Sep 30, 2022

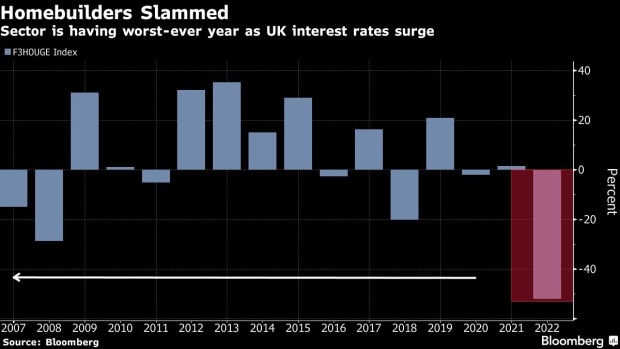

UK Homebuilders Down 50% This Year as Crisis Deepens Under Truss

, Bloomberg News

(Bloomberg) --

UK homebuilders have lost half their value this year as tax cuts announced by Liz Truss’s government plunged the sector further into crisis.

A FTSE index tracking companies like Persimmon Plc and Taylor Wimpey Plc has fallen by 14% just since Chancellor Kwasi Kwarteng delivered his “mini budget” a week ago. The unfunded fiscal bonanza spurred a surge in UK interest rates and triggered predictions of mortgage market paralysis.

The slump has cut the industry’s stock market value by about £22 billion ($24.5 billion). A year-to-date decline of over 50% for the index exceeds the 2008 plunge triggered by the US mortgage crisis that sent global financial markets tumbling.

That’s left some homebuilders trading at 30% discounts to the amount they originally paid for the land that they own, according to Shane Carberry, an analyst at Goodbody Stockbrokers who has buy ratings on companies including Persimmon, Taylor Wimpey and Barratt Developments Plc. That would loosely imply house prices will drop about 10%, he added.

Read: UK House Prices Stagnate as Market Starts to Flash Warning Signs

Carberry questioned whether house prices will fall by that much in reality, and added that homebuilders’ balance sheets are much stronger than they were during the financial crisis.

“They’re much better equipped to deal with any crash that comes their way, and I don’t think that’s being factored into valuations to the extent that it should be,” he said by phone.

The homebuilder index rose 3.2% on Friday, trimming a five-day decline.

(Updates index moves from second paragraph onwards.)

©2022 Bloomberg L.P.