Mar 24, 2023

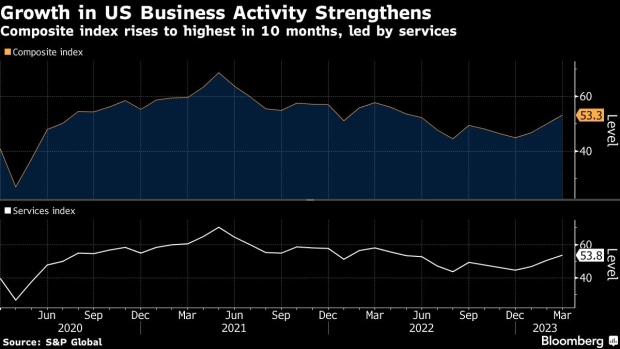

US Business Activity Accelerates to Fastest Pace in 10 Months

, Bloomberg News

(Bloomberg) -- US business activity expanded this month at the fastest pace in nearly a year, driven by solid demand for services that allowed those firms greater leeway to boost prices.

The S&P Global flash March composite purchasing managers index rose 3.2 points to 53.3, the group reported Friday. Readings above 50 indicate expanding output. A gauge of prices charged by service providers increased to a five-month high.

The improvement in the composite measure of output at factories and services providers, along with signs of lingering inflationary pressures, highlights the challenge faced by the Federal Reserve.

While policymakers would typically interpret such data as a green light to keep pressing forward with interest-rate increases, officials are also cognizant of recent troubles in the banking system.

“It will be important to assess the resilience of this demand in the face of the recent tightening of interest rates and the uncertainty caused by the banking sector stress, which so far only seems to have had a modest impact on business growth expectations,” Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement.

The US results, collected March 10-23, mirror those out of Europe. S&P Global’s composite measure of euro-zone activity also advanced to a 10-month high on firmer services. While business improved in both Germany and France, the strongest performance came in the rest of the 20-nation euro area.

The group’s measure of business activity at US service providers increased this month to the highest level since April. Services firms indicated the gain was due to a pickup in demand and the strongest growth in new business since May.

The US manufacturing purchasing managers index, meanwhile, also increased but remained in contraction territory. Factories benefited from waning input-cost growth as well as an unprecedented improvement in delivery times of materials that indicates supply chains have recovered.

(Adds graphic and data on euro-zone economic growth)

©2023 Bloomberg L.P.