Mar 10, 2023

UK Economy Bounces Back From Strikes Stronger Than Expected

, Bloomberg News

(Bloomberg) -- Prime Minister Rishi Sunak said the UK economy is proving stronger than expected after growth in January beat forecasts.

Gross domestic product expanded 0.3% in January, Office for National Statistics data showed on Friday. That marked a sharp rebound from the 0.5% fall logged in December when strikes by health care workers and postal and rail staff hammered activity.

Growth beat City forecasts of 0.1%, prompting KPMG to upgrade its outlook for the year ahead and adding to a series of positive recent surprises on business activity, house prices, retail sales and consumer confidence. They have have raised hopes the UK might avoid the shallow recession the Bank of England is forecasting.

“If you look at some of the things that have been coming out in the last month, they’re all showing encouraging signs that things are better than people had feared, that sentiment is improving, confidence is returning,” Sunak told reporters traveling with him to France on Friday. “The underlying fundamentals of the economy are strong.”

Better-than-expected growth comes less than a week before Chancellor of the Exchequer Jeremy Hunt’s annual budget statement due March 15, but is too late to affect his forecasts. He faces difficult choices between driving growth and keeping debt under control.

And while stronger growth raises hopes the UK can dodge a downturn altogether, it also piles pressure on the BOE to keep raising interest rates in its fight to bring down double-digit inflation.

Shorter Downturn

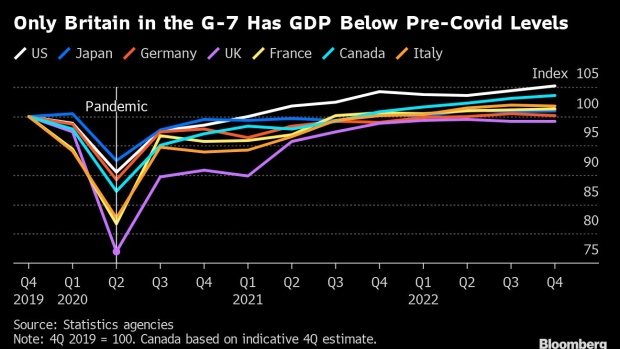

The underlying picture remains weak, as GDP is still 0.2% smaller than it was before the pandemic.

“We expect the current downturn to be shallower and shorter than previously thought, with stronger business sentiment and a steady fall in inflation expected to support the recovery in the second half of the year,” said KPMG UK’s Chief Economist Yael Selfin.

However she added that a recession was “still on the cards”, as falling wholesale natural gas prices and the easing of supply chain disruptions might not be enough to counter weak spending and stave off a slump.

Money markets expect the Monetary Policy Committee to raise interest rates by a further 75 basis points to 4.75% by year-end. Investors pared back expectations for the peak rate overnight on concern about how pockets of trouble in the US banking sector could point to broader dangers from higher rates.

What Bloomberg Economics Says ...

“The surprisingly large expansion in GDP in January gives the UK economy a good chance of avoiding a technical recession in the first half of the year. That will come as an upside surprise to the Bank of England — emboldening those policymakers calling for further tightening. Our base case remains for a final 25-basis-point rate increase later this month. But the economy’s resilience raises the risk that rates peak a little higher than we expect.”

—Ana Andrade, Bloomberg Economics. Click for the REACT.

Prospects have brightened in the last few weeks, prompting the British Chambers of Commerce to predict the economy could avoid a recession this year. Recent figures on retail sales, the housing market and closely-watched surveys of purchasing managers have all showed surprising strength.

Growth in January was driven by the services sector, which expanded 0.5%. Consumer-facing services rebounded from the strike affected December. Construction shrank 1.7% and manufacturing fell 0.4% in the month.

The largest contributor to the services sector was from education, as school attendance levels rebounded to normal levels following a “significant” drop in December.

Widespread strikes in December curtailed retail sales during the Christmas period. The economy suffered further disruption in January as rail staff, teachers and thousands of other workers walked off the job, demanding their pay keep pace with inflation.

But so far the evidence is retailers and other service-sector companies had a strong start to the year.

And after strikes caused activity in the postal and courier sector to slump by 10.5% in December, this rebounded by 6.4% in January, helping the transport and storage sector grow by 1.6% on the month.

Arts, entertainment and recreation also grew by 3.4%. That was driven by sports and recreation, which grew by 8.9% as Premier League football returned to its full schedule following postponements in December for the FIFA World Cup.

“This modest rebound suggests that the economy is still on a downbeat path as eye-watering inflation bites into household incomes and curbs business activity,” said Suren Thiru, economics director at Institute of Chartered Accountants in England and Wales. “We’re likely to continue flirting with recession throughout much of 2023.”

But in a sign of gloom in the housing market, real estate was the only negative contributor to services in January, falling by 0.1%. Mortgage lenders reported a dearth of buying activity in January amid rising mortgage rates and cost-of-living pressures.

--With assistance from Andrew Atkinson and David Goodman.

©2023 Bloomberg L.P.