Mar 11, 2019

UBS joins Morgan Stanley in warning of Amazon’s UPS-FedEx threat

, Bloomberg News

Another analyst is raising concerns about the damage Amazon.com could do to United Parcel Service and FedEx.

UBS writes that Amazon “remains a meaningful long term risk” for both companies as the web retailer will likely build out its package delivery operations, even though the timing of this expansion is uncertain.

“While the path is increasingly clear, the velocity is more difficult to gauge,” analyst Thomas Wadewitz said. "There is still likely a meaningful timeframe of limited direct impact."

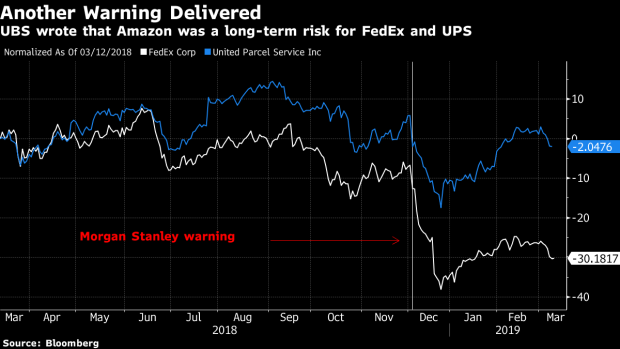

He is not the first to sound the alarm. In December, Morgan Stanley wrote that the two faced underappreciated competitive risks as the tech giant has been building up its freight delivery service. The firm estimated that "the opportunity cost of AMZN Air’s ramp represents 2 per cent of potential revenue lost for UPS+FDX in 2018, growing to 10 per cent+ by 2025.”

According to Bloomberg data, Amazon is UPS’ biggest customer. The package shipper derives about 1.4 per cent of its revenue from Amazon. For FedEx, Amazon is its fourth-largest customer, accounting for 0.26 per cent of its revenue.

Wadewitz’s comments follow a panel hosted by UBS about Amazon’s logistics and “last mile” operations. The panel suggested a path of continued expansion of Amazon’s package facilities and last mile capacity which would eventually make Amazon Logistics and the U.S. Postal Service “the dominant providers of delivery for Amazon.”

However, the complexity of changing Amazon’s delivery operations will likely take time as the Seattle-based company tweaks its systems and builds out package pickup capability, Wadewitz said. Also, Amazon will need to add delivery stations to offer a broad package delivery service. The timing for this -- along with the “potential direct competition” with FedEx and UPS -- remains “unclear,” the analyst said.

UPS and FedEx may have limited options for pushing back against this trend, UBS said. The firm suggested that if the pair were to raise prices during peak shipping periods, “the efficacy of pushing these levers may be limited as higher delivery cost from the three network players provides greater incentive for Amazon to invest even more aggressively in its own package delivery capability.”

Despite this risk, “there is a meaningful period of time when competition from an Amazon package delivery offering is unlikely to be broad enough to have a direct impact on UPS and FDX,” Wadewitz said. Any changes in how Amazon uses the shippers is “likely to be gradual.”

Shares of UPS climbed 1.5 per cent on Monday, while FedEx rose 1.7 per cent. Amazon increased 1.8 per cent.