Mar 7, 2023

UK House Prices Are Rising the Most Since June, Halifax Says

, Bloomberg News

(Bloomberg) -- Halifax said UK house prices rose at the quickest monthly pace since June, suggesting strength in the property market that may prevent a deep decline.

The mortgage lender said Tuesday that prices rose 1.1% last month, the second increase this year, and by 2.1% from a year ago.

The figures mark a sharp contrast with rival mortgage lender Nationwide Building Society, which says prices are now falling at the fastest annual pace since 2012. Halifax said the average house now costs £285,476 ($343,740), down by 2.9% from its peak last year but about £9,000 above the start of 2022.

“Recent reductions in mortgage rates, improving consumer confidence, and a continuing resilience in the labor market are arguably helping to stabilize prices following the falls seen in November and December,” said Kim Kinnaird, director at Halifax Mortgages. “Still, with the cost of a home down on a quarterly basis, the underlying activity continues to indicate a general downward trend.”

The two mortgage lenders calculate average house prices based on the loans they’re making, which sometimes leads to divergence. Halifax had reported a sharper drop at the end of last year than Nationwide did.

The figures are the latest in a series of reports suggesting unexpected strength in an economy that many forecasters expect will tip into recession this year. Gross domestic product, retail sales and surveys of purchasing managers all advanced in recent weeks. The British Retail Consortium this morning said Valentine’s Day purchases helped lift shop sales last month.

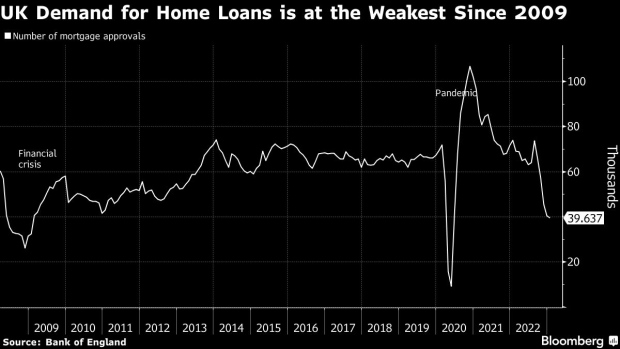

But with households still under pressure from the cost-of-living squeeze, experts are predicting house prices will fall on balance this year. In an indication of the challenges facing the market, BOE figures last week showed mortgage approvals dropping to their lowest since the financial crisis housing crash, when excluding the pandemic.

Halifax’s figures also hint at at a regional divide. House prices in the North East, which has been slower to recover its economic output since the pandemic, weakened sharply. It recorded annual growth of 1.1% last month, down from 3.6% a month earlier.

London broadly stagnated, reflecting the large proportion of flats sold there. Homes in the capital still cost over £240,000 more than the UK national average.

“Estate agents across the UK have seen a small drop in the number of sales being agreed whilst the number of new properties coming to market has remained the same,” said Nathan Emerson, chief executive officer of Propertymark, the UK professional body for estate agents.

Read more:

- UK House Prices Slide at Sharpest Annual Pace Since 2012

- UK Retailers Get Valentine’s Day Boost Despite Inflation Squeeze

- UK Mortgage Approvals Fall to Levels Seen in 2009 Housing Crash

(Updates with details from the report.)

©2023 Bloomberg L.P.