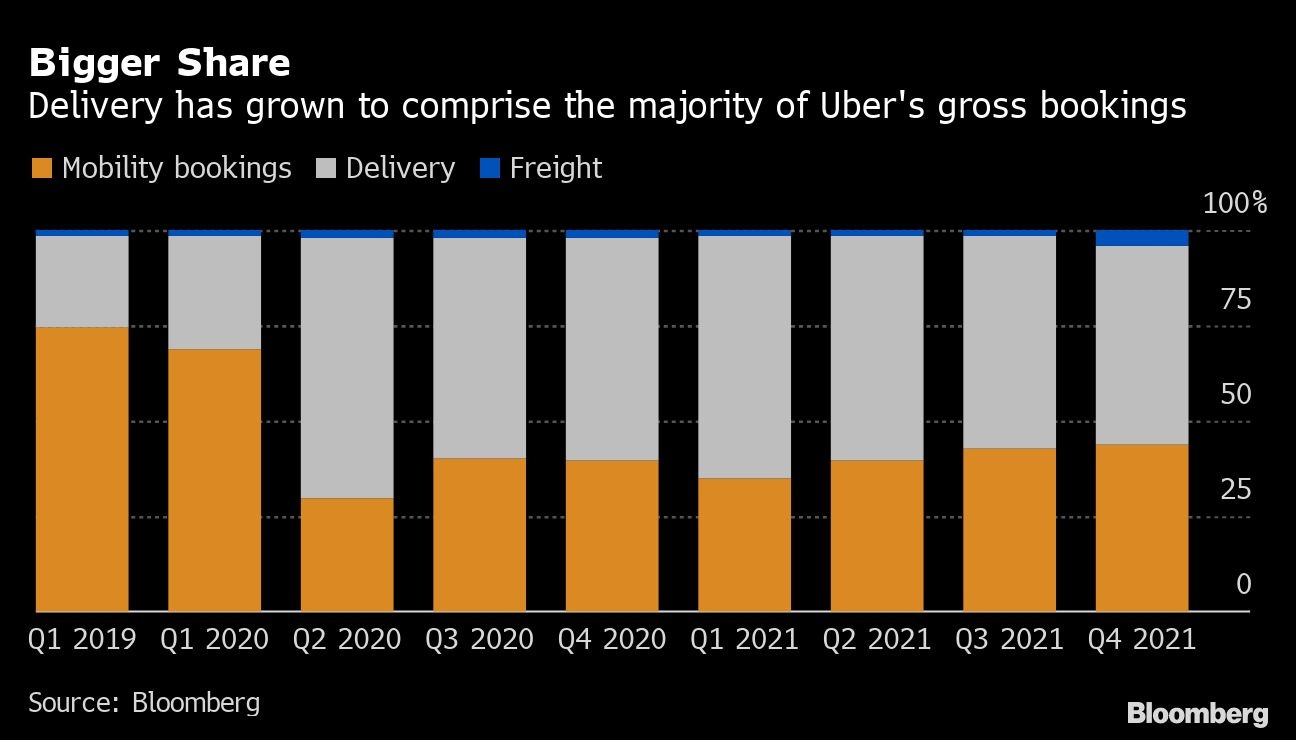

The pandemic fundamentally changed Uber’s business composition, forcing it to bolster its delivery unit when demand for rides plummeted. The company expanded offerings to include grocery, alcohol and convenience items, which have contributed to bookings in the delivery segment eclipsing mobility. Uber’s deliver business had its first profit last quarter on the basis of adjusted earnings before interest, tax, depreciation and amortization, reaching US$25 million.

A key challenge to a recovery for Lyft and Uber has been a shortage of drivers to meet customer demand. The imbalance has resulted in higher wait times and fares. But that’s improving, Khosrowshahi said in a conference call with analysts.

“We are entering this year with the best supply since 2020,” he said. “Onboarding conversion rates are happening much more successfully.”

Uber, based in San Francisco, has increasingly focused on refining its membership service to increase user retention rates across meal delivery and rides. Adjusted Ebitda was US$86 million in the fourth quarter. Analysts expected US$63.6 million.

Uber’s unrealized gains from stakes in Grab Holdings Ltd. and Aurora Innovation Inc. reaped US$1.4 billion, which contributed to net income of US$892 million.