Oct 6, 2022

Uruguay Hikes Key Rate by a Half Point to 10.75%, Maintains Hawkish Bias

, Bloomberg News

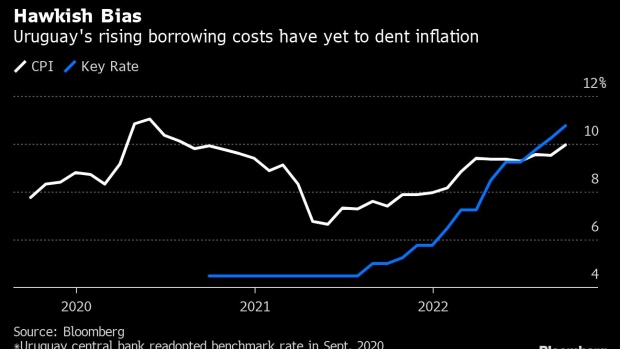

(Bloomberg) -- Uruguay’s central bank increased its benchmark rate to 10.75% and signaled it plans to continue raising borrowing costs in its last two policy meetings of 2022.

The central bank lifted its key rate by 50 basis points for a third consecutive meeting with inflation on the cusp of double digits for the first time in two years.

Further policy tightening this year “would reach rate levels consistent with the convergence of inflation expectations toward the target range” of 3% to 6%, the central bank said in a statement.

Latin America is grappling with the inflationary fallout from Russia’s invasion of Ukraine, which has pushed up energy and food prices. Uruguay already had chronically high inflation before the war. The consumer price index averaged 8.7% a year the last two decades due to a highly dollarized economy, the indexing of salaries and contracts, and little political appetite to inflict deflationary pain on voters.

Inflation jumped 9.95% in September from a year earlier due to rising healthcare costs and a temporary spike in fresh produce, fruit and dairy prices.

Inflation expectations have crept higher as hawkish monetary policy fails to blunt consumer prices. Analysts surveyed by the monetary authority last month see 7% inflation at the end of the central bank’s 24-month policy horizon.

The central bank reiterated that rigid inflation expectations are a concern.

©2022 Bloomberg L.P.