Mar 9, 2023

Ukrainian Investor’s Exit Marks Rude Awakening for Warsaw Bourse

, Bloomberg News

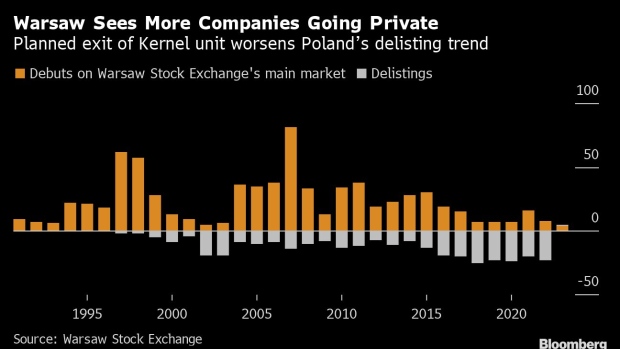

(Bloomberg) -- Eastern Europe’s leading bourse is losing another member as one of the world’s biggest producers of sunflower oil delists from the Warsaw Stock Exchange, citing complaints including poor liquidity and thin analyst coverage.

Namsen Ltd — the investment vehicle of Ukrainian businessman Andrii Verevskyi — announced an offer this week to buy out all other shareholders in Kernel Holding SA, the company he founded whose listing in 2007 came amid a push to encourage Ukrainian firms to the Polish exchange.

The exit is primarily due to Russia’s invasion of Ukraine just over a year ago, which devastated Kernel’s operations and sent its market value tumbling more than 60%. But the statement announcing the move also cited disappointments with the Warsaw exchange, where the number of traded stocks is now the lowest in more than a decade.

Multiple attempts to “improve stock visibility and widen the shareholder base” had largely failed, the company said in a statement. Kernel suffers from a “lack of financial visibility and poor analyst coverage.” And low liquidity stops investors from exiting the stock “in a fast and predictable fashion, especially with the war-related risks.”

A representative for the bourse declined to comment on Kernel.

Until recently, Warsaw was a magnet for listings, attracting UK discount retailer Pepco Group in 2021 and its biggest-ever initial public offering from e-commerce platform Allegro.eu SA a year earlier. Kernel’s 2007 debut and three subsequent share issues between 2008 and 2011 raised a total of 1.2 billion zloty ($270 billion).

But the economic pain and massive outflows from Polish equities since the invasion have taken a toll.

Polish billionaire Sebastian Kulczyk’s chemicals firm, Ciech SA, said it would be able to respond more nimbly to geopolitical and economic challenges once taken private.

Pension Revamp

Jakub Szkopek, an analyst covering Kernel at Erste Group Bank AG, disputed some of the company’s accusations. Even before the invasion, he said, Kernel traded at a discount to international peers due to geopolitical tensions following Russia’s annexation of Crimea in 2014.

“Lack of active communication with investors in the months following the invasion additionally soured sentiment,” said Szkopek, one of four analysts covering the company. “Blaming Polish investors and the bourse, when most of the shareholders were international ones, doesn’t seem valid.”

Kernel’s investment allure has been curbed by the war and the blockade of Ukraine’s Black Sea ports by Russia, which made it difficult for the company to monetize its harvest and challenged new sowings. Before the invasion, Ukraine contributed to 29% of global sunflower oil output.

Szkopek said the buyout bid looked like an “attempt to retake full control of company at a low price” as the conflict sours sentiment. Kernel shares were little changed on Thursday at 18.69 zloty, compared with the buyout offer at 18.5 zloty. The stock peaked above 86 zloty in 2011 and traded around 60 zloty before Russia’s invasion started.

The Polish investor share of the free float is now around 15%, compared with about 80% after the initial public offering, Namsen said. It blamed Polish pension-fund overhauls for that change, saying they eroded the bourse’s natural longer-term domestic investor base.

An unsuccessful attempt to raise emergency equity funding in September faced “huge resistance” from minority shareholders, who showed “no interest” in the company’s longer-term prospects, Namsen said.

Since the war, Kernel risks becoming “a speculative asset in the hands of hedge funds and short-term investors,” it said.

(Updates with details about Kernel)

©2023 Bloomberg L.P.