Mar 20, 2019

UBS Says First Quarter Was ‘One of the Worst'’ in Recent History

, Bloomberg News

(Bloomberg) -- Want the lowdown on European markets? In your inbox before the open, every day. Sign up here.

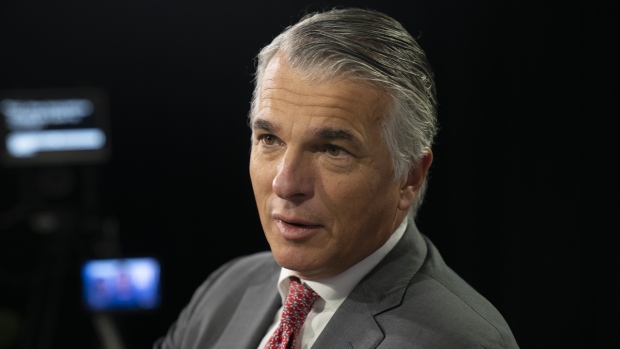

UBS Group AG Chief Executive Officer Sergio Ermotti gave a gloomy outlook to investors at a conference in London Wednesday, saying conditions in the first three months have been among the toughest in years.

The investment bank had “one of worst first-quarter environments in recent history,” Ermotti said Wednesday. There has been very little merger activity or initial public offering activity outside of the U.S., he said. Investment banking revenues are down about one third compared with a year ago. The bank is slowing hiring and some IT projects as it seeks to make up for weak markets.

Ermotti -- like many European bank executives -- needs all the tools he can get to keep investors on board. The stock lost 32 percent of its value last year despite positive financial results. UBS suffered from the wild market swings that kept many clients on the sidelines at the end of last year, taking the shine off rising profits and a higher dividend. Despite some rebound in equity markets, clients so far have remained cautious in the first months of this year, the bank said last week.

The Swiss bank cut thousands of investing banking jobs over the last decade as it tilted to private banking, a business in which it has become the world’s largest. That strategy has proved a blueprint for rivals including Credit Suisse Group AG, but also leaves the bank open to revenue dips after market corrections or when clients trade less.

To contact the reporter on this story: Patrick Winters in Zurich at pwinters3@bloomberg.net

To contact the editors responsible for this story: Dale Crofts at dcrofts@bloomberg.net, Christian Baumgaertel, Ross Larsen

©2019 Bloomberg L.P.