May 21, 2023

UK Asking Prices for Houses Climb at Fastest Pace in a Year

, Bloomberg News

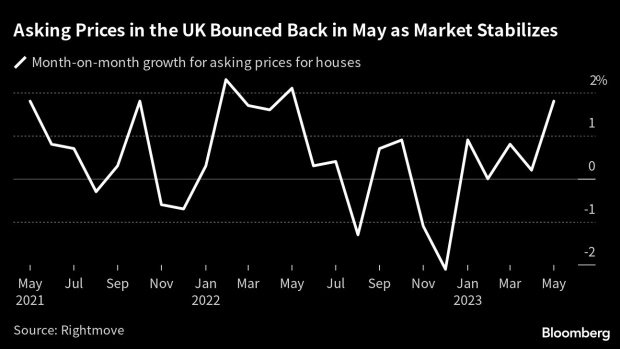

(Bloomberg) -- The price of houses put up for sale in the UK climbed at the fastest pace in a year as buyers were enticed back by a resilient economy and stabilizing mortgage rates.

Online property site Rightmove said average asking prices jumped 1.8% in May, hitting a record high of £372,894 ($465,000).

The property market appears to be defying predictions of a slump in prices despite the continued cost-of-living crisis. Househunters are being buoyed by a brighter economic outlook and a steadying of mortgage rates, which spiralled to 14-year highs last year in the turmoil triggered by former Prime Minister Liz Truss’s radical economic program.

“This month’s strong jump in new seller asking prices looks like a belated reaction and a sign of increasing confidence from sellers, as we’d usually see such a big monthly increase earlier in the spring season.,” said Tim Bannister, Rightmove’s director of property science.

London’s property market roared back into life, with values in the capital jumping by 2.8% month-on-month following a 0.5% fall in April. Nationally, buyer demand is 3% up on levels seen before the pandemic, despite households being battered by double-digit inflation.

However, mortgages have started to creep up again in recent weeks, as markets anticipate the Bank of England is not yet done raising interest rates. Rightmove said on Tuesday that the average two-year fixed-rate mortgage with a 75% loan-to-value ratio rose to 4.73%, up six basis points on the previous week.

Properties for first-time buyers are rising more slowly than the broader market, indicating strains on the affordability of property, Bannister said.

“The rental market is at record prices and still showing close to double digit growth, and London is a double digit growth in terms of prices,” he said in a Bloomberg Radio interview. “It’s very difficult for first time buyers on the affordability front. But at the moment they’re choosing to move ahead.”

--With assistance from Caroline Hepker.

(Updates with quote from Bannister. Earlier version’s currency conversion was corrected.)

©2023 Bloomberg L.P.