Apr 6, 2023

Ugly Quarter in M&A Was Better Than Feared, Giving Traders Hope

, Bloomberg News

(Bloomberg) -- The worst quarter in years for US mergers and acquisitions just ended, but considering all the recent chaos, arbitrage traders insist it could’ve been worse. And that gives them hope for what comes next.

“I expect deal activity will pick up slightly with interest rates stabilizing” and banking-sector turmoil having eased, said Frederic Boucher, a risk arbitrage analyst at Susquehanna International Group.

A Bloomberg News survey of 17 merger arbitrage analysts, brokers and fund managers found that most were encouraged by a flurry of private equity deals announced in the first quarter while markets were still gripped by volatility, rising interest rates and banking-sector chaos. Boucher expects to start seeing smaller transactions from private equity firms looking at technology investments, and potentially health care and banks.

Of course, any rebound in deal activity will be coming off a low base. The US M&A market just had its slowest quarter since 2020, with $271 billion in transaction volume, almost 50% less than a year earlier.

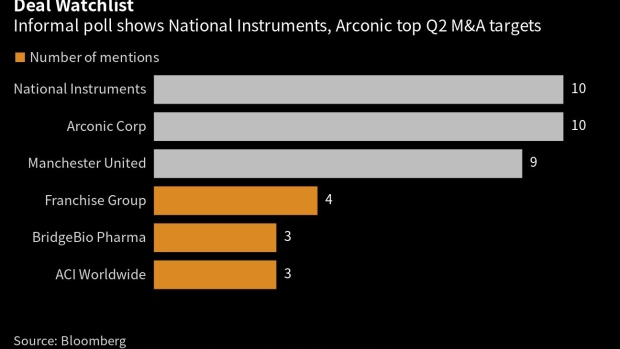

Respondents to the poll, which was conducted last week, see industrial firm National Instruments Corp., equipment and parts manufacturer Arconic Corp. and storied British football club Manchester United Plc as top takeover targets. The popular picks have a common element: They all have sale processes under way with reports of interest from multiple buyers, making them ideal for arbitrage bets.

None of this is to say that the M&A market right now is strong. A key gauge for the merger-arb community is the number of pending transactions to trade on. The tally, comprised of publicly listed US targets with more than $500 million of equity value, is roughly 35, down from around 40 about three months ago, according to WallachBeth Capital’s Brett Buckley.

Among those are a slew of private equity transactions, including Qualtrics International Inc., Univar Solutions Inc., Focus Financial Partners Inc. and Cvent Holdings Corp. — all announced over the past two months and worth more than $4 billion.

Software Buyouts Are Surging and Investors See More: Tech Watch

To survey respondents, it’s encouraging that prospective buyers are willing to put their money on the line and in some cases pay all cash upfront — as in the case of Focus Financial and Sumo Logic Inc. That dynamic should ease some concerns that risk-averse lenders could derail deals.

It also explains why some investors see deal flow stabilizing, and possibly picking up. With expectations building that the Federal Reserve is close to the end of its tightening cycle, and banks finally moving to offload the riskiest chunk of financing from last year’s Citrix Systems Inc. buyout, some survey respondents said private equity momentum will likely continue. Granted, several of those polled were more wary, pointing to lingering worries over regional banks.

Increased antitrust scrutiny is another concern, the poll showed. The trend isn’t new, but the headwinds hit hard last quarter with extended merger reviews and three public transactions being blocked by regulators, including Tegna Inc.’s takeover, JetBlue Airways Corp.’s combination with Spirit Airlines Inc., and Intercontinental Exchange Inc.’s acquisition of Black Knight Inc.

That said, these market participants still see deals surviving antitrust tests. The question is how to price in the risk. For instance, the deal spread for Broadcom Inc.’s acquisition of VMWare Inc. has widened to $28 as of Wednesday’s close from roughly $18 at the beginning of the year.

Read more: Regulators Sue to Stop ICE-Black Knight Deal. Traders Don’t Care

“Global regulators are flexing their muscles,” said Roy Behren, co-chief investment officer at Westchester Capital Management. “It’s certainly adding more volatility to deal spreads, but the ultimate impact remains to be seen, because at the end of day they still have to follow the antitrust laws, which have not changed.”

©2023 Bloomberg L.P.