Feb 23, 2021

UBS Team Says Get Ready for Another Global Equity Rotation

, Bloomberg News

(Bloomberg) -- Tightening financial conditions will likely lead to a “phase change” in global markets in the second quarter, resulting in lower overall returns and favoring growth stocks over value, according to UBS Group AG.

A shift from a liquidity-driven market to one based on growth and earnings will come as inflation enthusiasm peaks and will precede any tapering of Federal Reserve support, wrote strategists including Bhanu Baweja in a note Monday. This regime change will be marked by a bottoming in real rates and credit spreads -- which will signal the end of the liquidity “tailwind,” they said.

“While these changes don’t imply a big drawdown, they do make for an important change in the nature of the rally,” the strategists wrote. “Liquidity tailwinds have been the biggest contributor to market gains.”

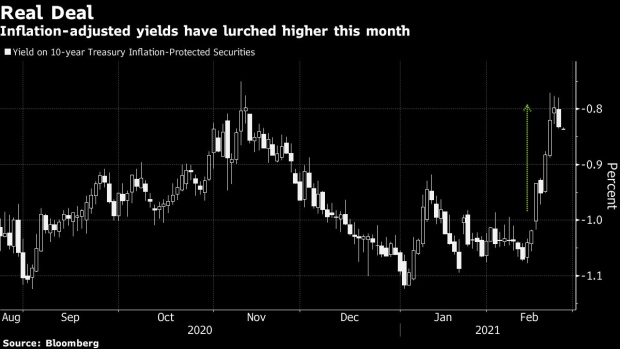

A recent surge in U.S. real yields has raised alarm among investors who see negative real rates as a cornerstone of the risk-asset rally which has sent global equities to all-time highs. The rate on 10-year Treasury Inflation-Protected Securities has jumped to as high as minus 0.77% last week from minus 1.08% on Feb. 11.

While higher real yields signal the economy is gaining traction, they can lead to a tightening in financial conditions and a shift in asset allocation.

“A small increase in real rates will likely not be a big concern, but as real rates accelerate, each incremental move becomes more challenging for markets,” wrote Baweja and his team.

Real Yields’ Rise Is Canary in the Coal Mine for Risk Assets

An analysis of similar historic “phase changes” when liquidity drivers shift to neutral from loose suggests lower market returns and growth stocks marginally outperforming value shares, UBS said. The dollar usually sees modest gains against emerging-market currencies and a rotation out of the U.S. into other markets becomes less compelling, the strategists wrote.

©2021 Bloomberg L.P.