Aug 16, 2022

UK Job Vacancies Fall in Early Sign Labour Market May Weaken

, Bloomberg News

(Bloomberg) --

UK job vacancies fell for the first time since August 2020 as real wages dropped at the sharpest pace on record, indicating a tightening inflation squeeze on consumers and businesses.

The number of jobs employers are seeking to fill fell by 19,800 to 1.27 million in the quarter through July, the Office for National Statistics said Tuesday. Pay excluding bonuses and adjusted for inflation fell by 3% in the three months through June, the most since records began in 2001.

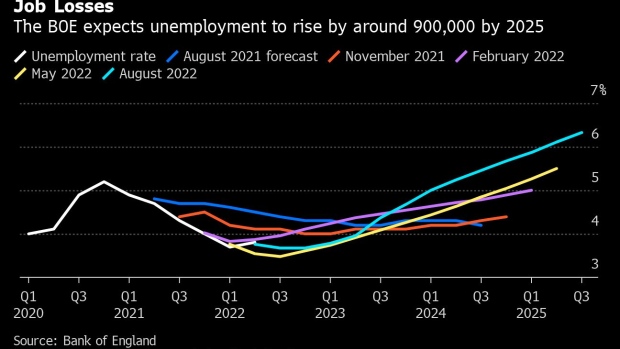

The figures add to evidence the economy may be slowing under the weight of inflation at a 40-year high. The Bank of England is raising interest rates to prevent a wage-price spiral and expects a recession will lift unemployment to 6% over the next three years from 3.8% in the most recent month.

“The labor market could ease further as the economy weakens,” said Yael Selfin, an economist at KPMG. “This will weaken the bargaining power of employees. A more forceful response from the Bank of England to tame inflation should also help lessen pay demands.”

Employment increased by 160,000 in the second quarter, 46% less than the three months through May. The wage figures using the Consumer Prices Index measure instead of CPIH showed a 4.1% drop, also a record decline.

“There is evidence that the cost of living crisis is starting to lower demand for workers,” said Jake Finney, economist at PwC UK. “This will ease pressure on the Bank of England to deliver another 50 basis points hike to interest rates next month.”

The central bank’s Governor Andrew Bailey is concerned that tightness in the labor market is fanning upward pressure on wages. He’s signaled plans to keep raising interest rates to prevent rampant inflation causing a wage-price spiral.

Further out, the prospects are less bright, with the BOE predicting unemployment will rise to over 6% as the cost of living crisis weighs on the economy.

For now, most measures of the labor market remained tight. The number of employees on payrolls rose 73,000 in July, almost triple the pace expected. Average weekly earnings including bonuses rose 5.1% in the second quarter, stronger than the 4.5% pace that had been expected by economists.

“Today’s stats demonstrate that the jobs market is in a strong position, with unemployment lower than at almost any point in the past 40 years -- good news in what I know are difficult times for people,” Chancellor of the Exchequer Nadhim Zahawi said in a statement.

(Updates with comment and details from the report.)

©2022 Bloomberg L.P.