May 19, 2023

Ueda Warns Against Premature Policy Change Even After Price Jump

, Bloomberg News

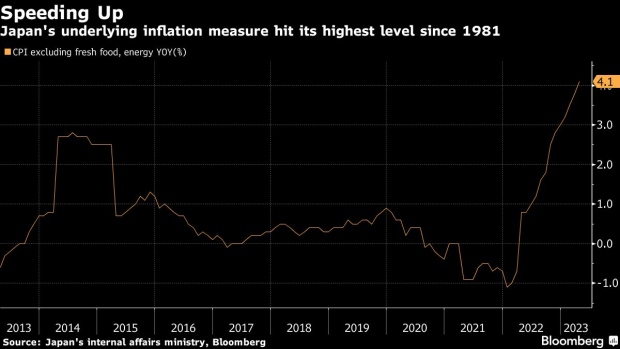

(Bloomberg) -- Bank of Japan Governor Kazuo Ueda continued to strike a dovish tone hours after data showed underlying inflation accelerating to the fastest pace in more than four decades.

“The cost of impeding the nascent developments toward achieving the 2% price stability target, which are finally in sight, by making hasty policy changes would likely be extremely high,” Ueda said in a speech in Tokyo Friday.

Ueda’s reassurance that the BOJ will continue with easing contrasts with lingering speculation over policy adjustment among BOJ watchers. A range of economists from Goldman Sachs to Barclays currently expect a shift in July. Ueda hinted that faster inflation isn’t changing the BOJ’s view as the acceleration is largely being driven by cost-push factors.

Read More: Japan’s Inflation Quickens Again, Putting Pressure on BOJ View

While acknowledging that there are green shoots emerging toward getting to the BOJ’s inflation goal, the governor indicated there is no rush to nip that move in the bud by hurrying toward normalization.

“It is appropriate to take time to decide on adjustments to monetary easing toward a future exit,” Ueda said. “The bank will carefully support these nascent developments to mature and aim to achieve the price stability target of 2% in a sustainable and stable manner, accompanied by wage increases.”

Friday morning’s data showed consumer prices excluding fresh food and energy jumped by 4.1% in April, the fastest pace since 1981, confirming a strong wave of businesses continuing to pass their costs on to consumers.

Many BOJ watchers have said that the central bank will have to raise its quarterly inflation forecast in July, speculating that it may be accompanied by policy adjustments.

That view is also due to a widespread belief that Ueda can’t signal a change in the yield curve control in advance. Any pre-announcement could trigger a massive bond selloff before it’s officially confirmed.

“Ueda is saying monetary stimulus will continue and there is no normalization this fiscal year, but that doesn’t rule out adjustments to yield curve control,” said Yoshimasa Maruyama, chief market economist at SMBC Nikko Securities.

“Ueda knows he can’t talk about YCC tweaks in advance. Market players must understand that it will come as a surprise. I think it’s not strange at all if it takes place in the third quarter or fourth quarter,” he said.

For now, Ueda’s resolve for keeping policy ultra loose bodes well for those investing in Japan. The Nikkei 225 Stock Average hit its highest level since 1990 Friday, rising more than US stocks this year.

--With assistance from Sumio Ito.

©2023 Bloomberg L.P.