Nov 15, 2022

UK Housing Meltdown Threatens £9.5 Billion Dividend Bonanza

, Bloomberg News

(Bloomberg) -- Britain’s housing meltdown is threatening to end the era of bumper payouts by the country’s largest homebuilders.

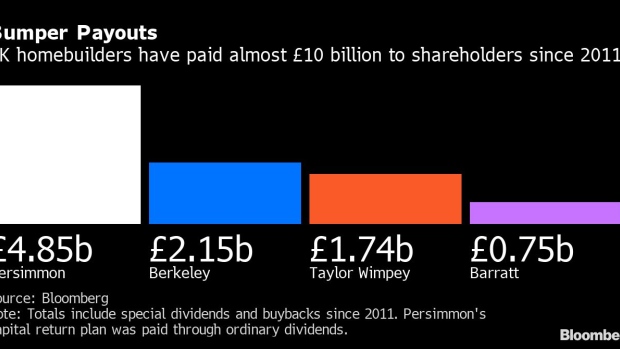

The four biggest UK homebuilders have doled out more than £9.5 billion ($11.1 billion) in capital return programs since 2011, according to Bloomberg calculations, wooing investors starved of income in the cheap money era. Persimmon Plc, the country’s largest homebuilder, announced last week it would review its capital return policy, raising questions about the sustainability of more payouts by other homebuilders.

The era of surplus capital returns “was a big part of the appeal of the sector,” Sam Cullen, an analyst at Peel Hunt said in an interview. “There wasn’t a great deal of yield on offer in the rest of the market, so it was one of the only places you could go and get a good dividend yield.”

Britain’s biggest homebuilder has returned £4.85 billion in capital -- which was further boosted through its ordinary dividend program -- since 2012. That’s more than double its initial estimates when the plan was first laid out. The super-sized payments partially reflect the impact of Help to Buy, a government stimulus program that fueled demand for new homes following its introduction the following year.

The homebuilder was propelled back into the FTSE 100 in 2013 a year after announcing its capital return program after several years’ absence from the index.

Rival Berkeley Group Holdings Plc, which capitalized on cheap land in the aftermath of the global financial crisis, was the first among the biggest UK homebuilders to initiate bumper payments to shareholders in 2011. Rivals Barratt Developments Plc and Taylor Wimpey Plc followed suit in 2014.

Persimmon’s move to end its program may mark the beginning of the end of a period where homebuilders became UK stock investor darlings.

“Investors will now start bracing themselves for lower payments from other housebuilders, especially as Vistry, Taylor Wimpey and Barratt Developments are all offering a double-digit dividend yield,” Russ Mould, investment director at AJ Bell Plc wrote in a report last week.

Market Uncertainty

Dividend income is crucial for UK income funds, which are a popular retirement investment and took a battering during the pandemic. The funds, which manage an estimated £43.6 billion, plunged 23% on average this year through October, according to data compiled by Morningstar Inc.

“The record of FTSE 100 firms that on paper were due to offer a double-digit percentage dividend yield is particularly bad when it actually comes to handing over the cash,” AJ Bell’s Mould said in his report. “Persimmon now looks set to join an inglorious list.”

Still, London-listed stocks currently offer a comparatively strong dividend yield -- 3.8% for the FTSE 100 versus 1.7% for the S&P 500.

The UK housing market is facing multiple headwinds: rising borrowing costs, inflation that’s pushing up the cost of materials and the threat of a recession that’s curtailing demand for new homes.

Read more: All the Ways Britain’s Housing Market Is Starting to Go Wrong

“It is the standard, and sensible housebuilder play book to run for cash when the going gets tough,” said Anthony Codling, a former Jefferies housing analyst who now runs property website Twindig. “It is not Persimmon’s move, but rather the underlying market conditions that have led to the end of special dividends.”

--With assistance from Iwona Hovenko.

©2022 Bloomberg L.P.