May 18, 2023

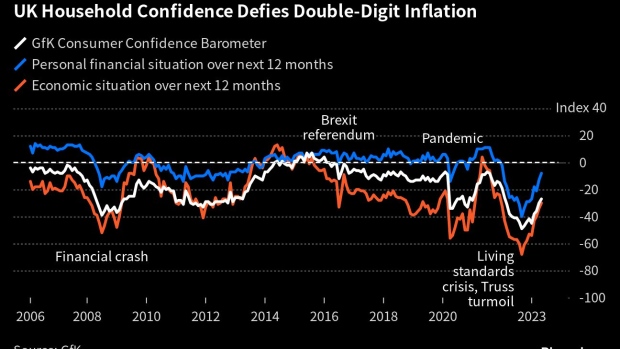

UK Household Confidence Extends Rebound Despite 10% Inflation

, Bloomberg News

(Bloomberg) -- The rapid recovery in UK household confidence extended into a fourth month in May, a leading survey found, in a signal that households are growing more optimistic as the energy price crunch wanes.

GfK’s consumer confidence index climbed a further three points to minus 27, the highest level since February 2022, shortly before energy and food bills were sent soaring by Russia’s invasion of Ukraine.

The figures add to a growing sense that the UK will avoid a recession that appeared almost certain late last year, when confidence plunged to half-century lows amid the market and political turmoil triggered by Liz Truss’s short-lived premiership.

While UK inflation is still running above 10%, surveys have suggested that households’ expectations for future price rises are receding. The squeeze from energy bills is set to ease significantly after a slump in natural gas prices.

“The headline score of minus 27 means we’re still deep in negative territory and a long way from any ‘sunny uplands,’” said Joe Staton, client strategy director at GfK. “However, the overall trajectory this year is positive and might reflect a stronger underlying financial picture across the UK than many would think.”

GfK found that confidence in the economic outlook improved to its highest since late 2021. Households’ sentiment over their own future personal finances was at a 16-month high. More people were willing to make major purchases.

That’s good news for Prime Minister Rishi Sunak, whose Conservative Party has a mountain to climb to avoid defeat in a general election likely to be held next year.

The chance of a recession happening over the next 12 months is now just 43%, the lowest reading since June last year, according to a Bloomberg survey of economists published Friday.

However, consumers are still battling falling real incomes and many are yet to be squeezed by much higher mortgage rates. The pressure on family budgets was underscored in a separate report by the Resolution Foundation think tank, which warned that food prices will soon overtake energy bills as the main driver of inflation.

The Resolution Foundation found that food prices will contribute 2 percentage points to inflation every month between March and September 2023. The contribution from energy will sink from 3 percentage points to less than 1 following the plunge in natural gas prices.

Lalitha Try, an economist at the Resolution Foundation, warned that Britain’s cost-of-living crunch is not ending but “entering a new phase.”

“This summer the food price shock to family finances is set to overtake that from energy bills,” she said. “What remains consistent is that those on low-to-middle incomes are worst affected.”

--With assistance from Harumi Ichikura.

(Updates with energy price context from first paragraph.)

©2023 Bloomberg L.P.