Jun 27, 2022

Ukraine Latest: US Pledges Air-Defense System, Russia in Default

, Bloomberg News

(Bloomberg) -- US President Joe Biden is set to announce the purchase of an advanced surface-to-air missile system for Ukraine. The news came as Group of Seven leaders are meeting in the Bavarian Alps and will talk with Ukrainian President Volodymyr Zelenskiy.

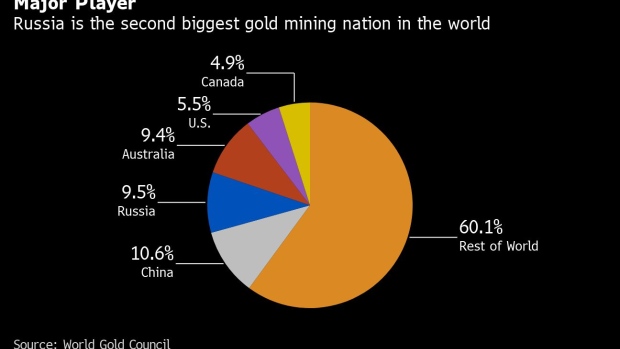

At their summit, Group of Seven leaders will commit to supporting Ukraine in its defense against Russia’s invasion “for as long as it takes,” according to a draft statement. Gold climbed in early Monday trading as leading countries roll out plans to ban imports of the precious metal from Russia in conjunction with the G-7 gathering.

Russia defaulted on its foreign-currency sovereign debt for the first time since 1918, the culmination of ever-tougher Western sanctions that shut down payment routes to overseas creditors.

(See RSAN on the Bloomberg Terminal for the Russian Sanctions Dashboard.)

Key Developments

- Finland, Sweden Gear Up for Top Level Talks on NATO With Turkey

- Russia Defaults on Foreign Debt for First Time Since 1918

- Ban on New Gold Imports From Russia Seen as ‘Largely Symbolic’

- EU Confronts Risks of Low Gas Storage in Test of Unity on Russia

- G-7 Draft Commits to Supporting Ukraine’s Defense Indefinitely

- Germany Pushes for G-7 Reversal on Fossil Fuels in Climate Blow

On the Ground

Ukrainian troops are withdrawing from Sievierodonetsk, while Russian forces are trying to block nearby Lysychansk from the south, closing in on the last major holdout in the Luhansk region that Kyiv still controls, Ukraine’s General Staff said in a statement on Facebook. President Volodymyr Zelenskiy urged citizens of neighboring Belarus to avoid being dragged into war after Russia launched a series of missile attacks from the country’s territory, including early Sunday Russian one on residential buildings in Ukraine’s capital.

(All times CET)

US Providing Anti-air Defense System to Ukraine (8:03 a.m.)

US President Joe Biden is set to announce the purchase of an advanced surface-to-air missile system for Ukraine.

NASAMS are an advanced medium to long range surface-to-air missile defense system. Ukraine is suffering from missile attacks and can only strike down a fraction of incoming missiles. The problem remains how quickly Kyiv can get them, how many will come and how long will it take to train people to use them.

It’s the same system the US uses to protect the airspace around the White House and US Capitol in Washington.

Japan to Ban Imports of Russian Gold (7:34 a.m.)

Prime Minister Fumio Kishida told his G-7 counterparts he planned to impose extra sanctions on Moscow that include banning the import of Russian gold. Japan will also ban the provision of services like accounting and freeze the assets of an additional 70 individuals, a government spokesman told reporters in Munich.

Spot gold rose 0.5% to $1,835.99 an ounce as of 6:20 a.m. in London on Monday. Shipments between Russia and London have collapsed to almost zero since western countries imposed sanctions on Russia for its invasion of Ukraine.

EU Confronts Risks of Low Gas Storage (5:00 a.m.)

European Union governments are confronting the risk of a splintering energy market as Russian cuts in natural-gas supplies test EU unity in response to the war on Ukraine.

An increase in gas supply disruptions following EU sanctions on Russia is prompting member countries to step up winter preparations as they seek to fill depleted storage. EU energy ministers will discuss risk preparedness at a meeting on Monday in Luxembourg, according to diplomats.

Read more: EU Confronts Risks of Low Gas Storage in Test of Unity on Russia

Crude Oil Fluctuates as Traders Monitor G-7 (4:06 a.m.)

Oil fluctuated near $107 a barrel as investors monitored developments from the gathering of G-7 leaders, while fears of a demand-sapping recession continued to hang over the market.

Oil is heading for its first monthly decline since November on escalating fears about a global slowdown as central banks hike interest rates to combat surging inflation. Retail prices for products like gasoline haven’t fallen anywhere near as fast as crude, however, due to a shortage of capacity to make fuels.

Ban on New Gold Imports Seen as ‘Largely Symbolic’ (4:04 a.m.)

The plan by some G-7 nations to ban new gold imports from Russia is “largely symbolic” as flows have already been restricted by sanctions, according to analysts.

While the UK government said in a statement over the weekend that “this measure will have global reach, shutting the commodity out of formal international markets,” analysts played down the potential impact as the London Bullion Market Association, which sets standards for that market, removed Russian gold refiners from its accredited list in March.

Read more: Ban on New Gold Imports From Russia Seen as ‘Largely Symbolic’

Russia Defaults on Foreign Debt (1:01 a.m.)

For months, Russia found paths around the penalties imposed after the Kremlin’s invasion of its neighbor. But at the end of the day on Sunday, the grace period on about $100 million of snared interest payments due May 27 expired, a deadline considered an event of default if missed.

The move is a grim marker in the country’s rapid transformation into an economic, financial and political outcast. The nation’s euro bonds have traded at distressed levels since the start of March, the central bank’s foreign reserves remain frozen, and the biggest banks are severed from the global financial system.

The last time Russia fell into default vis-a-vis its foreign creditors was more than a century ago, when the Bolsheviks under Vladimir Lenin repudiated the nation’s staggering Czarist-era debt load in 1918.

Read more: Russia Defaults on Foreign Debt for First Time Since 1918

©2022 Bloomberg L.P.