Aug 4, 2022

UK Energy Price Cap Estimate Tops £4,000 for the First Time

, Bloomberg News

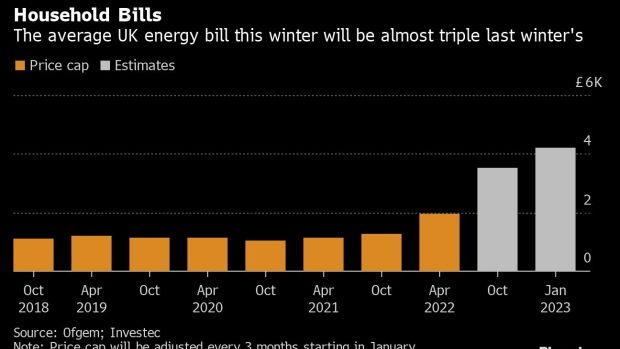

(Bloomberg) -- Estimates of the UK energy price cap for households have broken through £4,000 ($4,860) for the first time, as the Bank of England warns that the nation is heading for more than a year of recession under the pressure of soaring inflation.

The cap on default energy tariffs could jump as high as £4,210 a year in January, according to Investec Bank Plc, more than double the level now. The prediction will be grim reading for many families that are already struggling to pay record bills, and it’s not even cold yet.

On Thursday, regulator Ofgem said that the price cap will be adjusted quarterly instead of twice a year to better adapt to market volatility. This move was criticized by energy poverty campaigners as “inhumane” because it will hit households in mid-winter, the worst time for higher bills.

“We understand why Ofgem wishes to provide greater market resilience, but the pressure on households grows,” Martin Young, analyst at Investec said in a note.

The estimate comes on the same day that the Bank of England unleashed its biggest interest-rate hike in 27 years. Rising energy prices prompted the BOE to boost its forecast for the peak of inflation to 13.3% in October, and warn that costs will remain elevated throughout 2023.

There’s increasing pressure for the next Conservative prime minister to expand government aid to try to blunt a cost-of-living crisis that will see real disposable incomes fall more than at any time in about 60 years.

©2022 Bloomberg L.P.