May 30, 2023

UK’s Record Migration May Have Boosted Home Rental Costs by 7%

, Bloomberg News

(Bloomberg) -- Record net migration into the UK drove property rental costs up by as much as 7% and could be behind the manic market facing tenants in London, according to economists at Capital Economics.

Forecasters at the consultancy warned that growth in rent costs will likely remain historically high even if UK net migration eases after the record surge last year.

A record 606,000 more people migrated into the UK last year than departed, adding to strains on public services of all kinds. Rents are already rising at a record pace, with London’s market particularly frantic.

However, experts have said net migration is likely to ease due to a surge in student arrivals reversing and fewer people coming from from Ukraine. That may reduce some of the pressure on Prime Minister Rishi Sunak to make good on his promise to reduce the inward flow.

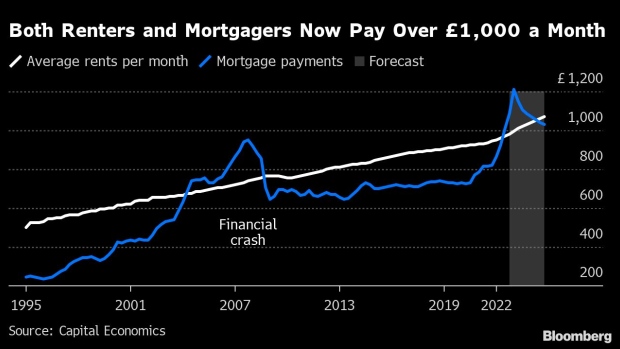

“Immigration won’t be as high this year, adding to the reasons to think that rental growth has peaked,” said Imogen Pattison, economist at Capital Economics. “But strong pay growth, high mortgage rates and some Ukrainians seeking their own homes mean it will remain high by past standards.”

She said that immigration may have increased rents by 3% to 7% when looking at the historical relationship between rents and the share of homes that are empty. Pattison added the impact may be particularly strong in the capital since “incoming immigrants tend to initially live in London.”

Average UK private rental prices climbed by 4.8% year-on-year in April with England, the biggest increase since records began in 2006. However, survey data suggests those agreeing new rental deals are suffering even bigger rises.

©2023 Bloomberg L.P.