May 24, 2022

US Business Activity Softens as Inflation Tempers Demand

, Bloomberg News

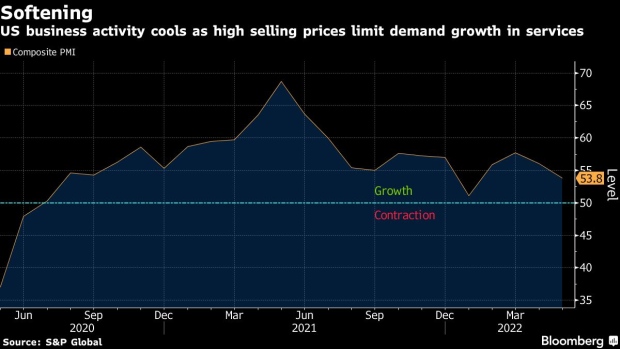

(Bloomberg) -- US business activity settled back to a four-month low in early May as costs ballooned and high selling prices tempered demand at service providers.

The S&P Global flash May composite purchasing managers index slipped 2.2 points to 53.8, the group reported Tuesday. Readings above 50 indicate growth. A measure of input prices edged up to the highest in data back to 2009, while output price growth slowed from the record pace seen in April.

The group’s gauge of new business at service providers fell to the lowest level since August 2020, indicating some customers are beginning to balk at higher prices. But costs continue to balloon for businesses amid rising wages, interest rates, fuel costs and material prices.

“Companies report that demand is coming under pressure from concerns over the cost of living, higher interest rates and a broader economic slowdown,” said Chris Williamson, chief business economist at S&P Global Market Intelligence.

In the euro area, services expanded at a solid pace and manufacturing growth slowed for a fourth straight month. While services activity was buoyed by tourism and recreation, factories were hampered by supply problems related to Russia’s invasion and Covid lockdowns in China.

While at a still-robust 57.5, the S&P Global index of US manufacturing settled back to a three-month low in May. The new orders gauge eased, and production growth cooled.

Order backlogs mounted amid persistent logistics challenges, and manufacturer output prices grew at the third-fastest pace in data back to 2007, though improved somewhat from April.

Meantime, a measure of factory hiring improved to the highest level since July.

“Manufacturers in particular also report that capacity continues to be constrained by supply shortages, though these bottlenecks showed further encouraging signs of easing,” Williamson said.

(Adds graphic)

©2022 Bloomberg L.P.