May 23, 2023

US Business Activity Unexpectedly Quickens to a 13-Month High

, Bloomberg News

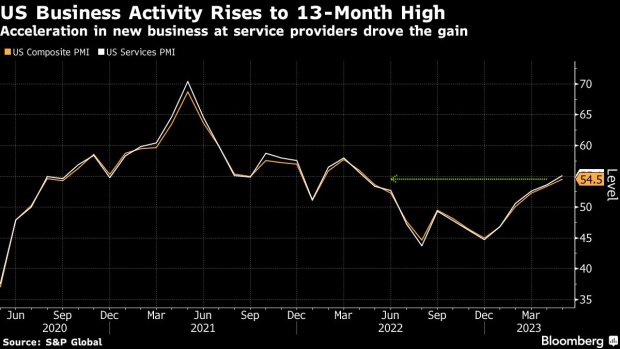

(Bloomberg) -- US business activity grew in May by the most in over a year, powered by robust demand for services, while views about the economic outlook brightened.

The S&P Global flash May composite purchasing managers index advanced 1.1 points to 54.5, the group reported Tuesday. That’s the highest since April of last year and above the 50 level that separates growing and shrinking activity.

The group’s services gauge also increased to a 13-month high, fueled by an acceleration in new business growth. At the same time, the manufacturing index slipped back into contraction territory as orders shrank and output growth cooled.

Service providers, especially those in leisure and hospitality, are benefiting from the shift in consumer spending preferences away from goods and more toward experiences.

“The inflation picture is also changing,” Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement. “Whereas manufacturing prices spiked higher during the pandemic due to strong demand and deteriorating supply, it is now the service sector’s turn to be hiking prices.”

That’s the challenge facing Federal Reserve policy makers looking to get inflation under control. While goods prices continue to show signs of moderating, the report showed services inflation remains elevated amid solid demand.

Business expectations climbed to a one-year high, with firms becoming more upbeat about demand conditions and suggesting the economy may skirt a recession. Even manufacturers expressed the greatest degree of optimism in a year about the production outlook.

The group’s composite measure of employment at manufacturers and service providers rose to the highest level since July.

Job growth is picking up at service providers “but this tightening labor market amid strong demand will be a concern as a fuel of further inflationary pressures,” Williamson said.

--With assistance from Chris Middleton.

(Adds graphic.)

©2023 Bloomberg L.P.