Mar 22, 2023

UK House Prices Fall for Second Month as Loan Costs Bite

, Bloomberg News

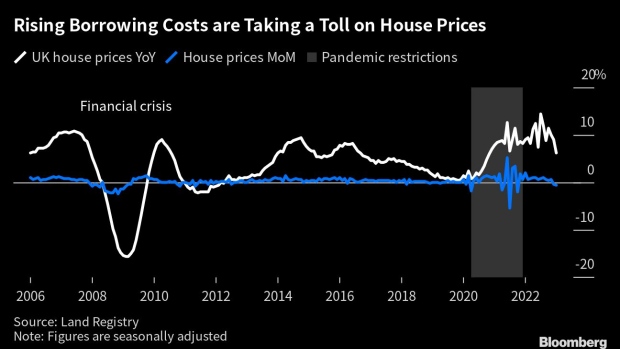

(Bloomberg) -- UK house prices fell at the fastest pace in 12 years in January, barring the pandemic, as higher mortgage costs piled further pressure on the housing market, official figures showed.

On a seasonally adjusted basis, which smooths out short-term fluctuations, prices fell 0.6% from December, according to the Land Registry. That followed a 0.4% decline in December and was the steepest monthly drop, bar distortions during Covid, since 2011.

For the year to January, prices climbed 6.3%, slower than the 9.1% annual rise to December 2022. More up to date figures from mortgage lender Halifax suggest prices may have recovered a little.

Britain’s housing market took off during the pandemic after the Bank of England cut rates to 0.1% in early 2020 and the government gave households tax breaks on property purchases. At its peak last July, annual house-price inflation was running at 14.5%.

Since the BOE started raising rates in late 2021, however, mortgage costs have doubled to around 4% and the property market has slowed. Transactions are down and annual price-growth is cooling.

Private renters are also being hit with higher costs, with average rents rising at the fastest pace since records began in 2016 - up 4.7% in the 12 months to February, the Office for National Statistics said.

Landlord instructions are falling while tenant demand is rising, putting the market off balance, the Association of Residential Letting Agents said in February.

While conditions for renters are deteriorating, there was a recovery in housing affordability for homebuyers last year, the ONS said. The average home cost 8.3 times the average full-time salary in England, a decline from a record of 9.1 times in 2021.

That was the steepest annual fall since records began in 1997 but only returned ratios “to the long-term trend.” Affordability improved because average house prices fell by £9,000 in England Wales in the 12 months to September 2022 while average wages rose £1,800, the ONS said.

©2023 Bloomberg L.P.